Two senior congressional Democrats have urged federal regulators to investigate the controversial launch of two memecoins by President Donald Trump and former First Lady Melania Trump, CNBC reported.

These tokens, dubbed $TRUMP and $MELANIA, have sparked concerns over potential conflicts of interest, misuse of public office for personal enrichment, and the risk of financial harm to retail investors.

Why is an Investigation Required?

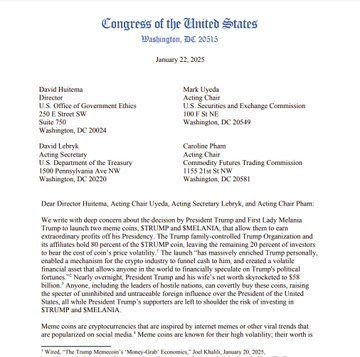

In a letter obtained by CNBC, Senator Elizabeth Warren and Representative Jake Auchincloss, both from Massachusetts, expressed their alarm. They questioned the ethics of a former president and first lady profiting significantly from digital assets tied to their names.

The tokens launched just days before Trump’s presidential inauguration, have raised fears of “rug-pull” scams—situations where token creators manipulate markets for quick gains at investors’ expense.

“We write with deep concern about the decision by President Trump and First Lady Melania Trump to launch two meme coins, $TRUMP and $MELANIA, that allow them to earn extraordinary profits off his presidency,” the lawmakers stated.

Rapid Financial Gains and Global Implications

The launch of $TRUMP and $MELANIA has had significant financial repercussions. President Trump reportedly retains 80% of $TRUMP coins in circulation.

This control, combined with a rapid increase in value from $3 to nearly $37 per token, has allegedly bolstered the Trump family’s net worth by tens of billions of dollars.

On paper, their total on-chain wealth, which includes holdings in other related tokens like $VANCE, may approach an astonishing $2.3 trillion.

Warren, a key member of the Senate Banking Committee, highlighted concerns about foreign influence. “Anyone, including leaders of hostile nations, can covertly buy these coins, raising the specter of uninhibited and untraceable foreign influence over the President of the United States,” she wrote.

Market Performance

Despite initial excitement, both tokens have experienced volatility. As of the latest figures, $TRUMP is trading at $34.78, down 5.15% in the last 24 hours, with a trading volume drop exceeding 30%.

Meanwhile, $MELANIA, valued at $2.77, is down nearly 10% over the same period. Interestingly, $MELANIA’s trading volume has surged by 24%, indicating speculative interest.

Whales Dominate the Market

The concentration of wealth within these tokens has drawn additional scrutiny. Approximately 40 crypto whales hold 94% of the combined $TRUMP and $MELANIA assets, each owning at least $10 million. This distribution leaves retail investors with minimal influence and higher risk exposure.

Warren and Auchincloss have emphasised the urgent need for regulatory intervention. They argue that the tokens exemplify the worst aspects of the volatile cryptocurrency market, where retail investors often bear the brunt of speculative losses.

The letter called on agencies like the SEC to assess whether the launch of these coins violated federal securities laws or ethical guidelines. The Democrats’ concerns extend beyond market fairness to potential conflicts of interest that could undermine public trust in democratic institutions.