On October 18, 2024, TapiocaDAO, a decentralized finance (DeFi) protocol, fell victim to a significant cyber attack. The incident, described by the Tapioca Foundation as a “social engineering attack,” resulted in the theft of approximately $4.7 million worth of cryptocurrency.

This breach highlighted the ongoing security challenges faced by DeFi platforms and sent shockwaves through the cryptocurrency community, prompting immediate action from the Tapioca Foundation to address the situation and mitigate the damage.

The Bounty Offer

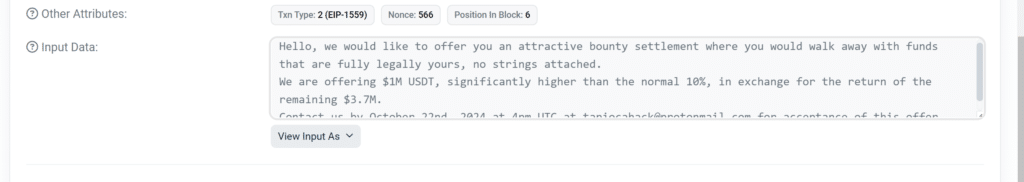

In a bold move to recover the stolen funds, the Tapioca Foundation yesterday proposed a settlement agreement to the attacker. This proposal was communicated through an on-chain message, offering a bounty of $1 million in USDT (Tether) to the hacker.

Notably, this bounty comes with no additional conditions attached, demonstrating the Foundation’s commitment to resolving the issue swiftly and amicably.

The Foundation emphasized that this bounty significantly exceeds the standard ratio typically offered in such situations, which is usually around 10% of the stolen funds.

Terms of the Agreement

The Tapioca Foundation’s offer is contingent upon the return of the remaining $3.7 million in stolen funds. This approach aims to incentivize the attacker to return the majority of the cryptocurrency while still allowing them to profit from the exploit.

The Foundation has set a specific deadline for this transaction, requesting that the funds be returned by 4:00 PM UTC on October 22, 2024.

Following the return of the funds, the attacker is instructed to contact the Foundation via email to complete the settlement process. This structured approach provides a clear path forward for both parties and sets a definitive timeline for resolution.

Also read: VUSD Suffers $13 Million Theft As Onyx Protocol Faces Security Breach

WazirX Offer $23M Bounty Rewards, 133 Entries Already Received

Implications and Industry Impact

This incident and the subsequent response from the Tapioca Foundation highlight several key aspects of the current state of DeFi security. Firstly, it shows the persistent vulnerability of even established protocols to sophisticated attacks, particularly those involving social engineering tactics.

Secondly, the Foundation’s approach of offering a substantial bounty reflects a growing trend in the cryptocurrency space of using financial incentives to mitigate the impact of security breaches. This strategy not only aims to recover stolen funds but also potentially deters future attacks by demonstrating the willingness of projects to work with hackers under certain circumstances.

As the deadline approaches, the crypto community will be watching closely to see if this unconventional approach proves successful in recovering the stolen assets and setting a new precedent for handling similar incidents in the future.