Tether, the issuer of the widely used USDT stablecoin, has taken strong action against illicit activities by freezing over 11 million USDT linked to suspicious transactions.

According to data from MistTrack, a blockchain security monitoring platform, the frozen funds were traced to a TRON blockchain address (THsPN…4bz9F), which is suspected of being involved in phishing-related scams.

The intervention highlights Tether’s continued efforts to mitigate fraudulent activities in the crypto space, particularly as phishing scams become increasingly prevalent.

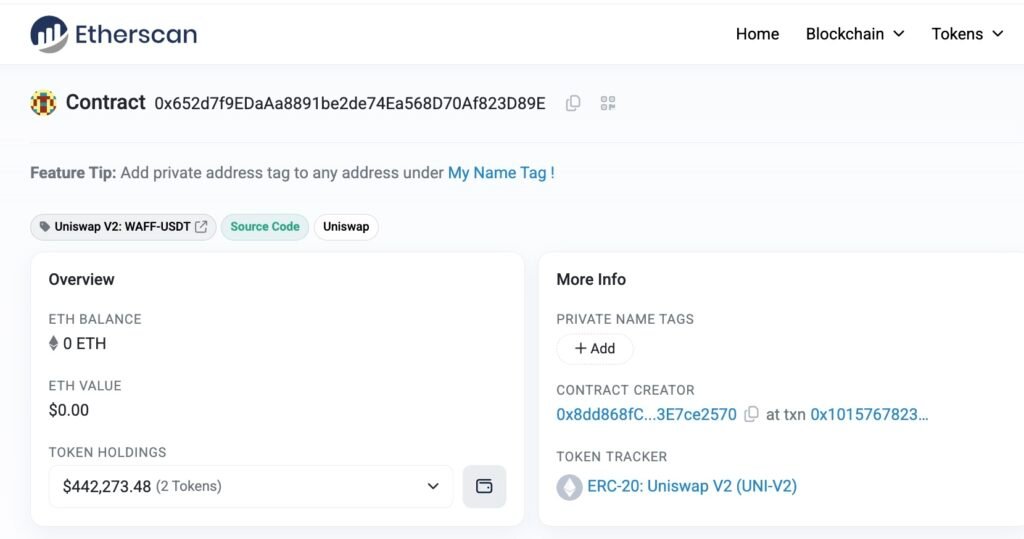

Additional USDT Frozen at Uniswap Amid Rising DeFi Exploits

Beyond the 11 million USDT frozen on TRON, another 442,400 USDT was also locked at a UniswapV2Pair contract address (0x652d…89E), signaling a growing trend of malicious actors using decentralized finance (DeFi) protocols to launder stolen assets.

Uniswap, one of the largest decentralized exchanges, is frequently targeted by scammers who exploit its permissionless nature to move illicit funds.

By freezing these assets, Tether aims to disrupt fraudulent cash-out attempts and enhance security across decentralized protocols.

The action also raises awareness of the increasing risks in DeFi platforms, where users and liquidity providers must remain vigilant against potential threats, including malicious smart contracts and phishing attacks disguised as legitimate transactions.

Phishing Scams Surge as Crypto Industry Faces Security Challenges

Phishing scams in the crypto industry have reached alarming levels, with attackers employing increasingly sophisticated methods to deceive users.

Telegram, in particular, has witnessed a 2000% surge in crypto-related scams over the past few months per reports, overtaking traditional phishing tactics.

Scammers deploy fake bots, malware, and deceptive messages to trick users into exposing their wallet credentials.

Additionally, fraudsters have been leveraging Google search ads to impersonate legitimate crypto platforms like Four.Meme on the BNB Chain, further exposing investors to financial losses.

While freezing assets can provide some level of damage control, the broader industry must adopt stronger security protocols and user education initiatives to curb these threats effectively.

Investor Losses and the Debate Over Centralization in Crypto

The growing threat of phishing scams has resulted in massive financial losses for investors.

In one instance, a crypto trader lost $1.82 million in USDC after unknowingly signing a fraudulent transaction. This highlights the dangers of malicious approvals in DeFi and the importance of verifying transaction requests before authorizing them.

However, there has been a noticeable decline in overall phishing losses, with total losses dropping from $10.25 million in January to $5.32 million in February, marking the third consecutive month of decline.

Despite these improvements, thousands of users still fall victim to scams, reinforcing the importance of proactive security measures.

While Tether’s ability to freeze funds has sparked debates over centralization, its actions demonstrate a commitment to regulatory compliance and user protection.

As the crypto landscape continues to evolve, balancing security and decentralization remains a crucial challenge for the industry.

Also Read: Binance Users Targeted by SMS Crypto Phishing Scams: How does it work?