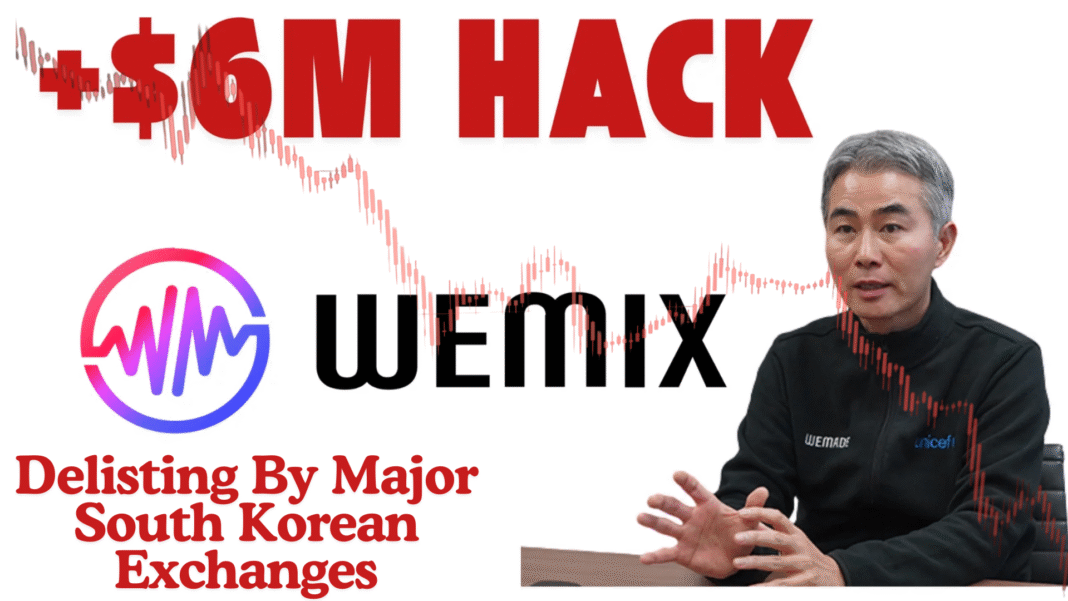

The WEMIX token, developed by South Korean Web3 gaming company Wemade, has suffered a dramatic collapse in value, plunging over 50% in the past 24 hours.

The sharp downturn follows a joint announcement from South Korea’s five leading cryptocurrency exchanges, Upbit, Bithumb, Coinone, Korbit, and Gopax, stating their decision to delist the token.

These exchanges, which comprise the Digital Asset Exchange Association (DAXA), represent the entirety of South Korea’s fiat-to-crypto trading market.

The delisting decision marks the second time WEMIX has faced removal from major platforms and is scheduled to take effect on June 2, with withdrawals ending on July 2.

Also Read: QuantMaster Project Suffers USDT Crypro Hack After Malicious Address is Hard-coded By Employee

Underlying Issues: Security Breach and Delayed Disclosure

WEMIX’s current troubles are rooted in deeper issues, including a security exploit earlier this year. In February, $6.2 million worth of WEMIX tokens were stolen from Play Bridge, a cross-chain protocol supporting the token.

Critically, the Wemix Foundation waited four days before disclosing the breach to the public, citing concerns about triggering market panic.

However, this delay led to a 40% price drop during the undisclosed period and raised concerns over transparency and risk management.

The incident prompted DAXA to place WEMIX on its investment caution list, and the Foundation’s handling of the matter was later cited as a key reason behind the decision to proceed with full delisting.

Market Reaction and WEMIX Price Impact

The market responded swiftly and severely to the delisting news. The price of WEMIX tumbled to $0.3536, representing a staggering 51.52% loss in just 24 hours and a nearly 50% drop over the past week.

The token’s market capitalization now stands at approximately $147.3 million, with a 24-hour trading volume exceeding $47 million.

The timing of the delisting announcement, around 3 p.m. KST, coincided with a sudden and steep price drop, reflecting panic selling and uncertainty among investors.

The delisting removes WEMIX from the only fiat-accessible exchanges in South Korea, significantly hampering the token’s liquidity and trading prospects in the region.

DAXA’s Final Verdict and Implications for the Wemix Ecosystem

According to Bithumb’s official statement, DAXA concluded that the Wemix Foundation had “insufficiently addressed” the issues that led to the caution designation, sealing the token’s fate.

This delisting presents a serious blow to Wemade’s broader Web3 gaming ambitions, as WEMIX was meant to serve as a central utility and governance token within its ecosystem.

With South Korea being a core market for Wemade, losing access to its dominant exchanges could significantly disrupt both user engagement and developer confidence.

Moving forward, the Wemix Foundation will need to restore credibility through stronger security, transparency, and governance if it hopes to relist or regain momentum in the global crypto landscape.

Also Read: Kraken Detects North Korean Hacker’s Deceptive Job Application in Failed Crypto Hack Attempt