THORChain, the cross-chain swap protocol, has announced a 90-day restructuring plan to address pressing financial challenges.

The plan includes halting its THORFi services, specifically lending and savings programs, as the protocol grapples with allegations of insolvency.

According to THORChain’s announcement, the restructuring is aimed at resolving issues related to unserviceable debt linked to its lending operations.

Despite these measures, the platform’s core trading functionalities, such as cross-chain swaps, remain active.

Details of the Restructuring Plan

The primary goal of the restructuring plan is to alleviate financial strain caused by THORFi’s “Savers and Lending” programs.

These services, which have reportedly accumulated significant debt, are being paused while the protocol reevaluates its operational model.

Validator nodes have implemented the plan, ensuring the platform’s critical trading services remain unaffected during this period.

While this step aims to address underlying financial issues, the suspension of lending operations has sparked uncertainty among investors and community members, leaving the long-term outcome of the restructuring uncertain.

Also Read: FTX/Alameda Moves $58.7M Worth of Worldcoin ($WLD) to BitGo Escrow As Bankruptcy Payout Begin

Market Fallout and Impact on $RUNE Token

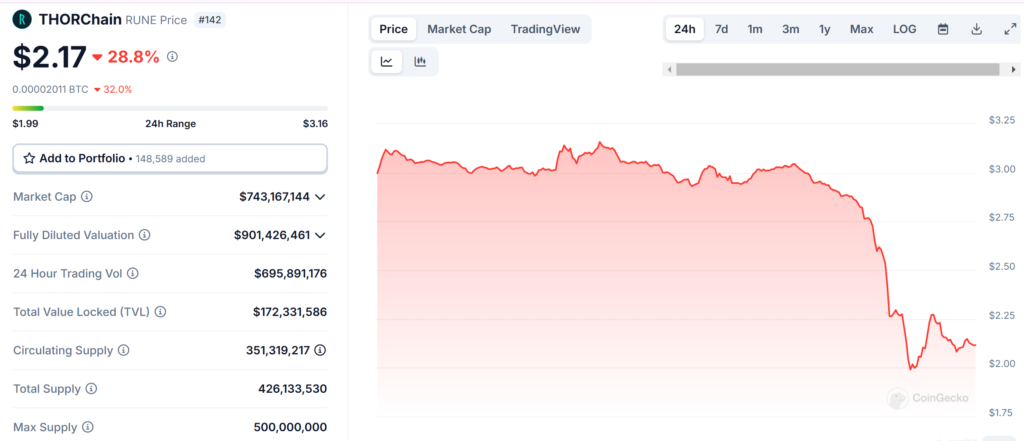

The announcement has had a profound impact on the price of THORChain’s native token, RUNE.

Over the past 24 hours, RUNE has plunged by 30.41%, with the token currently trading at $2.11.

The situation has been even bleaker over the past week, with the token experiencing a 43.17% drop.

The increased volatility is evident in the 24-hour trading volume, which now stands at $695.8 million.

While heightened trading activity suggests investor attempts to capitalize on the price swings, it also reflects growing unease about the protocol’s stability and future.

Broader Implications and Crypto Industry Context

THORChain’s restructuring highlights the financial vulnerabilities that can arise within decentralized ecosystems.

The pause in lending services, coupled with insolvency rumors, raises concerns about the protocol’s long-term viability and its ability to navigate the ongoing crisis.

These challenges occur against a backdrop of other notable events in the crypto space.

For instance, WazirX recently secured Singapore court approval to repay users after a $235 million hack, and BitMEX’s parent company was fined $100 million for compliance violations.

THORChain’s situation serves as a reminder of the risks involved in decentralized finance, emphasizing the importance of robust financial management and regulatory adherence in ensuring ecosystem stability.

The next 90 days will be crucial for THORChain as it seeks to resolve its financial issues, rebuild investor confidence, and maintain its position within the cross-chain ecosystem.

Also Read: South Korean Crypto Platform Haru Invest Files for Bankruptcy Amid $1 Billion Fraud Scandal