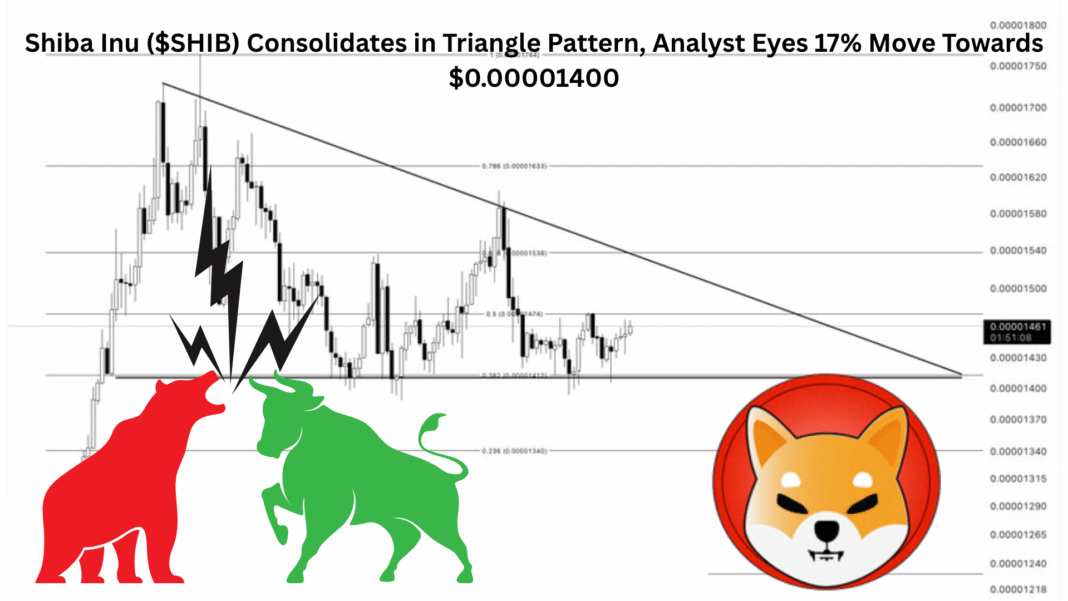

Shiba Inu (SHIB) is presently stabilizing within a descending triangle pattern, which frequently precedes notable price changes, according to cryptocurrency researcher Ali Martinez.

Although the breakout’s direction is still unknown, Martinez believes that this setup could result in a 17% price swing. This can force the token to fall as low as $0.00001400.

The descending triangles are usually seen as bearish patterns that indicate a possible decline.

However, as breakouts can occur in either direction, traders are closely monitoring SHIB’s price action for confirmation. A clear advance over the triangle’s upper boundary might signal a positive breakout and refute the pessimistic forecast.

Market Awaits Breakout to Define SHIB’s Next Major Price Move

As of now, SHIB is trading at approximately $0.00001423, with an intraday high of $0.00001464 and a low of $0.00001423. The market is awaiting a clear breakout from the current consolidation phase, which would provide a more definitive direction for SHIB’s next significant price move.

Shiba Inu (SHIB) is currently facing a decline due to a combination of reduced trading volume and broader market weakness.

Over the past 24 hours, its price has dipped by over 2%, with trading volume dropping significantly—indicating waning investor interest and participation.

This comes amid a general cooldown in the crypto market, where even major assets like Bitcoin and Ethereum are experiencing corrections. Technical indicators, such as a neutral RSI, suggest indecision among traders.

Additionally, SHIB’s price is consolidating within a triangle pattern, creating uncertainty about its next move. These factors together are contributing to SHIB’s short-term downward pressure.

Also Read: Shiba Inu Marketing Lead Warns Community Of Pervasive Scams, Calls Crypto Space Confusing

What Can Help $SHIB Rise in the Future?

The price of Shiba Inu ($SHIB) may rise in the future due to a few important factors. First, by facilitating quicker, less expensive transactions and enabling decentralized apps, Shibarium’s Layer 2 blockchain can increase utility and encourage adoption.

Second, regular token burning has the potential to decrease SHIB’s substantial supply, which will eventually push the price higher.

Third, interest in meme coins like SHIB may increase as a result of the rebound of the cryptocurrency market as a whole and improved investor sentiment.

Lastly, maintaining long-term demand and value appreciation for Shiba Inus will depend heavily on a robust and active community, ongoing developer engagement, and ecosystem expansion (such as NFTs and DeFi interfaces).

SHIB’s RSI Holds Neutral at 50, Showing No Clear Buying or Selling Pressure

There is neither an overbought nor an oversold situation fo SHIB indicated by the Relative Strength Index (RSI), which is neutral at about 50.

Converging moving averages, like the 50-day and 200-day EMAs, suggest that momentum may be changing. While a breakdown would result in a comparable decline, a breakthrough above the triangle might set off a 17% rally.

Traders are eagerly awaiting confirmation because the subsequent action may determine SHIB’s short-term trajectory within the larger cryptocurrency market.

Also Read: UAE Ministry Partners With Shiba Inu For Web3-Powered Government Services