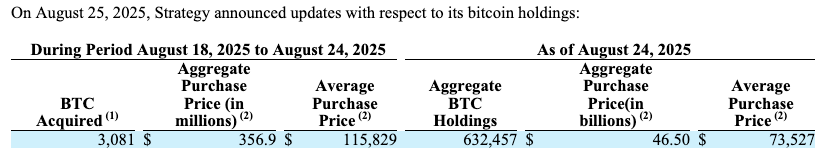

Michael Saylor’s company, Strategy, has reinforced its position as the world’s largest public holder of Bitcoin by acquiring 3,081 BTC worth around $356.9 million over the last week.

The purchase came as Bitcoin’s price fell to $112,000, marking one of its least favorable prices in some time amid various factors, UnoCrypto reported.

According to a Monday filing with the U.S. Securities and Exchange Commission, Strategy purchased the 3,081 BTC at an average price of $115,829 per coin, bringing its total holdings to 632,457 BTC.

As a company, it has now spent about $46.5 billion on its Bitcoin holdings in total, with an average price of $73,527 per coin.

Also Read: MARA Holdings Closes $950 Million Convertible Note Offering To Fund Bitcoin Purchases

Accumulation Pace Slows in August

The latest acquisition comes on the heels of two smaller purchases in August: 430 BTC that was announced last Monday, and 155 BTC from the week prior.

To date, Strategy has purchased 3,666 BTC in August, which is slow relative to prior months, particularly June and July, when it was making substantially larger purchases of 17,075 BTC and 31,466 BTC, respectively.

This slowdown has raised speculation on whether Strategy continues to sell into its buying or will complete a sizable purchase again before the end of the month.

Also Read: El Salvador Undertakes $2.84M Bitcoin Purchase Over Past Week Despite $1.4B Recent IMF Loan

A Shift in Strategy Toward Buying Dips

Strategy’s recent acquisition is notable for its placement in a downturn, which Michael Saylor has both publicly shared about and avoided in the past.

Saylor likes to emphasize that he prefers buying Bitcoin at higher prices as he focuses on conviction and long-term value over short-term market weakness.

By picking up coins in a downturn, Strategy may be signaling a careful reorientation in its treasury management strategy or even further diversifying its entry points to add to its already substantial assets.

Analysts indicate this approach could be driven by external market conditions or internally, as the firm meets its own objectives, improving entry points to its growing, expansive holdings.

Also Read: Michael Saylor Says “Apple should buy Bitcoin” In Response To Apple Stock Repurchase Plan

Broader Market Context and Peer Activity

The downward trend in the market has not stopped other institutional actors from continuing to act.

Earlier today, Japan’s Metaplanet announced it had acquired 103 BTC, worth $11.7 million, bringing its total to 18,991 BTC worth close to $2.23 billion.

The firm’s aggressive accumulation strategy has also resulted in the FTSE Japan Index increasing to mid-cap status.

These events demonstrate increasing institutional interest in Bitcoin, even during times of price weakness, indicating that long-term confidence in BTC as a store of value remains strong across global markets.

Also Read: BlackRock Makes Major Bitcoin Investment with $481 Million Purchase of 4,476 BTC

Bitcoin Price Performance Amid Adoption

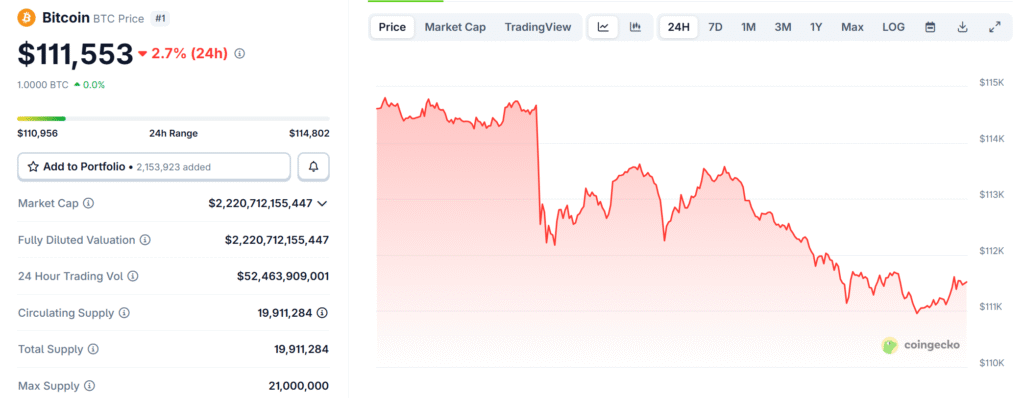

The price of Bitcoin is still under some selling pressure, although these companies have made headlines in acquiring BTC.

At the time of writing, BTC is $111,556 with a 24-hour trading volume of $52.4 billion.

The cryptocurrency has experienced a 2.67% decline on the day and a 3.04% decline over the week, leaving it with a total market capitalization of approximately $2.22 trillion.

While we are only able to analyze the short-term outlook, the ongoing accumulations from sophisticated purchasers within Strategy and Metaplanet instill confidence in Bitcoin’s long-term thesis as a core treasury asset in the face of volatility and price corrections.

Also Read: Robert Kiyosaki Urges Bitcoin Purchases, Predicts Rapid Growth As Supply Shrinks