Federal Reserve Chairman Jerome Powell has introduced a note of caution to the markets, particularly affecting cryptocurrency price movements, with his recent remarks in Dallas, Texas on November 14.

In his speech, Powell emphasized that the current economic conditions don’t necessitate rushed interest rate reductions, stating explicitly that “the economy is not sending any signals that we need to be in a hurry to lower rates.”

This stance follows the Fed’s previous monetary policy actions, which included two rate cuts in September and November, of 50 and 25 basis points respectively. The measured tone of Powell’s comments suggests a more deliberate approach to future monetary policy decisions.

Market Impact and Bitcoin’s Response

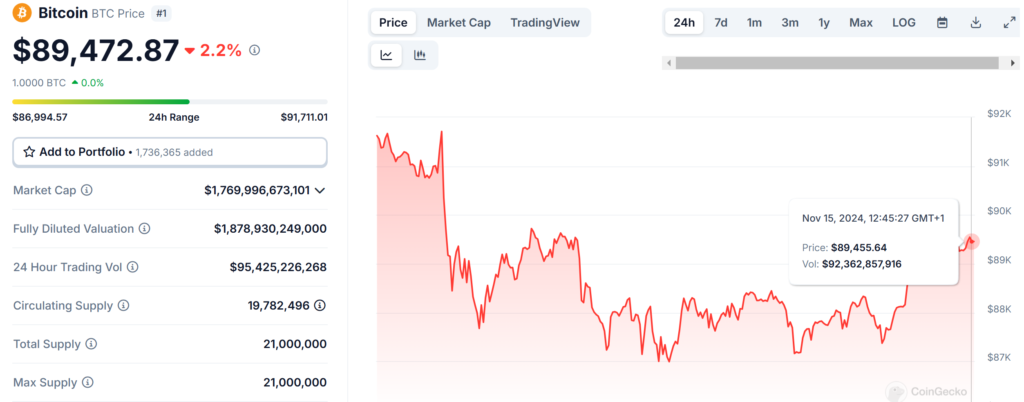

The immediate impact of Powell’s comments was reflected in Bitcoin’s price action, with the leading cryptocurrency experiencing a 2.79% decline to $86,979 following his speech.

This reaction demonstrates the continuing sensitivity of cryptocurrency markets to traditional monetary policy signals.

However, it’s noteworthy that Bitcoin has shown resilience, managing to recover some of its losses. The current price stands at $89,472.87, with a substantial 24-hour trading volume of $95.4 billion, indicating robust market activity despite the pullback.

While showing a 2.16% decline over the last 24 hours, Bitcoin maintains a strong 17.62% gain over the past week, with a market capitalization of approximately $1.77 trillion.

Recent Market Achievements and Political Context

Prior to Powell’s remarks, Bitcoin had achieved a significant milestone by breaking through the $90,000 level on Wednesday, reaching an all-time high of $93,480.

This rally was particularly notable as it appeared to be driven by market expectations surrounding Donald Trump’s potential impact on cryptocurrencies.

The cryptocurrency’s performance in the week following the election has been one of the most remarkable movements in the financial markets, highlighting the growing intersection between political developments and cryptocurrency valuations.

Also Read: Delta Exchange tops $1 Billion in Daily Volume as Bitcoin Keeps Hitting New ATH

Future Outlook and Economic Considerations

Looking ahead, the Federal Reserve’s next interest rate decision, scheduled for December 18, will be a crucial event for market participants.

Powell’s additional comments that “the strength we are currently seeing in the economy gives us the ability to approach our decisions carefully” suggest a data-dependent approach to future policy decisions.

This methodical stance is further reinforced by his statement that “ultimately, the path of the policy rate will depend on how the incoming data and the economic outlook evolve.”

The market’s response to these developments, coupled with Bitcoin’s current circulating supply of 20 million coins, indicates that the cryptocurrency market remains highly responsive to macroeconomic policy signals while maintaining strong fundamental metrics.

Also Read: U.S Senator Lummis Plans To Push FED To Buy Bitcoin Reserves By Selling Its Gold