A major cryptocurrency whale has experienced substantial losses following a significant investment in the Trump Token ($TRUMP).

The investor allocated $9.5 million to acquire 187,360 $TRUMP tokens at an average price of $58.03 per token.

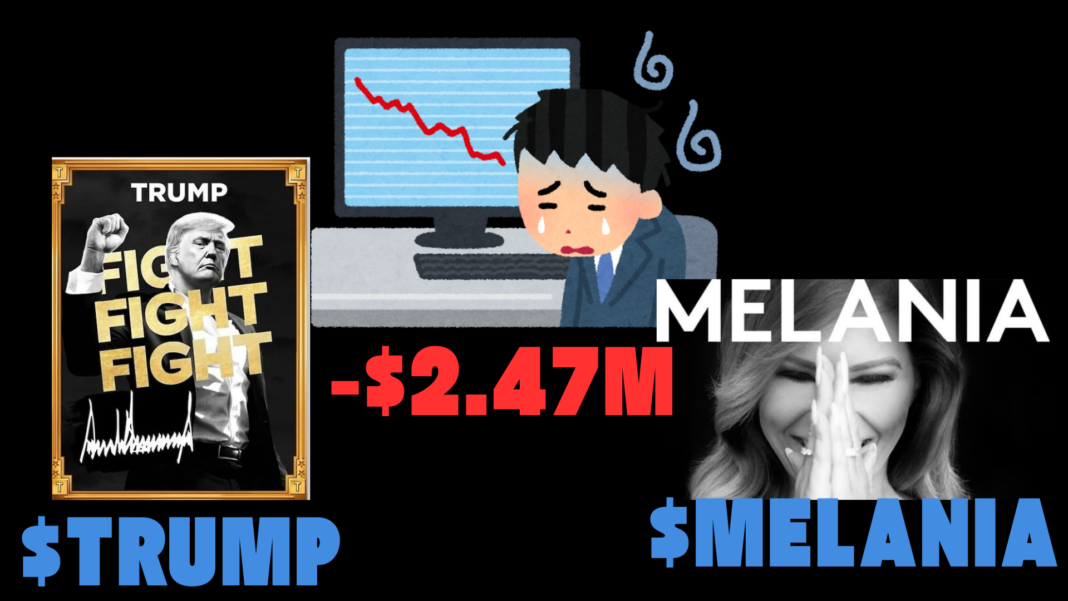

The investment by the address FqdKe…NG7xG earlier today has since deteriorated in value, with the token’s current price at $38.45, resulting in an unrealized loss of approximately $2.47 million.

The token’s recent performance has been particularly challenging, showing a dramatic 34.79% decline in just 24 hours, despite maintaining a total market capitalization of $7.57 billion with a circulating supply of 200 million tokens.

The substantial trading volume of $21.6 billion in the past 24 hours indicates significant market activity and volatility.

Market Dynamics and Parallel Token Performance

The situation has been further complicated by the launch of the $MELANIA token, which has created interesting market dynamics within the political token ecosystem.

The same whale investor holds approximately 1.438 million $MELANIA tokens, valued at nearly $10.98 million, purchased at an average price of $7.78 per token.

However, $MELANIA has also faced significant market pressure, with its price dropping to $4.28, representing a steep 65.29% decline in 24 hours.

The token maintains a market cap of $632.9 million with a circulating supply of 150 million tokens and shows active trading with a 24-hour volume of $3.69 billion.

Notably, the launch of $MELANIA had a direct impact on $TRUMP’s market performance, contributing to its market cap reduction from $71 billion to $56 billion.

Portfolio Impact and Investment Strategy

The whale’s investment strategy and its outcomes highlight the volatile nature of cryptocurrency markets, particularly in the emerging sector of politically-themed tokens.

While facing losses on the $TRUMP position, the investor has maintained their holdings without selling, suggesting a longer-term investment perspective.

The combined exposure to both $TRUMP and $MELANIA tokens represents a significant investment in this specific market segment, with the total position value fluctuating substantially due to market volatility.

The case serves as a prominent example of how even well-resourced investors can face substantial risks in the cryptocurrency market, especially when taking large positions in newly launched tokens.

Market Implications and Future Prospects

The emergence and performance of these politically-themed tokens have sparked broader market interest and speculation about potential future developments.

There is growing discussion about the possibility of additional Trump family members launching their own tokens, expanding this unique market segment further.

The substantial market movements and high trading volumes suggest significant investor interest in these tokens, despite their volatile nature.

The market’s response to these tokens has demonstrated the increasing intersection between political branding and cryptocurrency markets, creating new opportunities and risks for investors.

The current market dynamics and trading patterns indicate that while there is substantial speculative interest in these tokens, they remain subject to extreme price volatility and market sentiment shifts.

Also Read: Crypto Trader Turns 2,500 $SOL Into $66M With $MELANIA Token Trade