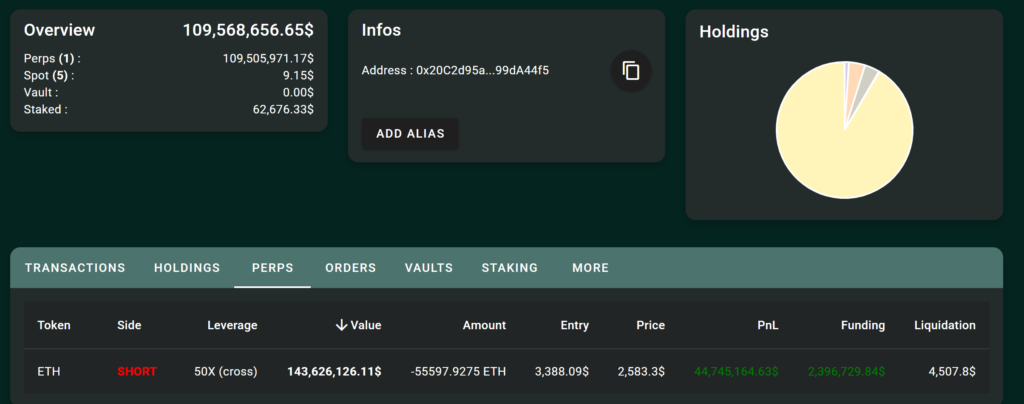

A high-stakes crypto trader, commonly referred to as a whale, has made waves in the market by executing a massive short position on Ethereum (ETH) using 50x leverage on the Hyperliquid trading platform.

The whale initially invested $2.38 million into the leveraged short position, and with Ethereum’s price in free fall, their unrealized profits have surged to an astonishing $44.7 million.

Despite the potential for significant gains, the trader has yet to close the position, fueling speculation about their strategy.

The high-risk move highlights the extreme volatility in crypto derivatives trading, where traders can either see monumental gains or suffer severe losses depending on market movements.

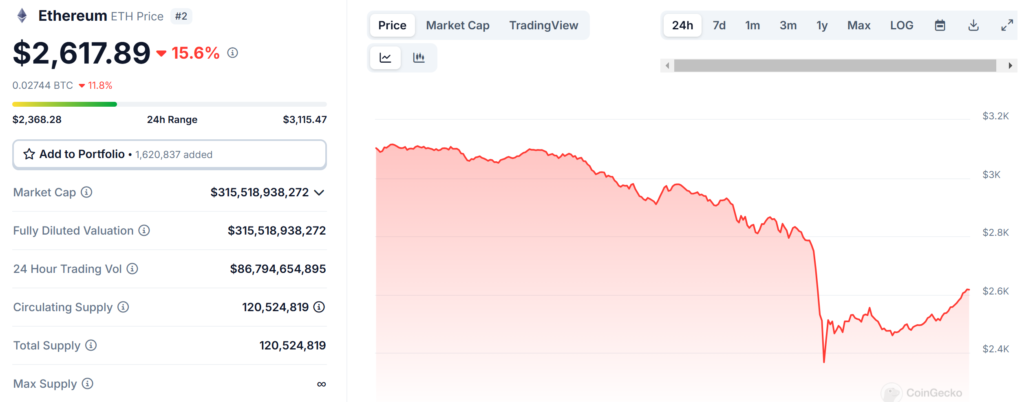

Ethereum Price Plummets, Driving Short Traders’ Gains

Ethereum’s steep price decline has been the primary driver behind the whale’s extraordinary profits.

As of today, ETH is trading at $2,615.33, reflecting a 15.71% drop in just 24 hours and a 15.04% decline over the past week.

With a staggering $86.79 billion in trading volume, Ethereum’s market cap has now fallen to $315.5 billion, reinforcing bearish market sentiment.

Analysts attribute this decline to broader macroeconomic pressures, large-scale liquidations, and overall market instability.

The downward trajectory has presented ideal conditions for short sellers, particularly the Hyperliquid whale, who continues to benefit as Ethereum struggles to find a stable support level.

Also Read: ConsenSys CEO Confirms Trump’s $250M ETH Purchase for DeFi Venture

Market Speculation and Potential for Further Ethereum Declines

The whale’s strategic short position has sparked widespread debate among traders, with many speculating whether Ethereum will continue its downward spiral.

Analysts warn that if ETH breaks below the critical $2,500 support level, further liquidations could occur, potentially driving the price even lower and increasing the whale’s profits.

Meanwhile, long-position traders are facing heavy losses, with liquidations piling up as Ethereum struggles to regain bullish momentum.

The ongoing uncertainty has heightened market volatility, with both retail and institutional investors closely watching ETH’s next moves.

Hyperliquid’s Growing Influence on Crypto Derivatives Trading

The success of this massive short position highlights the increasing role of leveraged trading platforms like Hyperliquid in shaping market dynamics.

With traders placing aggressive bets on major cryptocurrencies, these high-stakes positions can create ripple effects that influence broader price trends.

Hyperliquid has recently reported a record-breaking $15 billion in daily trading volume, further cementing its dominance in the derivatives market.

Meanwhile, other notable trades on the platform illustrate both the risks and rewards of leverage—one Bitcoin whale faced a $6.75 million loss on a long position, while another trader secured an $8.3 million profit by shorting SOL, ETH, and BTC.

As platforms like Hyperliquid continue to grow, their impact on market sentiment and price movements is becoming increasingly evident, making them a focal point for traders and analysts alike.