Trust Wallet said on posts that perpetual futures will arrive soon in the app, with more than 100 markets and up to 100x leverage, powered by Decentralised exchange Aster. The team also published a multi-layer product roadmap driven by Trust Wallet Token, or TWT.

The firm posted the news today on its channels and explained the move as part of a push to onboard more users and add advanced trading, everyday finance and rewards to the wallet experience.

Perpetuals coming to wallets

Trust Wallet’s social post was short and direct, and it said perps are coming soon to Trust Wallet.

The post promised 100+ markets and up to 100x leverage, and it named Aster as the engine behind the product and called the feature “advanced trading, designed for everyone.”This marks a clear step into pro-style trading inside a self-custody wallet.

Perpetuals let users take long or short positions without an expiry date. Leverage amplifies gains and losses. Built into a wallet, these features aim to let users trade without leaving their keys.

What this means for users?

Putting perpetuals inside Trust Wallet could change how some people trade. Users will be able to open leveraged positions while staying self-custodial. That reduces the need to move funds to a centralised exchange.

It can speed up execution and keep custody with the user, and at the same time, higher leverage increases risk. Traders will need to manage margin carefully and understand liquidation rules.

Trust Wallet framed the launch as part of a broader plan. The company said wallets are the backbone of Web3. It argued that every onchain action starts with a wallet. The blog post described wallets as the main way billions of people will access crypto, DeFi and tokenised real-world assets.

The TWT product roadmap

Trust Wallet said it is entering a new era and will use TWT to power access and features inside the app.

The roadmap is split into three layers, and the first layer focuses on everyday finance. The firm plans cheaper and simpler cross-chain transfers, local on and off ramps, scam protection, and payment features like Trust Card and Trust Pay.

The second layer centres on advanced trading, and Trust Wallet said swap volumes have risen and the team will add pro modes, perpetuals up to 100x, prediction markets, limit orders, DCA tools and real-time insights.

It promised stronger security features such as token scanning and protections against MEV and front-running. The firm also said it will push cross-chain swaps that feel seamless while staying self-custodial.

The third layer is about earning and growth. TWT holders will gain access to staking, lending, enhanced yields and exclusive airdrops. Trust Alpha, the launchpool product, will help new projects reach the community and potentially graduate into a wider ecosystem.

A note on accessibility and risk

Trust Wallet stressed easy use and broad reach, and the company says it already hosts over 210 million users. Its message ties growth goals to better tools and cleaner user flows.

At the same time, products like perpetuals and high leverage are complex. They suit traders who understand margin, volatility and liquidation. The addition of such features inside a wallet will likely spark debate about consumer protection and education.

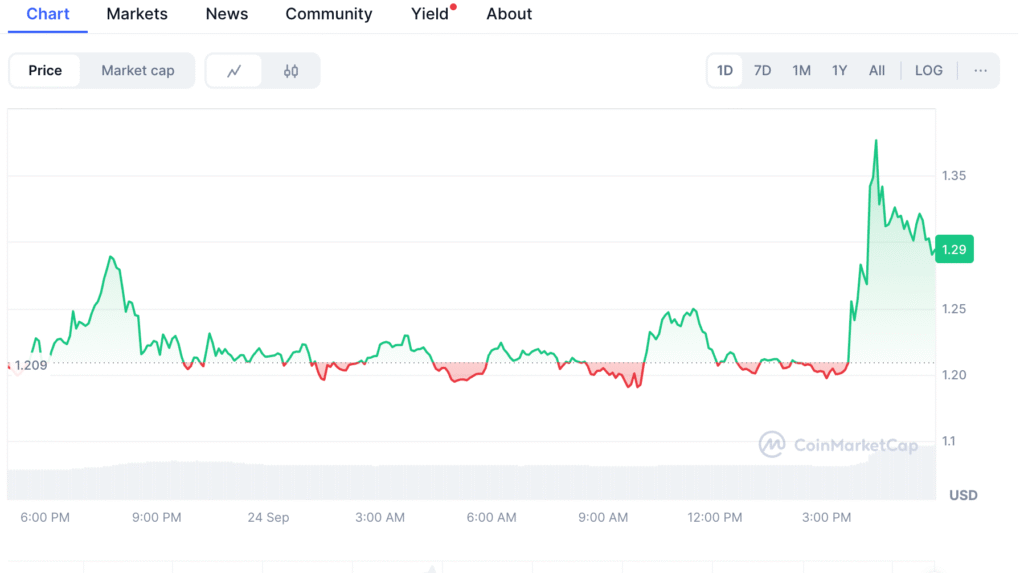

Trust Wallet Token ($TWT) Price Actions

Meanwhile, TWT is trading at $1.28 with a 1-day gain of 5.11%. Market cap sits near $553.86 million, up 5.11% on the day. Reported 24-hour volume reads about $170.9 million, a jump of 79.95%.

Trust Wallet is moving from a basic wallet to a broader financial hub. The arrival of perpetuals and a TWT-driven product plan signals that the team wants to cover trading, payments and rewards inside a self-custodial app.