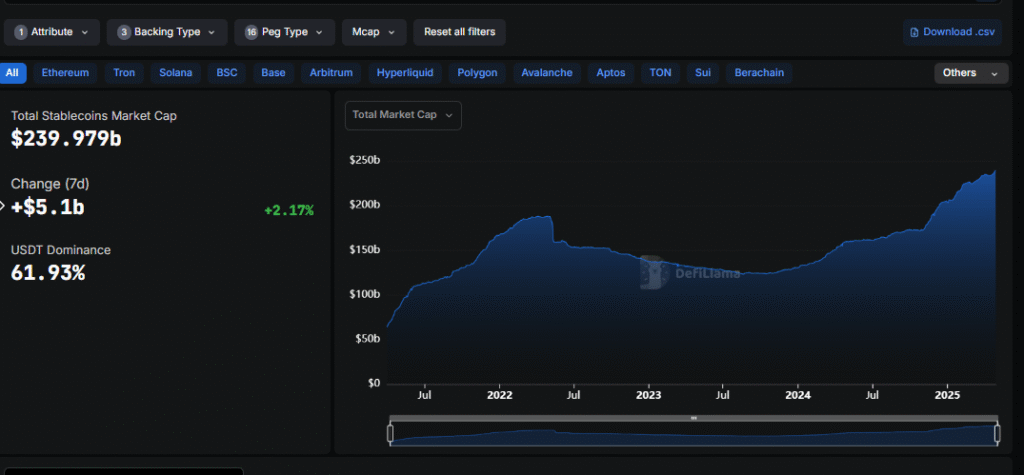

The market value of stablecoins as a whole has risen to around $240 billion, setting a new record for the asset class, according to official data.

Due to increased demand and ongoing investor confidence in reliable digital assets, the market has grown by $4.78 billion in just the last seven days.

More than $36 billion has been added to the value of stablecoins since the start of 2025, demonstrating their growing significance in the larger cryptocurrency ecosystem.

Why are Stablecoins Gaining Investor Confidence?

With their widespread use in trade, remittances, and decentralized finance (DeFi) applications, stablecoins appear to be emerging as a significant element of digital finance, based on their rapid growth.

The price stability of stablecoins, which is usually based on the US dollar, makes them a dependable link between the fiat and cryptocurrency markets. Increasing market capitalization also indicates increased regulatory and institutional interest.

As stablecoin adoption expands, they are expected to play an even more central role in crypto transactions and the future of programmable money.

Also Read: Worlds First Bitcoin Backed Stablecoin USDa Hits 100M Supply Amid Rise In Demand

Citigroup Projects High Expectations for Stablecoins

According to a startling prediction made by Citigroup, the total value of stablecoins might reach $3.7 trillion by 2030 under ideal circumstances.

The supply is anticipated to surpass $1.6 trillion even under a more conservative baseline view, indicating rising trust in the asset class. This forecast highlights stablecoins’ growing significance in international finance, which goes well beyond their beginnings in cryptocurrency trading.

The growing use of stablecoins in remittances, cross-border payments, and decentralized finance (DeFi), as well as their possible incorporation into traditional financial institutions, is reflected in Citigroup’s report.

According to the estimate, stablecoins may serve as the cornerstone of financial infrastructure in the future, particularly if demand for quicker, less expensive, and more transparent digital transactions keeps growing.

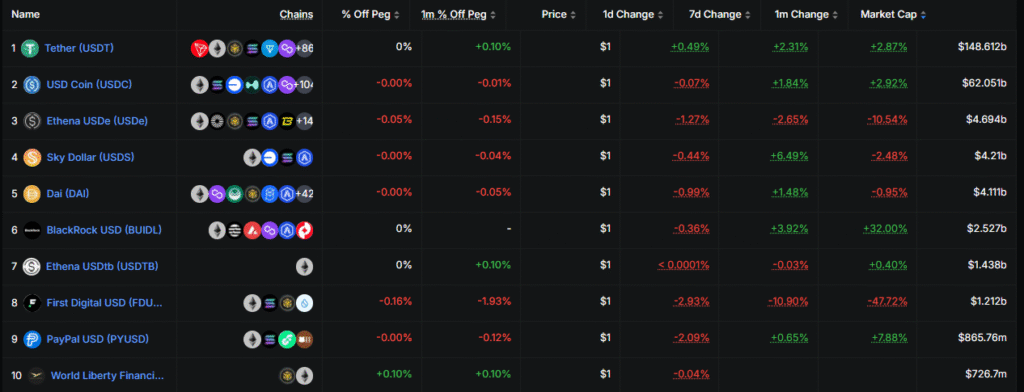

In the same tone, the USD Coin (USDC) has achieved a noteworthy milestone for the stablecoin industry, marking market valuation of over $60 billion.

This increase is a result of growing use in both traditional and cryptocurrency finance, as well as increased demand for dependable, dollar-pegged digital assets.

The rise of USDC indicates a greater level of confidence in transparent, regulated stablecoins and emphasizes their growing significance in institutional transactions, payments, and decentralized finance (DeFi).

Stabelcoin Market Likely to Witness Less Dominance of US Dollar

The dominance of the U.S. dollar in the stablecoin market may soon face increasing challenges, according to Reeve Collins, co-founder of Tether.

While USD-backed stablecoins are currently at the forefront of industries like real-world asset tokenization (RWA), Collins said in a statement from Dubai that interest in stablecoin development is growing globally.

In light of changing economic policies and fintech advancements, he emphasized that more nations and financial institutions are investigating stablecoins linked to alternative currencies.

By introducing competitive alternatives catered to local and global financial demands, this change may result in a more varied stablecoin environment and less dependence on the US dollar.

Also Read: Stablecoin Issuer Circle To Tap On Hong Kong Markets, Awaits New Framework By Govt