Justin Sun, the founder of Tron (TRX), recently expressed via X his optimism following the announcement that TRX is now part of the assets under consideration by Grayscale, a leading crypto-focused asset management firm.

On April 10, Grayscale released an updated report that lists potential candidates for inclusion in future investment products, highlighting TRX as a key asset.

The recent development is a notable milestone for Tron, as Grayscale’s move signals the increasing recognition of TRX’s role in the cryptocurrency landscape.

Sun’s reaction on social media was one of excitement, as he noted that the competition for a Tron Exchange-Traded Fund (ETF) is growing more intense, a significant development in the world of digital assets.

Grayscale’s Role in Shaping Crypto Investment Products

Grayscale’s report sheds light on its mission to expand investor access to a diverse range of digital assets.

The firm’s aim is to create investment products that provide exposure to promising cryptocurrencies, helping investors diversify their portfolios.

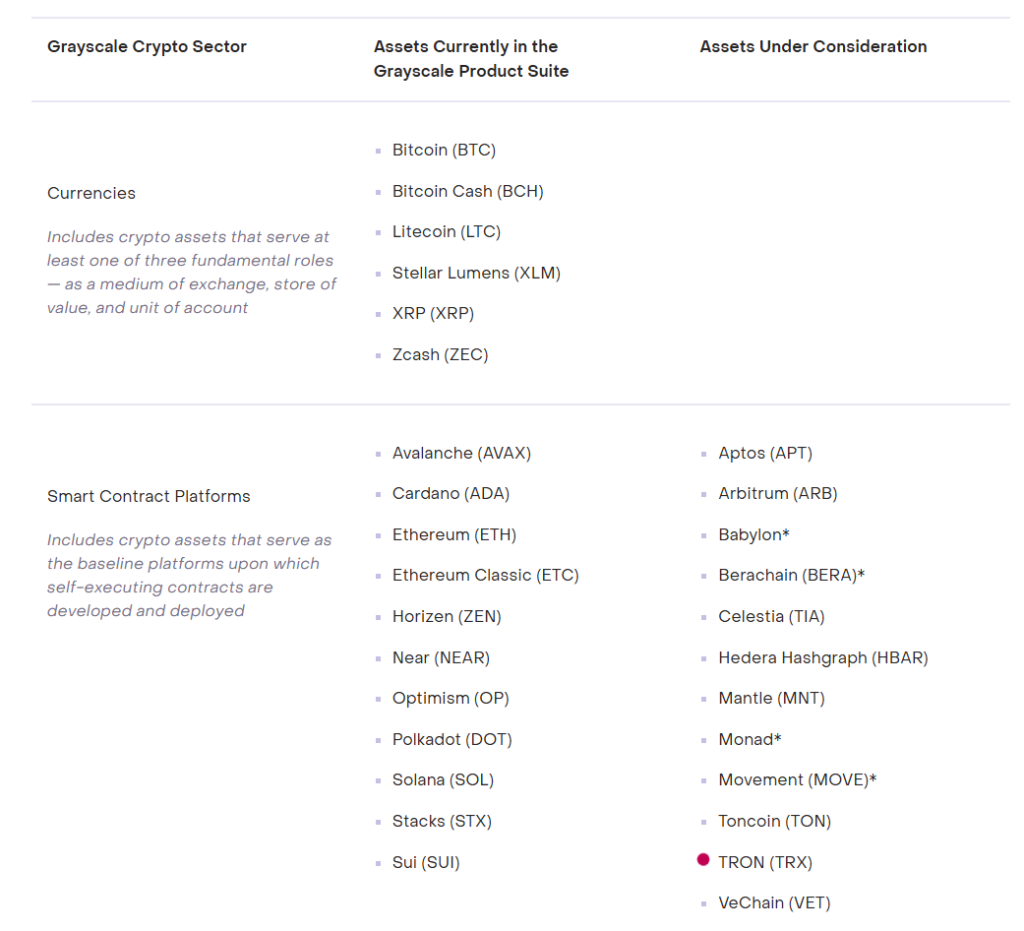

The list, as detailed in Grayscale’s April 10 report, is categorized into two sections: assets currently held by Grayscale products and those under consideration for future products.

TRX’s inclusion in the “Assets Under Consideration” list places it in the running for potential future Grayscale products, which could ultimately lead to wider institutional adoption.

The strategic move by Grayscale underlines the growing acceptance of cryptocurrencies in mainstream financial products.

Also Read: SunPump Partners with Poloniex to Boost TRON Meme Growth

Breakdown of Grayscale’s Crypto Sectors Framework

Grayscale’s new framework, which categorizes assets by crypto sectors, is designed to help standardize how different types of digital assets are understood within the market.

The report breaks assets into categories like “Currencies,” which include cryptocurrencies that function as a medium of exchange, store of value, or unit of account.

Also, “Smart Contract Platforms,” which includes assets that enable the development and deployment of self-executing contracts.

TRX is categorized under the Smart Contract Platforms section, alongside well-known cryptocurrencies like Ethereum (ETH), Solana (SOL), and Cardano (ADA).

The positioning reinforces the idea that TRX is not just a transactional currency but also an essential platform for decentralized applications and smart contracts.

TRX’s Growing Influence and Institutional Appeal

Justin Sun’s positive reaction highlights the increasing institutional appeal of TRX, which has garnered significant attention over the years as one of the most active and widely-used blockchain platforms.

By securing a spot on Grayscale’s list, TRX is now in the same league as major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), both of which are currently part of Grayscale’s product suite.

As institutional interest in cryptocurrency continues to grow, the possibility of a Tron ETF is becoming more realistic.

The competition for a Tron ETF, as Sun pointed out, is intensifying, indicating that investors are eager for more ways to access Tron’s potential through traditional financial channels.

The Future of TRX and Its Role in the Broader Crypto Market

The inclusion of TRX in Grayscale’s consideration list marks a significant step forward in Tron’s journey as a recognized and potentially institutional-grade asset.

The Tron network has consistently demonstrated its utility in areas such as decentralized finance (DeFi), gaming, and content creation, and this recognition from Grayscale is expected to bolster its credibility.

If TRX is eventually included in Grayscale’s investment products, it could open the door for greater institutional participation, enhancing its liquidity and market stability.

For Justin Sun and the Tron community, this is not just a victory for the token but also a testament to the broader growth of the cryptocurrency sector, which continues to gain momentum and mainstream acceptance.

Also Read: TRON’s USDD Stablecoin Exceeds 300 Million Minted, Reaches Key Milestone