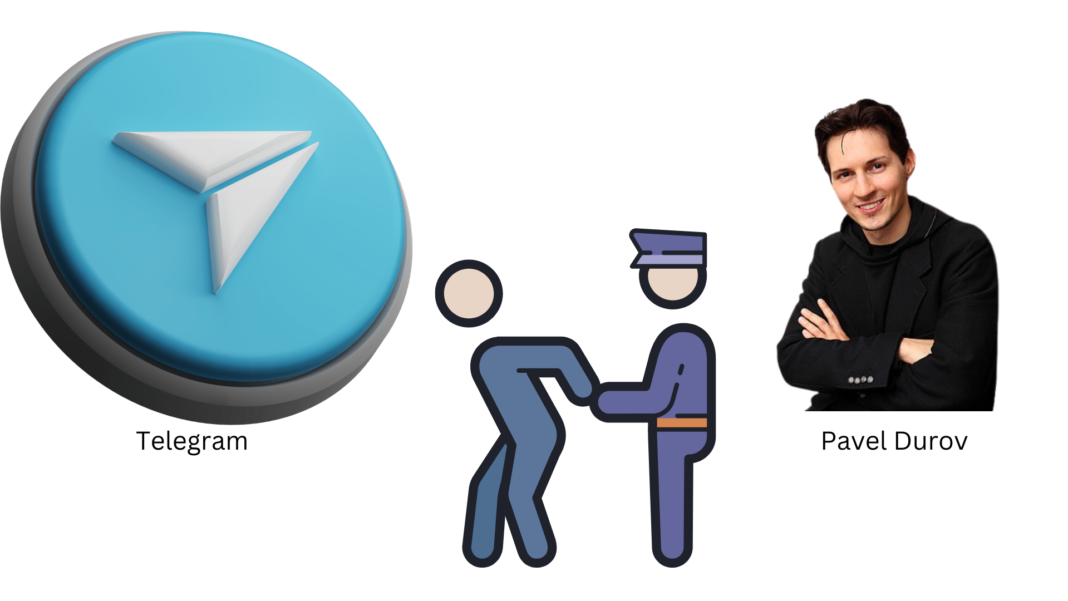

Messaging app Telegram is likely away from troubles and financial issues despite the platform’s founder facing legal problems in Paris. According to the latest report by the Financial Times, given that its business is increasingly being supported by the rising value of its cryptocurrency holdings, Telegram has assured investors that the detention of its CEO, Pavel Durov, by French authorities has not had any “material impact” on the messaging app’s operations.

Telegram’s native token TON coin has demonstrated this optimism, as the coin has stayed up over 165% in the past year.

Telegram 2024 First Half Revenue Stays Upbeat

Telegram recorded significant increases in the value of its digital assets in the first half of 2024, rising to $1.3 billion from almost $400 million at the end of the previous year, according to unaudited financial statements obtained by the Financial Times and not previously reported.

The detention of Telegram founder Pavel Durov outside of Paris on August 24 had sparked alarm in the cryptocurrency venture capital industry.

There has been a stir since Durov’s arrest on suspicion of aiding illegal activity on Telegram, especially with regard to Toncoin, a cryptocurrency intimately associated with the well-known messaging service.

Also read: Telegram Opens Office in Kazakhstan Paving Way For More Crypto Adoption

Telegram’s Rise in Finance Comes On The Back Of TONCOIN Trading

According to the Financial Times, the increase in Revenue and other finances, along with the money it received from the sale of Toncoins, has enabled the Dubai-based business to recover financially after being rocked by Durov’s legal issues.

TONCOIN Price: What To Expect?

TONCOIN has been trading in green territory for most of the last year. Considering just the last month, the overall optimism in the industry has kept the coin upbeat so far.

Considering this, the Fear & Greed Index for the coin is currently at 79 (Extreme Greed), and the emotion is that its future trajectory is bullish.

Over the past 30 days, Toncoin’s price volatility was 7.46% and it had 16 out of 30 (53%) green days. According to market parameters, there is a general bullish feeling toward the price of Toncoin, with 27 technical analysis indicators indicating optimistic signs and 0 indicating bearish signals.

Toncoin’s 200-day SMA is expected to grow over the course of the next month, reaching $6.77. In a similar tone, the short-term 50-day SMA for Toncoin is predicted to reach $9.60 by end of December 2024.

Right now, the TON market is in a neutral position, according to the RSI value of 63.48.

Also read: OKX Ventures Launches $10M Telegram Growth Hub With Key Partners