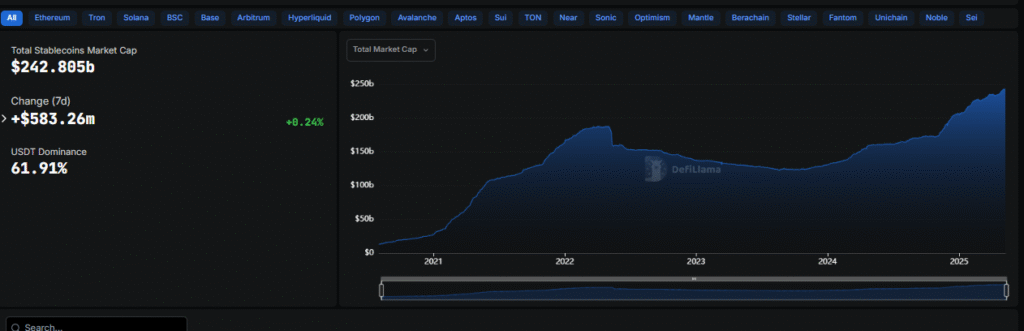

The total market value of stablecoins climbed by more than nine billion dollars in the past 30 days to reach $242.8 billion, according to DeFiLlama data.

Since January, stablecoin market capitalisation has grown by $37.6 billion. This surge underscores the growing role of stablecoins in the wider world of digital finance.

Top Stablecoins by Market Value

At the forefront is Tether, with a market cap of $150.315 billion. USD Coin follows at $60.882 billion. Ethena USDe holds a value of $4.647 billion.

Sky Dollar stands at $4.378 billion, and Dai rounds out the top five at $4.232 billion.

Together, these five tokens account for the vast majority of the stablecoin space.

What the Growth Means?

This rapid expansion shows how trusted stablecoins have become. Their link to the US dollar offers a steady bridge between traditional currencies and digital tokens.

As more people use stablecoins for trading, remittances, and DeFi services, they help to lower risk and improve efficiency. Higher market caps signal that both institutions and regulators are paying closer attention to this corner of the crypto market.

Widespread Use in Finance

Stablecoins have proven useful in many areas. Traders rely on them to move in and out of volatile crypto positions without returning to fiat. Remittances often use stablecoins for faster and cheaper cross‑border transfers.

In decentralised finance, they serve as the backbone for lending, borrowing, and yield farming. This wide range of uses has driven demand and pushed market values higher.

Also Read: Federal Reserve Governor Waller Backs Stablecoins, Promotes Its Banks & Non-Banks Usage

Institutional and Regulatory Interest

With stablecoin values rising, more traditional players are taking notice. Banks and financial firms are exploring ways to custody or issue their own versions. At the same time, lawmakers are racing to set ground rules.

One notable effort, the GENIUS Act, aimed at creating a clear legal framework for stablecoins, failed to move forward in the Senate.

Despite this setback, Senator John Thune will reintroduce the motion next week. His push shows that lawmakers see stablecoins as too important to leave unregulated.

Industry Voices Weigh In

Binance co‑founder Changpeng “CZ” Zhao voiced his support for the growing stablecoin market. He particularly welcomed the upcoming launch of WLFI’s USD1 stablecoin. CZ said new entrants help strengthen the ecosystem and offer more options for users.

His comments reflect a broader sentiment that competition and innovation will benefit the market as a whole.

Challenges and the Road Ahead

Despite strong growth, stablecoins face hurdles. Regulators are keen to ensure that issuers hold enough reserves and follow strict rules. Market participants worry about over‑collateralization and transparency.

Meanwhile, technical issues such as smart contract risks remain a concern for DeFi users. Addressing these challenges will be crucial if stablecoins are to earn and keep public trust.

Also Read: SBI VC Trade Secures First-Ever License To Handle Stablecoins In Japan