BitFuFu, the Singapore cloud Bitcoin mining company, just had its best month this year, really putting itself on the map in the mining world.

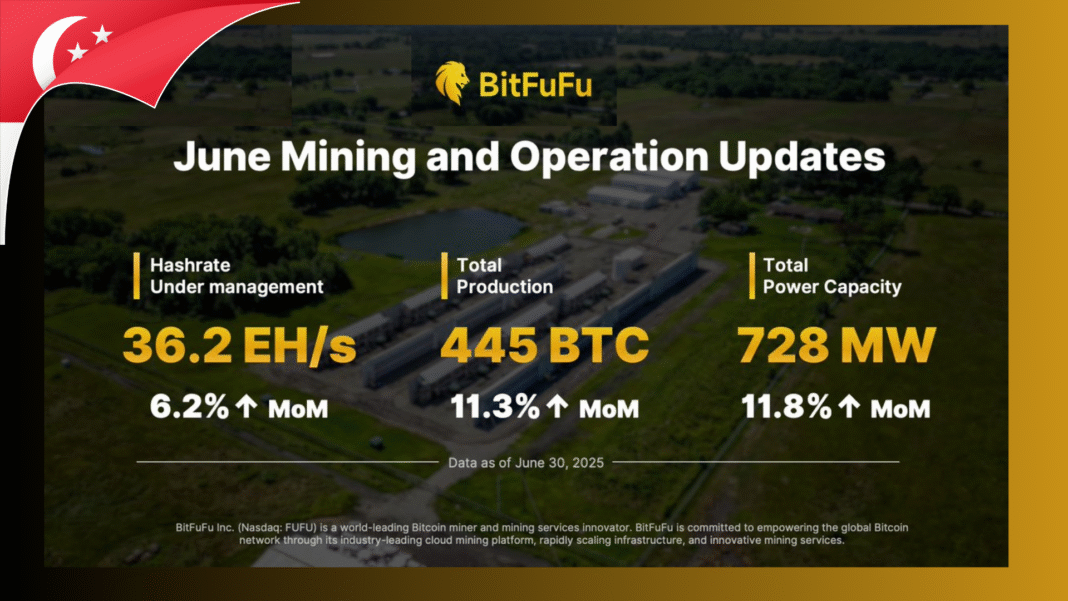

Last month, they pulled in 445 Bitcoin, that’s roughly $48.2 million worth which beats their May numbers by 11.3%. Not too shabby for a single month’s work.

The breakdown’s pretty interesting: most of it (387 BTC) came from their cloud mining setup, while they grabbed another 58 BTC through their own mining rigs.

According to Chairman and CEO Leo Lu, they owe this win to constantly growing their mining operation. The company’s been pretty aggressive about expanding their fleet all year long, and it’s clearly paying off.

Expansion Efforts Pay Off with Hashrate and Power Capacity Gains

This production boost happened right alongside some serious upgrades to BitFuFu’s operations.

The company saw their hashrate jump 6.2% from the previous month, hitting 36.2 exa hash per second (EH/s) – that’s basically the measure of how much computing muscle they’ve got working for them in Bitcoin mining.

Out of that figure, about 32.4 EH/s came from outside suppliers and hosting customers, which really shows how they’re mixing cloud services with their own mining setup.

On top of that, BitFuFu bumped up their total power capacity by 11.8%, getting them to 728 megawatts (MW) spread out across mining sites on five different continents.

These infrastructure wins really demonstrate how the company can grow bigger without losing steam on their actual output.

Strategic Hardware Deal with Bitmain Drives Growth Outlook

BitFuFu’s meteoric growth stems largely from a smart partnership they’ve struck with Bitmain, the mining hardware heavyweight.

Back in January, the company locked in a two-year deal to buy as many as 80,000 Bitcoin miners – basically guaranteeing they’d have access to top-tier, efficient equipment for the long haul.

This move has been a game-changer for building out BitFuFu’s mining operations and keeping them competitive in an industry where getting your hands on decent hardware can be a real headache.

Right now, they’re sitting on 1,792 BTC in their treasury, that’s north of $193 million – which puts them in a pretty exclusive company among Bitcoin miners.

Of course, they’re still trailing the big dogs like MARA Holdings with their 50,000 BTC stash and Riot Platforms holding 19,225 BTC.

Also Read: Marathon-Backed Anduro Launches Bitcoin RWA Platform Featuring Tokenized Whiskey

Market Confidence Grows as Miner Stocks Surge Ahead of U.S. Holiday

BitFuFu’s success mirrors broader positive sentiment in the Bitcoin mining sector.

In the trading days leading up to the U.S. Independence Day holiday, shares of public mining companies, including Riot Platforms (RIOT), Hive Digital (HIVE), Hut 8 (HUT8), MARA Holdings (MARA), and Bitfarms (BITF), surged between 13% and 28%.

BitFuFu, which is publicly listed on NASDAQ under the ticker FUFU, also saw its stock tick upward.

The various stock increase reflected renewed investor confidence in mining equities amid recovering market conditions and operational milestones.

Global Developments Reflect Rising Strategic Importance of Bitcoin Mining

BitFuFu just had an absolutely incredible month, and it’s happening right when some really interesting stuff is going down in the mining world globally.

Take Hut 8, for instance, they’re one of the big names in this space, and they just reported a massive $134 million loss for Q1.

Then there’s Pakistan making some pretty bold moves. They’ve announced they’re planning to set up a national Bitcoin reserve and they want to use about 2,000 MW of their extra energy to power mining operations.

Over in the UK, Vinanz managed to raise £3.6 million to fuel their growth plans, which sounds great until you realize their stock price dropped a whopping 36%.

Right in the middle of all this action, BitFuFu is really starting to make its mark as a major player.

Also Read: Tether Acquires 31.9% Stake In Canadian Gold Royalty Firm Elemental’s Outstanding Shares