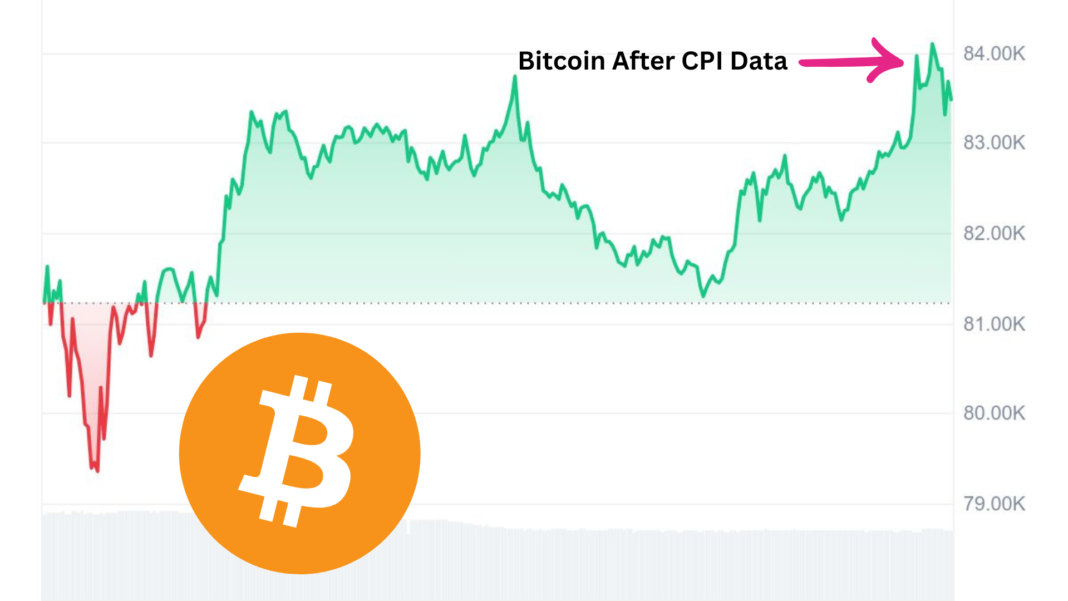

Bitcoin price took an upward turn after the US CPI data came better than expected. The US Consumer Price Index rose 2.8% in February compared to 3.0% in January, according to the Bureau of Labor Statistics.

After the news, the price of Bitcoin rose by 3% to $84K, after being up 1% earlier in the day.

US CPI Lands Better than Expected

February saw a 2.8% increase in the US Consumer Price Index, up from 3.0% in January. The core CPI, which does not include volatile food and energy prices, increased 3.1% year over year, which was less than the 3.3% increase in January.

After increasing by 0.5% in January, the CPI increased by 0.2% in February. In line with the January increase, the core CPI increased by 0.2%.

According to FactSet’s consensus predictions, economists predicted that the CPI will increase by 0.3% on a monthly basis in February, bringing the annual inflation rate down from 3.0% in January to 2.9%.

Core inflation was predicted by economists to increase by 3.2% annually and 0.3% monthly.

Also Read: Crypto Market In Turmoil As Liquidations Cross $1.4 Billion Amid Inflation Fears & Bybit Hack

Bitcoin Price Finally Picks Optimistic Cue

Bitcoin price had seen a subdued trading in the past, making investors worried. However, today’s CPI data might have given the much-awaited optimistic cue to the market.

As the price of Bitcoin had dropped below significant support levels, it was experiencing significant volatility. Numerous factors, including investor sentiment and overall market conditions, were to blame for this decline.

Investors’ reduced risk appetite as a result of rising geopolitical tension, concerns about inflation, and uncertainty in the global economy has affected Bitcoin and other cryptocurrencies.

Furthermore, because Bitcoin is linked to traditional markets, particularly equities, its price has been more impacted by shifts in the stock market.

CPI Data’s Affect on Bitcoin Price: What Are Investors Accessing

The price of Bitcoin is directly correlated with CPI (Consumer Price Index) statistics, which represents inflationary economic trends.

Bitcoin’s price may climb as a result of improved investor mood brought on by CPI data that indicates low inflation or a decline in prices, such as the most recent 2.8% annual rate.

This is because Bitcoin is frequently viewed as an inflation hedge, and assets like Bitcoin are more desirable as an alternative store of value when inflation predictions are lower.

High inflation numbers, on the other hand, may raise concerns about the devaluation of traditional currencies, which could increase demand for Bitcoin and raise its price.

Also Read: Euro Zone Ministers Fear U.S. Crypto Policy Change May Undermine Financial Stability