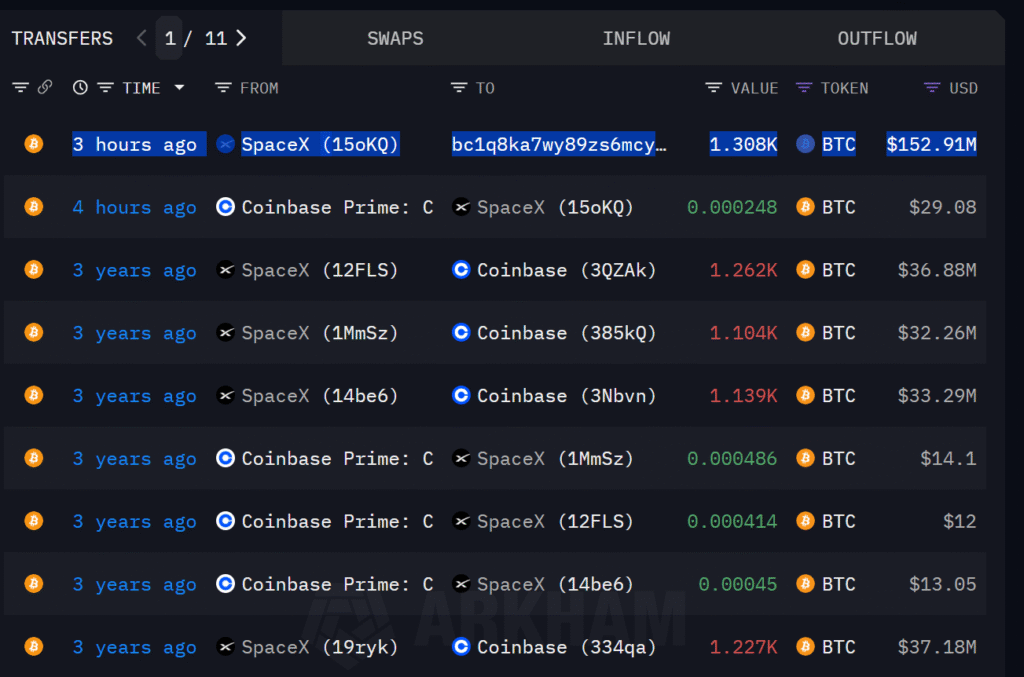

SpaceX, the space behemoth firm founded by Elon Musk, has triggered a wave of speculation among the crypto community after it transferred 1,308 BTC.

The Bitcoin transferred is worth approximately $153 million, coming from a wallet that had been inactive for three years to a mysterious recipient.

According to on-chain data tracked by Arkham Intelligence, the transaction happened on July 22 at 13:09 UTC+8, following Bitcoin reclaiming the $118,000 level. This is SpaceX’s largest Bitcoin move since June 10, 2022, when the company sent 3,505 BTC to Coinbase.

The wallet, “15oKQ,” used for the recent transfer had not been active in over three years, making recent activity all the more noteworthy.

The recipient address, which begins with “bc1q8ka…,” is left blank but speculated to be linked with SpaceX, raising concerns about company restructuring or upcoming fiscal plans.

SpaceX’s Bitcoin Holdings and Crypto Financial Footprint

While more famous for its space exploration and satellite launches, SpaceX has increasingly made inroads into the digital asset domain.

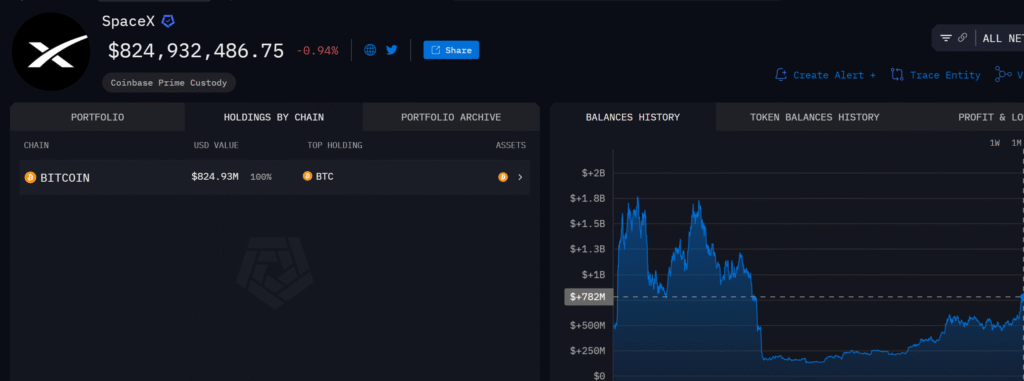

Between 2020 and 2022, SpaceX purchased over 9,000 BTC, mirroring the accumulation trend of Elon Musk’s other company, Tesla.

These purchases were largely made during the 2020–2021 bull runs and were routed through Coinbase.

As of now, SpaceX is reported to hold 6,977 BTC worth around $824 million.

While the company has never officially made formal public statements about its crypto assets, accounting reports and blockchain monitoring have always linked it with significant BTC holdings.

The $153 million transfer is mere drops in the bucket of its total holdings, and additional on-chain movement could be in the works as the firm rebalances its crypto holdings.

Also Read: Dormant Ethereum Investor Holding 400k ETH Dumps $224M Worth of Tokens

Potential Explanations for The Gigantic Bitcoin Transfer

The magnitude and timing of the transfer have set the wider investor community and analysts abuzz with speculation.

The consensus view is that SpaceX may be positioning its digital holdings for better custody and security, a move that institutions make.

Another option is an over-the-counter (OTC) sale to an institutional investor, which would enable SpaceX to sell Bitcoin without affecting market prices.

Some speculate that this might be an expression of a strategic shift regarding how the company intends to utilize its crypto assets.

The benefits include cross-border payments, fuel supply chains, or even smart-contract-based infrastructure within the context of its Starlink platform.

Ripple Effects on the Crypto Market and Institutional Sentiment

Although the market closely tracked the $153 million transaction, it did not lead to a sell-off or a significant decline in the BTC price, which instilled confidence in investors.

On the other hand, the trade is being interpreted as a bullish indicator. It reinforces Bitcoin’s role as a long-term treasury holding, especially for technology companies.

This subdued but calculated return by SpaceX also bodes well for a possible restart of the corporate crypto cycle.

With companies like SpaceX re-thinking their Bitcoin play and making large trades quietly behind the scenes, others may follow in their footsteps.

Such activity could lead to broader institutional investment in crypto markets in the coming months.

Also Read: Bitcoin Whale Awakens After 14 Years & Moves 20,000 BTC Worth $2.18B Acquired at $0.78 Each

Broader Whale Activity Suggests Resurgence in Dormant Holdings

SpaceX’s Bitcoin trade is not happening in isolation. Several long-dormant crypto whales have returned from the dead in recent times, suggesting something bigger is brewing.

Notably, a 14-year-old dormant wallet recently offloaded 80,202 BTC, worth approximately netting $9.53 billion to Galaxy Digital, having purchased the initial coins for as little as $2–$4 per BTC.

Elsewhere, a dormant whale secured a buyer for 11.3 million $OM tokens, worth $83.5 million, after generating more than $100 million in profit.

These moves mark a new phase of market realignment among established holders, which in turn further fans interest in SpaceX’s long-term crypto play and institutional investment in digital assets overall.

Also Read: Ethereum Investor Offloads $2.93M After 2-Months Of Dormancy While Facing $5.34M Unrealized Loss