Tao Alpha PLC, a UK-listed artificial intelligence infrastructure firm, has made headlines with its strategic purchase of 28.56 Bitcoin, worth approximately £2.5 million ($3.37 million USD).

The significant move comes as part of the company’s larger rebranding and treasury strategy shift, with Tao Alpha soon to be renamed Satsuma Technology PLC.

The Bitcoin was acquired through a newly formed wholly owned Singaporean subsidiary and marks the company’s first direct crypto asset purchase.

The average cost per BTC was £87,532 ($118,159 USD), signaling a strong commitment to integrating Bitcoin into its balance sheet as part of a broader financial strategy.

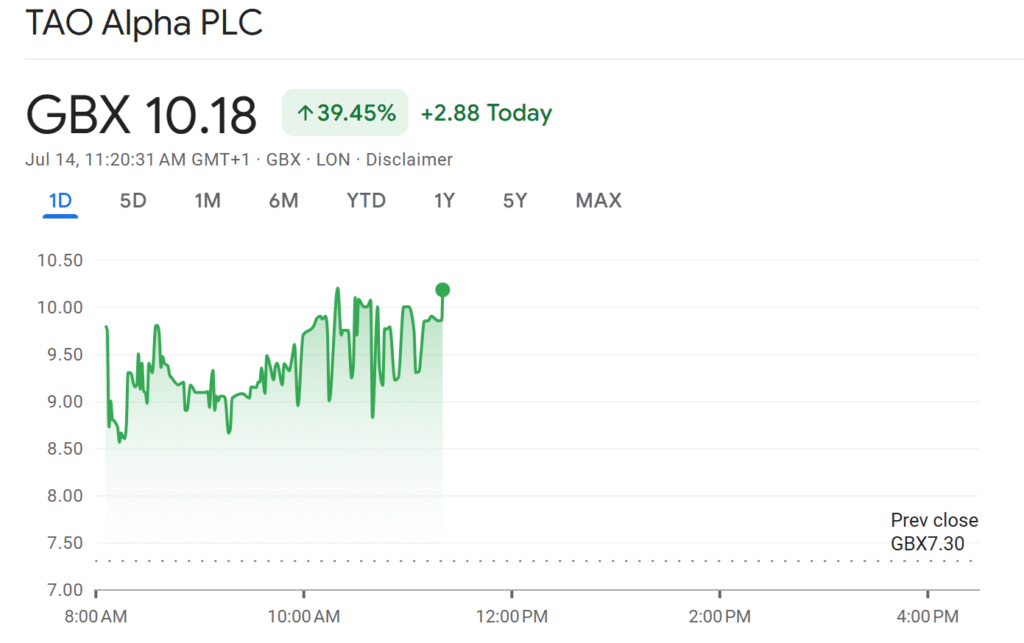

Share Price Soars 33% Following Investment and Leadership Change

Following the Bitcoin acquisition, Tao Alpha’s share price surged by 39.4%, closing at GBX 9.76 after climbing 2.46 points in a single day.

The bullish movement reflects a sharp rise in investor confidence, not only in response to the treasury allocation but also due to the announcement that Henry Elder will be taking over as full-time CEO.

Elder, formerly a principal at UTXO Management, is a respected figure in the world of institutional Bitcoin investment.

His proven track record advising and investing in BTC strategies for companies across the US, Japan, Canada, and Europe brings strong credibility to Satsuma Technology’s pivot toward a Bitcoin-integrated future.

Also Read: UK-Listed Panther Metals Sees 51% Share Price Surge After Announcing $5.3M Bitcoin Reserve Strategy

Henry Elder’s Vision: Institutional Bitcoin Adoption Through Public Markets

Elder’s appointment signifies a strategic inflection point for the company.

In his official statement, he expressed excitement about leading Satsuma’s growth, emphasizing that the London Stock Exchange offers a powerful platform for executing a public Bitcoin treasury strategy.

He highlighted the importance of institutional capital in fueling decentralized infrastructure, stating that the opportunity to lead such a transformation was one of the greatest of his career.

Elder has stepped down from his role at UTXO to fully dedicate his efforts to Satsuma, where he plans to build long-term value for shareholders by advancing both decentralized AI and Bitcoin holdings in tandem.

A Calculated Treasury Strategy: Balancing Risk and Operational Liquidity

The company has stated that it will maintain at least three months’ worth of operational capital in cash, with surplus funds held in Bitcoin through its Treasury.

The strategy reflects a cautious yet forward-looking approach, balancing the volatility of crypto assets with the need for steady operational funding.

The board will review the capital adequacy on an ongoing basis, with the potential to adjust the Treasury allocation based on future capital raises and financial performance.

The recent development aligns with broader trends among public companies seeking to hedge against inflation, diversify reserves, and attract tech-forward investors through Bitcoin adoption.

Bitcoin Treasury Trend Grows Across Global Markets

Tao Alpha’s move follows a broader trend of institutional and public company adoption of Bitcoin as a treasury asset.

Recently, companies like DDC and Remixpoint made similar headlines with strategic BTC purchases, leading to notable share price increases.

Two days back, DDC’s $100M partnership with Animoca Brands saw its stock jump 20%.

While a day before that, Remixpoint raised $215M to triple its Bitcoin holdings, despite facing share dilution.

Bit Digital also raised $163M to scale its Ethereum holdings, signaling a diversification of institutional crypto strategies.

Tao Alpha’s transformation into Satsuma Technology places it firmly within this growing cohort of forward-thinking firms leveraging crypto to drive value and innovation.