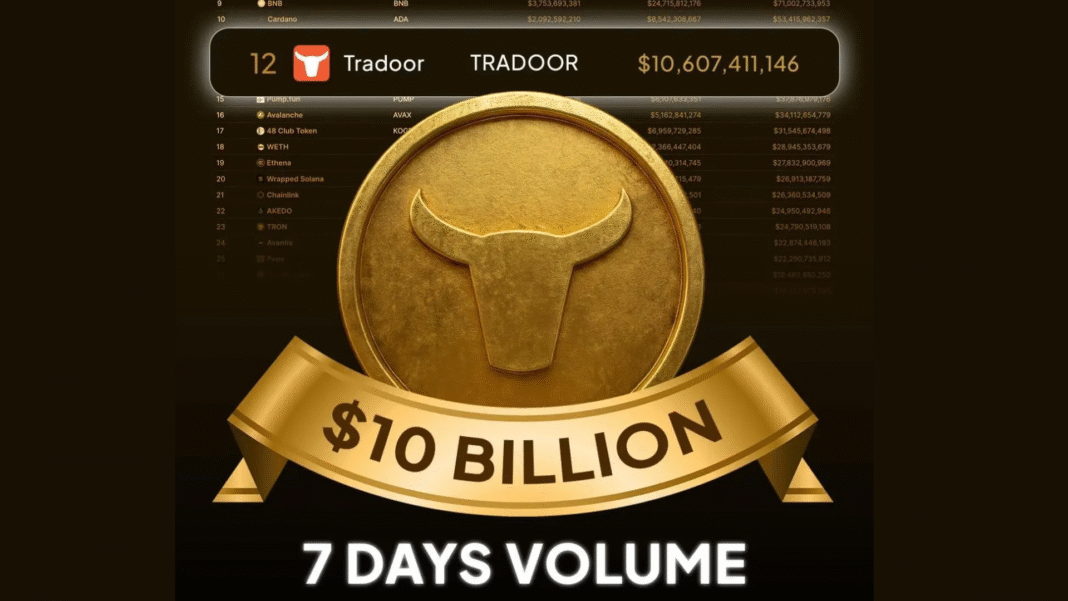

Tradoor, a decentralized derivatives protocol, is generating attention in the DeFi space after announcing that trading volume exceeded $10 billion in the previous week.

At the same time, its native token, TRADOOR, has seen substantial price growth of 30.9% this week and currently trades at $2.89, with a market capitalization of $1.73 billion.

This funding comes after a previous fundraising round of $3.2 million from Kenetic Capital and TON Ventures and the recent listing and trading of the project on Binance Alpha, which creates liquidity and visibility for the project.

This milestone serves to further reinforce Tradoor as one of the key projects within a quickly growing DeFi ecosystem.

Competitive Perp DEX Market

In the competitive landscape, Tradoor has quickly emerged as one of the top-three protocols on Binance Alpha, with over 60,000 token-holding addresses.

Notably, Tradoor has more than 350,000 active users and has over 300,000 community members who’ve engaged with the community.

Also, over $6 billion in trading volume over the previous 7 days, and outperforming tokens such as $TRUMP, $HYPE, $LINK, and $TRX.

Furthermore, Tradoor is ranked 4th overall in Binance Alpha’s leaderboard by points, extending its lead.

Currently, the $TRADOOR token ranks 22nd worldwide for 30-day trading volume in September, having experienced over $830 million of trading volume in the previous 24 hours and over $6 billion over the last 7 days.

User Growth, Liquidity, and AI Innovation

Tradoor’s edge comes from its balance of strong liquidity and quality trading experience, now improved with the release of its new USDT liquidity pools, Turbo + Wallet, that replace the Classic pool.

Traders can choose Turbo Mode for fast confirmations and 50% less in gas fees, or use Wallet Mode and get a more familiar experience. Liquidity providers will earn a better return and have added CV safety with a double audit performed by top firms.

With the new systems as a foundation and more than 350,000 active traders and more than 300,000 community members eagerly waiting to use the improved platform, Tradoor’s adoption is unaffected as it increases followers and traction in the marketplace.

Its Telegram Mini App enables one-click ordering and reduces barriers for retail users, while offering trading in both perpetual contracts and options, providing a range of trading options that meet various market needs.

In addition, Tradoor is extending its platform with the implementation of AI Tools, including the AI Liquidity Shield, which protects against non-competitive behavior through harmful traffic filtering, and a Quant AI Assistant, under development, which will allow traders to enter trades using simple text or voice commands.

These innovations signal Tradoor’s move away from DEX and an estimated AI trading ecosystem available to a wider audience.

Future Outlook and Market Positioning Against Hyperliquid

Industry experts are already drawing parallels between Tradoor’s progress and that of Hyperliquid, which has recently increased in value, including whales taking home tens of millions on their $HYPE token.

Tradoor, similar to Hyperliquid, offers fast execution, efficient liquidity, and growth based on community support, but in addition, focuses on AI and social trading.

By lowering the barrier to entry and offering intelligent algorithm trading functionality, Tradoor opens the door to not only being a competitor but likely a market leader, as well.

Today, TRADOOR has pulled back slightly (down 4.04% to $2.66); however, it is still up 30.44% for the week.

With 14m tokens in circulation, TRADOOR has a market capitalization of $38.4m, and certainly is shaping up to be a player that can challenge Hyperliquid with its identity in AI-powered DeFi.