The global crypto market has recovered the $4 trillion level for the first time since July 18, 2025, with a rally in altcoin values and underpinned by the passing of the US GENIUS Act.

This milestone was attributed to a combination of revived investor confidence and favorable regulatory footing.

As of today, Aug 9, 2025, total crypto market capitalization stood at $4.08 trillion, yet again, a gain of 1.6% from yesterday.

Bitcoin continues to dominate the pack, capturing nearly 60% of total capitalization, representing the continued demand for large-cap digital currency even amidst higher trading volumes.

Trump Executive Order Opens Retirement Plans to Crypto Investments

Among the causes of this rally is a significant policy shift in the United States. President Donald Trump issued an executive order allowing cryptocurrencies to be included in 401(k) and other defined-contribution pension plans.

The order is asking the US Labor Department to reconsider restrictions on alternative investments such as crypto, private equity, and real estate.

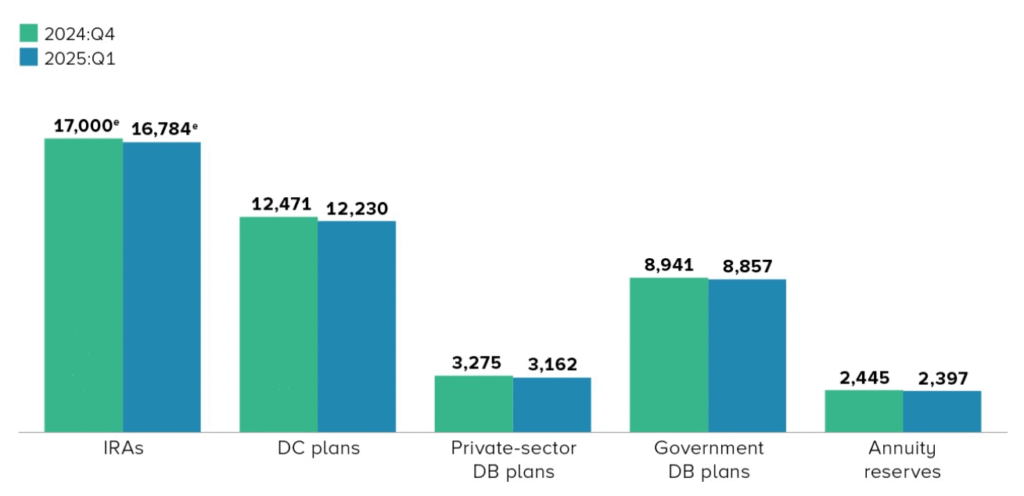

With US retirement accounts of $43.4 trillion in Q1 2025, $8.7 trillion of which were in 401(k)s, analysts suggest that even a small allocation of the funds to crypto can steer billions into the space, generating long-term demand and liquidity.

Monetary Policy Hopes Fueled the Rally

Market sentiment has also been underpinned by the Federal Reserve’s appointment of Stephen Miran to the Board of Governors, which has been interpreted universally as a harbinger of the potential for a shift toward more accommodative monetary policy.

Futures markets now place a 40% probability on August’s interest rate reduction from a whooping 95% last month.

The dovish mood has resulted in investors eager for risk assets like cryptocurrencies, as declining interest rates often stimulate capital flows into growth-trend and speculative markets.

Bitcoin and Ethereum See Price Gains, Massive Short Liquidations

Bitcoin currently trades at $117,266, reflecting a 0.47% increase in value over the previous 24 hours and a 3.09% increase in value over the previous week, with a total market capitalization of more than $2.33 trillion.

Notably, the Bitcoin Fear and Greed Index is currently at 67, which signifies Greed in the market.

Ethereum, however, has broken the $4,200 threshold, prompting $110 million in short liquidations, over half of all crypto shorts closed within an hour.

Eric Trump, son of President Trump, publicly celebrated the move, urging traders to “stop betting against BTC and ETH.”

Analysts note that while this short squeeze could push ETH toward $4,500, sustained buying pressure will be necessary to maintain upward momentum.

Also Read: Crypto Market Rebounds by 24% To $3.5 T In Q2, Despite Average Daily Volumes Dropping 26.2%: Report

Altcoins See Significant Movement on Regulatory Clarity and ETF Filings

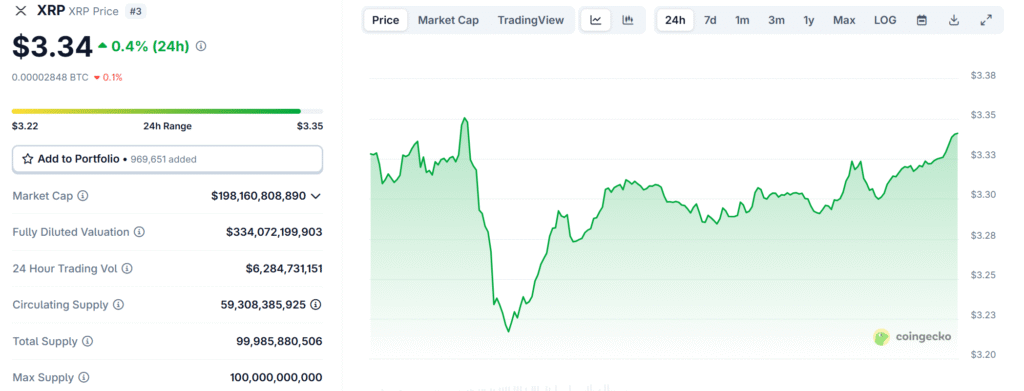

XRP has become a focal point for traders following regulatory clarity from the resolution of the SEC vs. Ripple case.

Although XRP’s price is up 0.4% in the past 24 hours to $3.34, it is still up 11.69% over the past week, with a market capitalization nearing $197.3 billion.

Japan’s SBI Holdings has further fueled optimism by filing for a Bitcoin-XRP ETF, potentially increasing institutional demand for both assets.

Other altcoins like DOGE have seen significant whale accumulation, further underscoring strong confidence among major holders.

Altcoins such as Solana (SOL), and Dogecoin (DOGE) are also contributing to market momentum.

Solana is up 3.66% in the past day at $181.89, with a market cap of $98.1 billion, while Dogecoin has risen 6.53% to $0.2372, fueled by large whale purchases.

Increased trading volumes, bullish derivatives positioning, and vigorous whale activity in DOGE are seen as indicators of growing institutional and retail confidence.