A major cryptocurrency investor, commonly referred to as a “whale,” has suffered a floating loss of $4.7 million after purchasing 20 million MANTRA (OM) tokens worth $143.1 million from Binance over the past four days.

The large-scale accumulation of OM as reported by Onchain Lens on X has not yielded immediate profits, as the token’s price has declined, reducing the total value of the whale’s holdings to $138.4 million.

The incident highlights the unpredictable nature of the cryptocurrency market, where even high-net-worth traders can experience significant unrealized losses due to market volatility.

The whale’s actions have drawn attention from analysts and traders, sparking speculation about their long-term strategy and the potential for recovery.

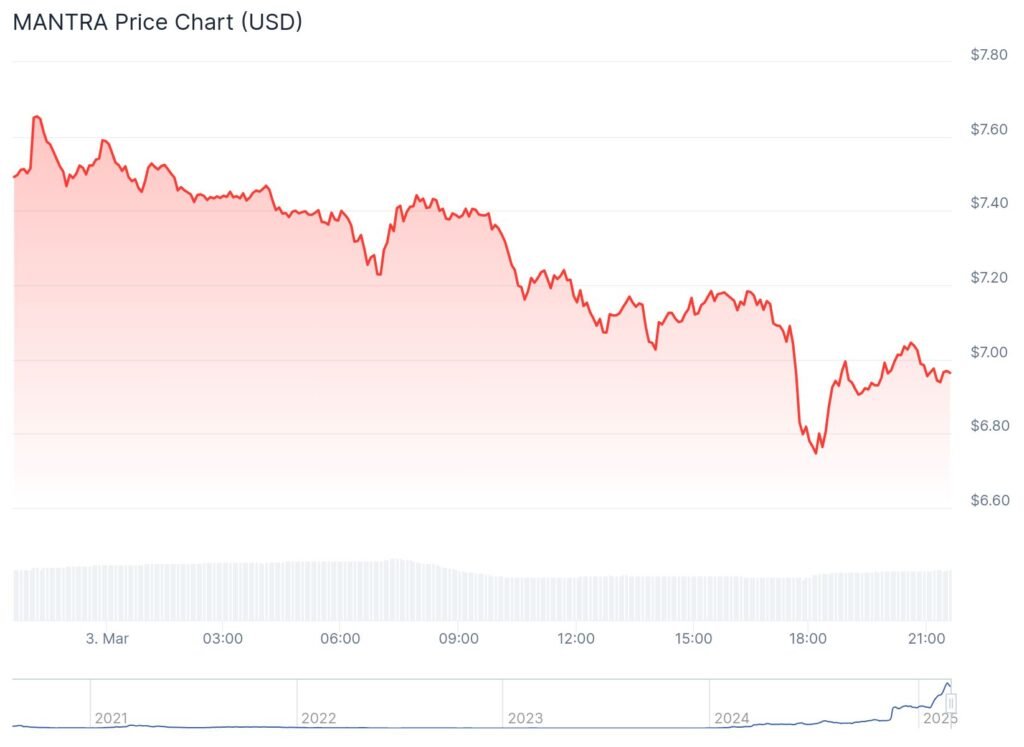

MANTRA (OM) Price Declines as Market Sentiment Weakens

MANTRA (OM) has been facing a steady downturn, with its price currently standing at $6.93. Over the past 24 hours, the token has dropped by 7.44%, while the past week has seen a more pronounced decline of 12.70%.

Despite the falling price, trading activity remains strong, with a daily volume of approximately $181 million.

The token’s market capitalization stands at $6.77 billion, supported by a circulating supply of 970 million OM.

While the market downturn has led to losses for short-term traders, OM’s strong market presence suggests that investor confidence has not completely eroded.

However, whether the token can regain momentum in the near term remains uncertain, with broader market conditions playing a key role in its potential recovery.

Whale’s Trading Strategy Raises Questions Amid Volatility

The whale’s decision to accumulate a significant amount of OM during a price downturn has sparked debate among crypto analysts. Some suggest that the investor is taking a long-term accumulation approach, expecting a price rebound in the future.

However, with the token continuing to decline, the strategy comes with high risks, as further depreciation could deepen losses.

Large-scale purchases can sometimes influence market trends positively, but in this case, they have not triggered the expected upward momentum.

If market sentiment remains bearish, the investor may face additional losses or be forced to reconsider their position. On the other hand, if new developments within the MANTRA ecosystem or broader crypto market improvements boost demand, the whale’s investment could still yield substantial gains.

Widespread Losses Across the Crypto Market Highlight Investment Risks

This is not the only case of significant losses in the crypto market. Other major investors have also faced substantial setbacks due to unfavorable price movements and risky trades.

One investor suffered a staggering $14 million loss after selling PEPE and BEAM at a steep discount but later reinvested $6.26 million in ONDO, a utility-driven asset.

Meanwhile, another trader lost $10.39 million after a highly leveraged 50x Bitcoin long position was liquidated, with additional losses of $265,000 on HYPE and $33,000 on HFUN.

Additionally, the second-largest holder of MELANIA tokens liquidated 6.688 million tokens at a $3.739 million loss as the token’s price plummeted by 26.65% over the past week.

These incidents serve as a stark reminder of the risks associated with crypto trading, especially in volatile conditions where even seasoned investors can suffer heavy losses.