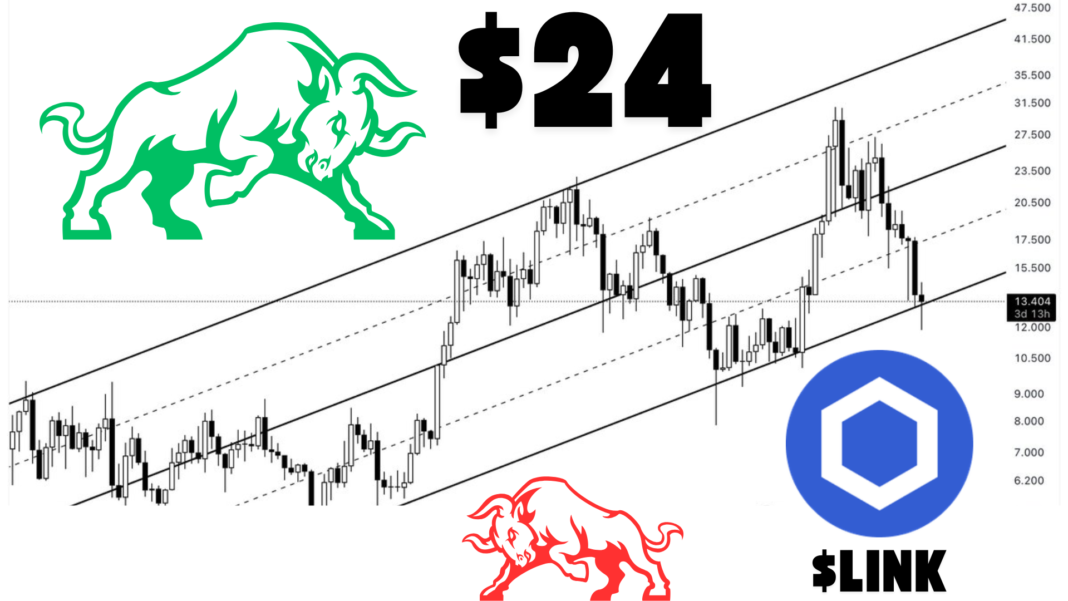

Renowned crypto analyst Ali Martinez has forecasted a potential rebound in Chainlink’s ($LINK) price, provided that the asset maintains its critical support level.

Martinez, known for his expertise in technical and on-chain analysis, emphasized that holding this key zone could pave the way for a recovery toward the $24 mark.

The prediction has sparked significant interest among traders and investors, who are closely watching LINK’s price action for signs of a bullish reversal.

Historically, cryptocurrencies that successfully defend crucial support levels often experience strong rebounds, making Martinez’s outlook an important factor in current market discussions.

Chainlink Sees Buying Interest Despite Market Volatility

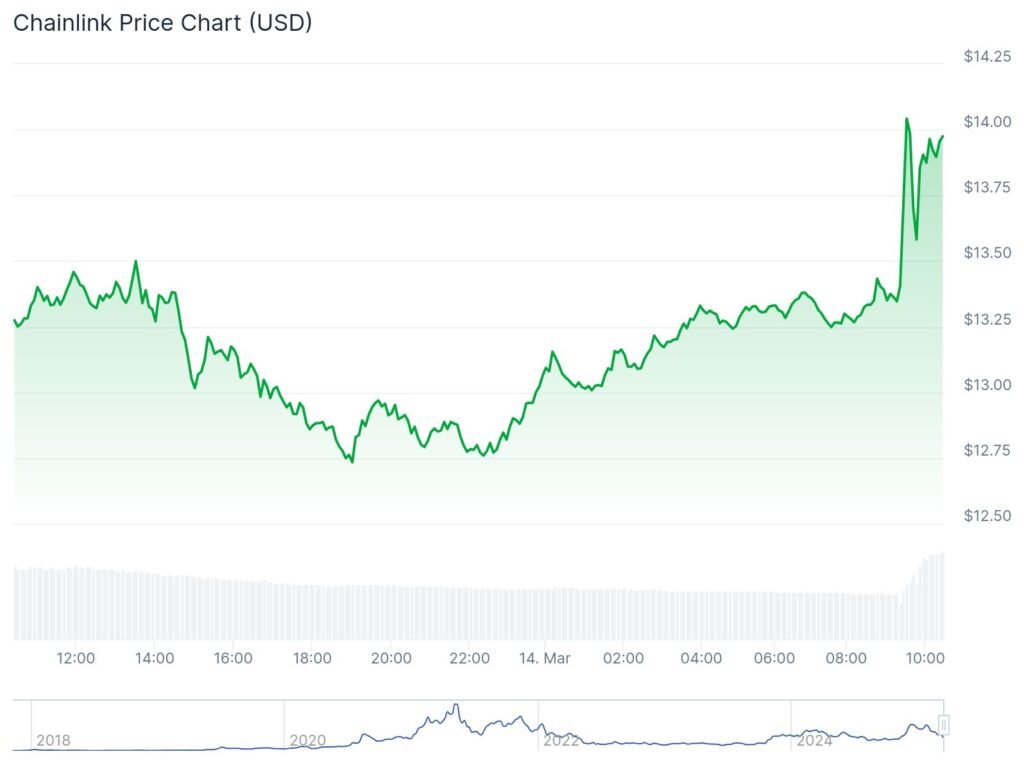

Amid broader market fluctuations, Chainlink ($LINK) has shown signs of resilience, currently trading at $13.97—a 5.24% increase in the past 24 hours.

However, the asset remains down 17.32% over the past week due to ongoing market pressure.

Despite this, the recent price recovery suggests renewed buying interest, particularly from investors looking to capitalize on potential gains.

If LINK continues to consolidate above its critical support level, it could gather enough momentum to target Martinez’s $24 projection in the near future.

The outcome largely depends on whether buyers can sustain the upward trend amid prevailing market volatility.

Chainlink’s Strong Fundamentals Support Bullish Outlook

Chainlink remains one of the leading blockchain projects, with a circulating supply of 640 million LINK and a market capitalization of approximately $8.92 billion.

The project’s decentralized oracle network plays a crucial role in smart contract functionality, making it a vital component in both decentralized finance (DeFi) and traditional finance (TradFi) integrations.

Its increasing adoption across multiple blockchain ecosystems strengthens its long-term value, reinforcing the credibility of a price recovery.

With institutional interest growing in blockchain infrastructure projects, Chainlink’s strong fundamentals support the potential for a sustained upward movement if market conditions align favorably.

Whale Activity and Market Sentiment Add to Uncertainty

While many investors are optimistic about a potential price rebound, on-chain data has revealed a large LINK sell-off by a whale investor.

Onchain Lens, a popular crypto tracking platform, reported that an unknown holder sold 356,665 LINK for $4.59 million USDC at an average price of $12.88.

Despite this significant sell-off, the whale still retains 7,693 LINK tokens worth approximately $101,533, suggesting that they may be anticipating a future price recovery.

The large transaction adds an element of uncertainty to LINK’s short-term price action, as whale movements often influence broader market sentiment.

However, if LINK holds its critical support level and investor confidence remains strong, the anticipated price rebound to $24 could still be within reach.

Also Read: Crypto Analyst Predicts $1.35 Target For Polkadot if Key Parallel Channel Resistance Is Breached