The Vatican Bank, officially known as the Istituto per le Opere di Religione (IOR), has publicly denied any affiliation with a fraudulent cryptocurrency project promoting a so-called “Vatican Chamber Token” (VCT).

The fake initiative was exposed as a phishing scam falsely claiming institutional backing from the Vatican.

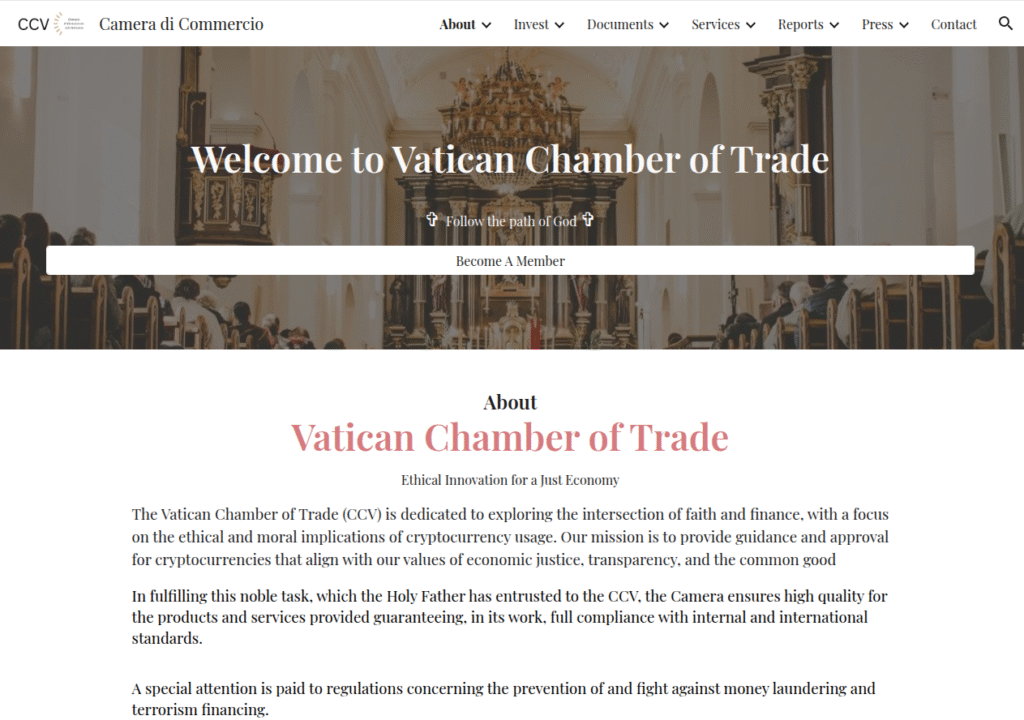

The project’s website, designed to appear credible, falsely stated that it was offering exclusive membership access to an elite economic institution called the “Vatican Chamber of Trade.”

Promoters framed the presale as a rare opportunity to join a generational financial initiative. The scam grew even more audacious by listing the real contact number of the Vatican Bank, adding to its apparent legitimacy.

False Legitimacy and Wikipedia Vandalism Amplified the Scam

The deception ran deeper than a standard phishing site. Investigators found that the so-called “Vatican Chamber of Trade” does not exist within the Vatican’s organizational structure.

To support the illusion, a fraudulent edit was made on the Vatican Bank’s Wikipedia page, falsely claiming the organization had ties to the “Vatican Chamber” established in 1950.

The edit included a hyperlink, marked in red to indicate lack of citation, highlighting how scammers attempted to manipulate trusted public sources for credibility.

A Vatican Bank representative confirmed in a direct call with Cointelegraph that the bank had no connection to the token project and labeled it outright as a scam.

Also Read: Blockchain Security Firm SlowMist Warns of Fake Telegram Groups Running Phishing Scams

Misleading Token Sale and Red-Flag Criteria Raised Alarm Bells

The fake VCT token was advertised as part of a membership offering that promised access to private investment opportunities, custodial holding, tokenized asset deals, and exclusive events.

The website laid out highly specific eligibility criteria, requiring businesses to demonstrate significant revenue or trading volume.

For example, traditional companies had to show at least €100,000 in annual income, while crypto projects needed €300,000 in total value locked or a cumulative trading volume of €500,000.

The scam even included a vague ethical requirement, listing values like transparency and financial inclusion, ironically undercut by the scam’s deceptive nature.

The token was priced at €25 per unit with a supposed total supply of 10 million tokens, 3 million of which were set aside for a “reserve fund.”

Also Read: EV Electra Plans $1 Billion HiPhi Auto Deal Amid Token Launch and As It Faces Legal Allegations

Questionable Infrastructure: Coinbase ENS Redirect Fuels Concern

Further inspection of the scam’s infrastructure revealed a link between the fraudulent project and Coinbase’s Ethereum Name Service (ENS) integration.

The “buy token” button on the scam website redirected users to a Coinbase Wallet address using the subdomain “vaticantrade.cb.id.”

While the domain “cb.id” is a legitimate Coinbase ENS offering that allows users to create wallet addresses without KYC verification, anyone can register a username, making it a potential haven for scams.

As of publication, Coinbase had not commented on whether it would investigate or act on this misuse of its infrastructure.

The misuse of Coinbase-linked domains raises broader concerns about how Web3 tools can be weaponized in social engineering attacks.

Rising Wave of Crypto Fraud Highlights Urgent Need for Oversight

This Vatican Chamber token scheme is just one among a rising tide of fraudulent token sales plaguing the crypto space.

In April, the collapse of Mantra’s OM token was witnessed, where insider dumping allegedly caused a near 90% loss in value.

Also far back in December, the Hawk Tuah token lawsuit came up amid the debunking of the $SHOWA token by its supposed parent company.

These cases highlight the urgent need for robust regulatory oversight and public education to protect retail investors from increasingly deceptive and complex schemes.

Also Read: Vietnam Police Arrest Gang Behind $400M Matrix Chain Crypto Scam