The much-hyped public token sale for Donald Trump’s World Liberty Financial ($WLFI) fell significantly short of expectations, generating only $12.5 million in sales despite the initial buzz surrounding the event.

Lookonchain reported that over 833 million $WLFI tokens were sold, but this represented just a fraction, 1.7%, of the 20 billion tokens allocated for public sale.

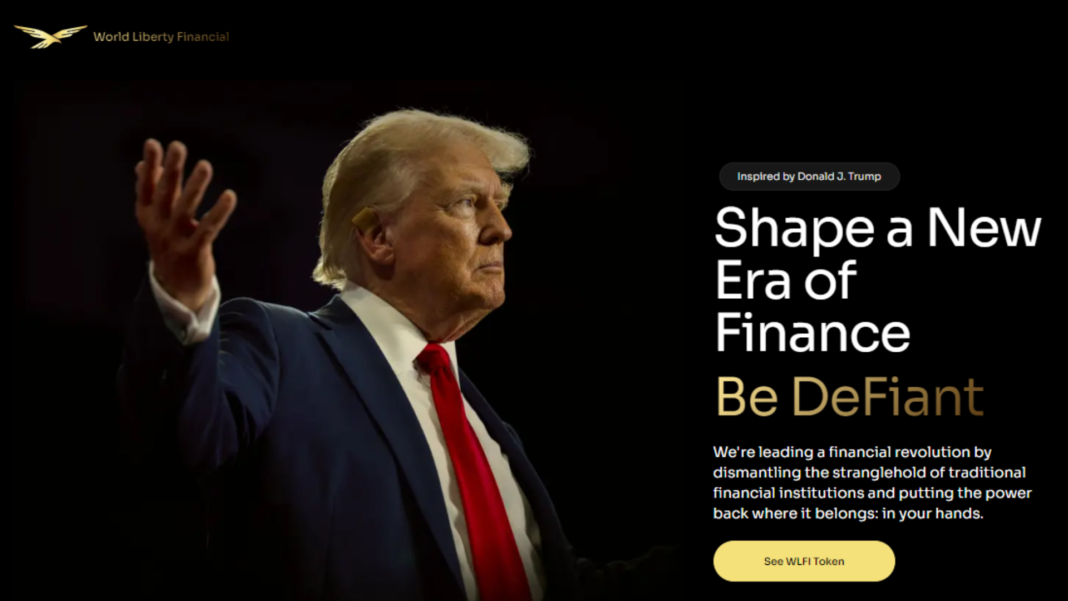

World Liberty Financial Token Sale Fails to Impress

About 10,000 investors participated in the sale; the biggest buyer, wallet “0x2d24,” paid 351.3 $ETH ($903,000) to purchase 60.43 million tokens; however, these figures are insignificant compared to the expected volume.

The sale officially began at 12:40 UTC, but despite early momentum, the response was much lower than expected. Approximately 3,000 wallets purchased 344 million tokens in the first hour, which is a small portion of the total offering.

World Liberty Financial positions itself as a next-generation financial ecosystem, leveraging blockchain technology to offer financial services to underserved communities globally. Despite the mission’s appeal, the token sale’s slow start has raised questions about the long-term viability of the project and its ability to attract significant investment.

The WLF Website Went Down in the First Hour

Sandy Peng, an advisor to World Liberty Financial and co-founder of the Scroll blockchain network, noted that the website outages, caused by 72 million unique visits in the first hour, contributed to the slower sales.

While the site struggled to stay online, switching web hosting providers after multiple crashes, the slow recovery didn’t boost sales significantly.

Despite the early setbacks, World Liberty Financial still hopes to regain momentum in the coming days. However, the initial figures reflect a much more modest interest than the project anticipated.