Bitcoin reserves held by U.S.-based entities have reached unprecedented levels, significantly surpassing offshore holdings, according to CryptoQuant data. As of today, U.S. entities’ Bitcoin reserve share is 65% greater than that of the non-U.S. entities.

This marks an all-time high for the U.S. share of Bitcoin reserves, underscoring the growing dominance of U.S. institutions in the cryptocurrency market.

Key Drivers of the U.S. Surge

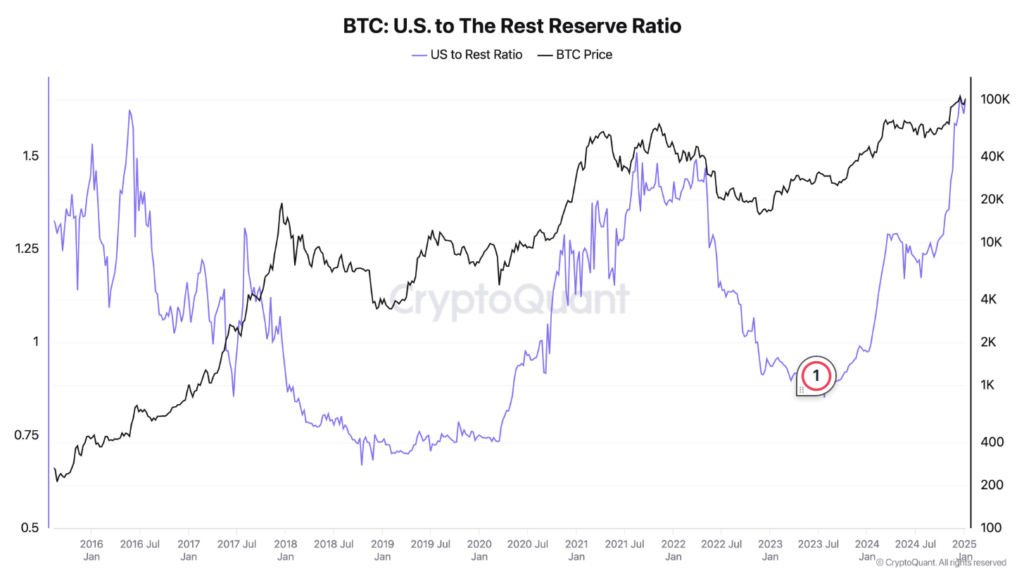

The ratio of U.S. to offshore Bitcoin holdings has shown a sharp upward trajectory. It climbed from 1.24 in September 2024 to 1.66 by December 16, before stabilizing at 1.65 as of January 6, 2025.

This shift follows a period in 2023 when offshore entities held a larger share of Bitcoin, coinciding with the asset trading below $30,000.

Several factors have contributed to the increasing concentration of Bitcoin reserves within the U.S. One of the most prominent is the re-election of pro-crypto President Donald Trump.

Also Read: U.S. Government Transfers $2 Billion In Bitcoin, Sparking Speculation

His administration’s proposed establishment of a national strategic Bitcoin reserve has instilled confidence in U.S.-based institutions, fueling a surge in Bitcoin acquisition. This policy shift has paralleled Bitcoin’s rise to an all-time high above $108,000.

A Big Thanks to MicroStrategy

MicroStrategy, a corporate leader in Bitcoin accumulation, continues to play a pivotal role in driving U.S. dominance. The company purchased an additional 1,070 BTC between December 30 and 31, 2024, at an average price of $94,004 per Bitcoin.

This acquisition, valued at $101 million, brought MicroStrategy’s total holdings to 447,470 BTC, worth approximately $28 billion. The company now controls 2.1% of all Bitcoin that will ever exist, further solidifying its position as the largest corporate Bitcoin holder.

The launch of U.S.-listed spot Bitcoin ETFs in January 2024 has also been a significant catalyst. These ETFs have recorded inflows of $106.8 billion to date, offering institutional and retail investors regulated, simplified access to Bitcoin exposure.

The strong demand for these ETFs highlights the growing appetite for cryptocurrency among U.S.-based investors.

Implications for the Market

The increased concentration of Bitcoin reserves in the U.S. has far-reaching implications. On a technical level, this trend could impact Bitcoin’s liquidity and market depth.

From a trading perspective, the dominance of U.S. reserves could cause fluctuations in Bitcoin pairs involving the U.S. dollar. Metrics such as the Relative Strength Index (RSI) and Moving Averages during U.S. market hours may provide valuable insights for traders seeking to navigate these shifts.

As the U.S. continues to assert its dominance in Bitcoin reserves, it is clear that the country is positioning itself as a global leader in cryptocurrency adoption and innovation.

Also Read: U.S Senator Lummis Plans To Push FED To Buy Bitcoin Reserves By Selling Its Gold