In a notable development within the Worldcoin ecosystem, blockchain monitoring service iChainfo has reported a substantial transfer of 60 million WLD tokens, valued at approximately $135.9 million, to Worldcoin’s multi-signature address (0xe797…61a3).

This significant movement of tokens has caught the attention of market observers, particularly as these funds are expected to be subsequently distributed to various market maker addresses.

The transfer represents a strategic movement of assets that could have implications for Worldcoin’s market dynamics and liquidity management strategies.

Current Market Performance and Metrics

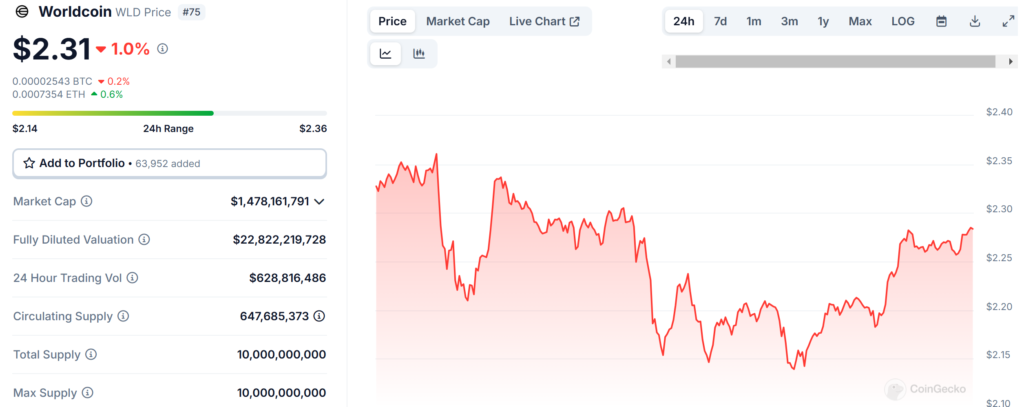

Worldcoin’s market performance presents a mixed picture, with its native token WLD currently trading at $2.31.

The token has experienced a slight decline of 1.0% in the past 24 hours, although it maintains a positive 7-day growth of 15.91%.

Trading activity remains robust with a 24-hour volume of $628,816,486, indicating sustained market interest.

With a circulating supply of 650 million WLD tokens, the project maintains a substantial market capitalization of $1.48 billion, positioning it as a significant player in the cryptocurrency market despite recent price fluctuations.

Also Read: WLD and SOL Top the Linear Unlocking List Amid Over 2% Price Surge

Profitability Analysis and Market Concerns

A critical market indicator has emerged showing that 97% of the total Worldcoin supply is currently in profitable positions.

This unusually high profitability rate has raised concerns among market analysts, as historically, when more than 95% of a cryptocurrency’s supply becomes profitable, it often signals a market top.

This metric is particularly significant as it typically precedes a period of reduced growth or potential market correction, following established patterns in cryptocurrency market cycles.

Future Outlook and Market Implications

The convergence of these factors – the large token transfer, current market metrics, and high profitability rates – presents a complex scenario for Worldcoin’s immediate future.

The expected distribution to market makers could influence market liquidity and price stability, while the high profitability rate suggests increased potential for profit-taking behavior.

This situation typically creates an environment where price corrections become more likely as investors look to secure their gains.

Market participants are closely monitoring these developments, as they could signal significant short-term price movements and impact Worldcoin’s market trajectory.

Also Read: Worldcoin (WLD) price moves up by 96% in 24 hours