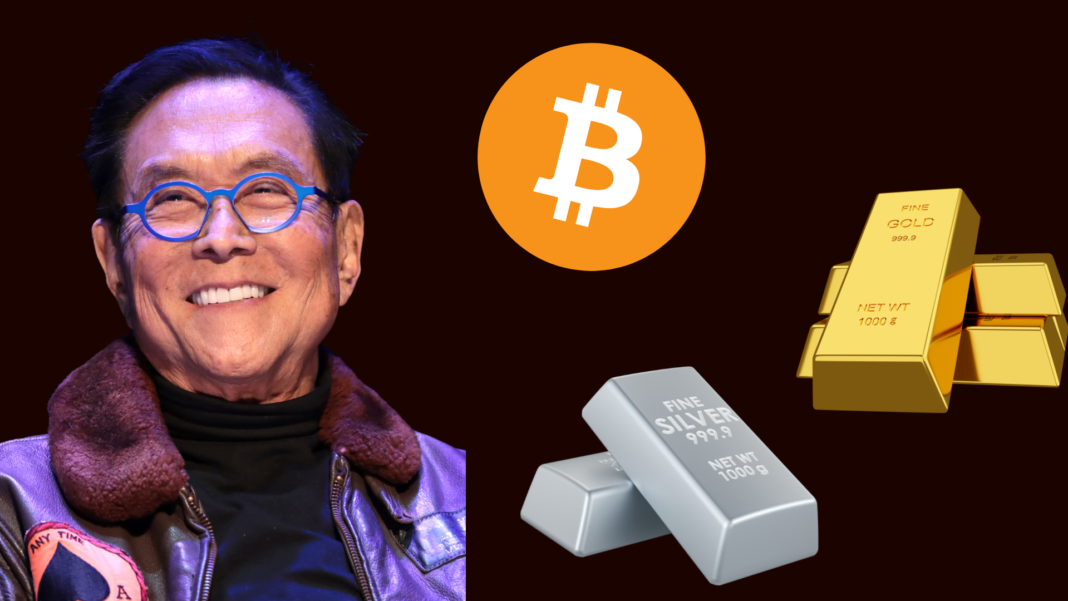

Renowned financial author Robert Kiyosaki has once again made headlines with his strong stance on Bitcoin. In a recent post on X (Twitter), the Rich Dad Poor Dad author reacted to the start of new tariffs under former U.S. President Donald Trump, predicting that gold, silver, and Bitcoin could see a sharp decline. Instead of worrying about the potential drop, Kiyosaki welcomed it as a buying opportunity.

New Confidence in Bitcoin?

“TRUMP TARIFFS BEGIN: Gold, silver, Bitcoin may crash. GOOD. Will buy more after prices crash. The real problem is DEBT….which will only get worse. CRASHES mean assets are on sale. Time to get richer,” he wrote.

Kiyosaki, who has long been a proponent of precious metals, is now shifting his focus to Bitcoin. He recently stated that he is actively selling off his gold and silver holdings in favour of accumulating more BTC, believing it has the highest potential for future gains. He has also made a bold prediction that Bitcoin could reach $250,000 by 2025.

Also Read: Robert Kiyosaki Responds To Buffett & Munger’s Criticism Of Bitcoin, Says “Bitcoin Made Me Rich”

Debt, Inflation, and the Shift to Bitcoin

One of Kiyosaki’s biggest concerns is America’s rising national debt, which now exceeds $36.2 trillion. He warns that the U.S. government is printing $1 trillion every 90 days, a strategy that devalues the dollar and fuels inflation.

In his view, this reckless monetary policy is driving the world toward an economic reset, with Bitcoin emerging as the ultimate hedge against financial instability.

He believes the global financial system is undergoing a historic shift—from traditional paper money to digital assets like Bitcoin. Unlike fiat currencies, which governments can print at will, Bitcoin has a fixed supply of 21 million coins, making it an attractive store of value in uncertain economic times.

A Historic Stock Market Crash?

Kiyosaki’s warnings extend beyond inflation and debt. He has also forecasted what he calls the “biggest stock market crash in history,” predicting it will happen in February 2025. He referred to his 2013 book, Rich Dad’s Prophecy, in which he outlined signs of an economic collapse.

While some analysts view Kiyosaki’s predictions as extreme, his belief in Bitcoin as a hedge against financial crises continues to gain traction. As traditional financial markets face increased uncertainty, more investors are looking at Bitcoin as a way to protect their wealth.

Bitcoin’s Price Actions

At the time of writing, Bitcoin is trading at $102,416.99, down 1.93% in the last 24 hours. The global cryptocurrency market cap stands at $2.02 trillion, while the 24-hour trading volume has increased by 17.93%, indicating strong market activity despite recent fluctuations.

Robert Kiyosaki’s latest statements reflect his long-term belief in Bitcoin as a hedge against financial instability. While his warnings of a market crash may seem alarming, he sees downturns as opportunities to buy valuable assets at lower prices.