Swedish health technology firm H100 Group AB experienced a 45% surge in its stock price on Wednesday after announcing it had raised 101 million Swedish kronor ($10.6M) to fund its Bitcoin investment strategy.

The company’s shares closed at 4.64 SEK ($0.49) on the Nordic Growth Market stock exchange.

The latest funding round marks a pivotal moment in H100’s strategic transformation, as it accelerates its push to build a sizable Bitcoin treasury.

Since first unveiling its Bitcoin-focused direction on May 22, the company’s stock has soared by 280%, according to data from MarketWatch, signaling a strong positive response from investors.

Significant Funding Round Boosts Bitcoin Acquisition Capacity

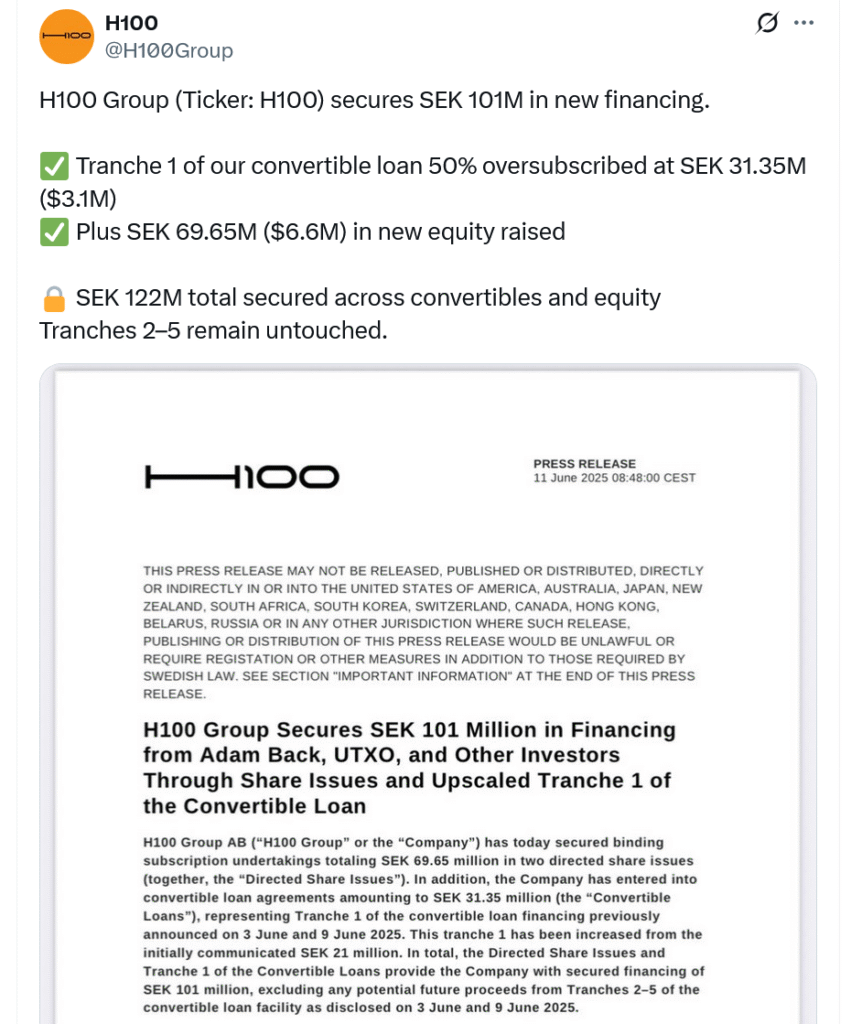

The $10.6 million capital raise is nearly five times the size of H100’s prior $2.2 million funding round led by Bitcoin pioneer Adam Back on May 25.

The recent raise was structured in two parts: a share issue worth 69.65 million kronor ($7.31 million) and convertible loans totaling 31.35 million kronor ($3.29 million).

H100 confirmed that the net proceeds would be used to accelerate its Bitcoin treasury strategy.

The company estimates it will now be able to purchase approximately 67.1 Bitcoin, significantly adding to its existing 13.95 BTC holdings and bringing its total Bitcoin assets to about 81.85 BTC.

The swift growth in crypto reserves marks a notable diversification move for a firm traditionally rooted in health and longevity innovation.

Institutional and Strategic Investors Back Bitcoin Initiative

The share issuance attracted attention from several prominent investors within the crypto and Nordic investment communities.

Among those who participated in this latest funding round were Adam Back, co-founder of Blockstream and a well-known figure in the Bitcoin community, as well as UTXO Management, a Bitcoin-focused investment firm.

Nordic investment firms including Race Ventures Scandinavia and Crafoord Capital Partners also took part.

Their involvement signals growing institutional interest in H100’s strategic pivot and validates the company’s decision to place Bitcoin at the core of its financial strategy.

The level of investor backing strengthens the perception of H100 as a pioneer in merging health tech with digital asset treasury strategies.

Also Read: Metaplanet Launches Bitcoin Reward Program For Shareholders, Stock Price Rises By 1.17%

H100 Joins Growing Wave of Corporate Bitcoin Adoption

H100 Group’s move reflects a broader trend of publicly listed companies incorporating Bitcoin into their balance sheets.

From fintech to health tech, more firms are embracing digital assets as long-term stores of value.

Recent examples include DigiAsia, which launched a $100 million Bitcoin treasury plan and saw its share price spike by 194%, and Bluebird Mining.

The report also showed a strong positive market response following a Bitcoin-linked strategic pivot.

In contrast, Bakkt’s decision to expand into Bitcoin investments triggered an 11% decline in its share price, illustrating that market responses vary depending on the timing, execution.

Also, investor confidence in the firm’s leadership. Still, the broader movement indicates growing corporate faith in Bitcoin as a legitimate treasury asset.

Bitcoin Strategies Redefining Corporate Growth Narratives

With Bitcoin reaching over $107,000 per coin, corporate treasury strategies focused on crypto are redefining traditional growth narratives.

Companies like H100 are no longer being seen purely through the lens of their core business sectors.

Instead, they are being evaluated based on their financial innovation and ability to align with emerging digital economies.

H100’s integration of Bitcoin into its corporate framework not only enhances its financial positioning but also places it within a rapidly evolving network of global companies embracing decentralized assets.

As the digital asset landscape matures, H100’s strategic foresight could serve as a blueprint for other mid-cap firms seeking both growth and resilience in a volatile global economy.

Also Read: Publicly Traded Bluebird Mining to Convert Future Gold Revenues To BTC as Shares Jump 60%