In a major development shaking up the crypto and traditional finance worlds, Nasdaq-listed SharpLink Gaming has officially become the largest holder of Ethereum (ETH), surpassing even the Ethereum Foundation.

According to on-chain data, the firm currently holds 270,000 ETH, accumulated aggressively in recent weeks.

The recent treasury bolstering makes SharpLink’s Ethereum treasury the most significant known corporate holding of the asset.

With ETH currently trading above $3,030, the company is sitting on an unrealized profit of more than $81.8 million.

The firm’s bold move reflects a growing trend of publicly traded companies using crypto as a strategic reserve asset, echoing the earlier Bitcoin acquisition strategy deployed by MicroStrategy.

SharpLink Acquires Over 60K ETH in Just Five Days

SharpLink’s aggressive Ethereum accumulation intensified last week, with the company acquiring 60,582 ETH in just five days through a $180 million investment.

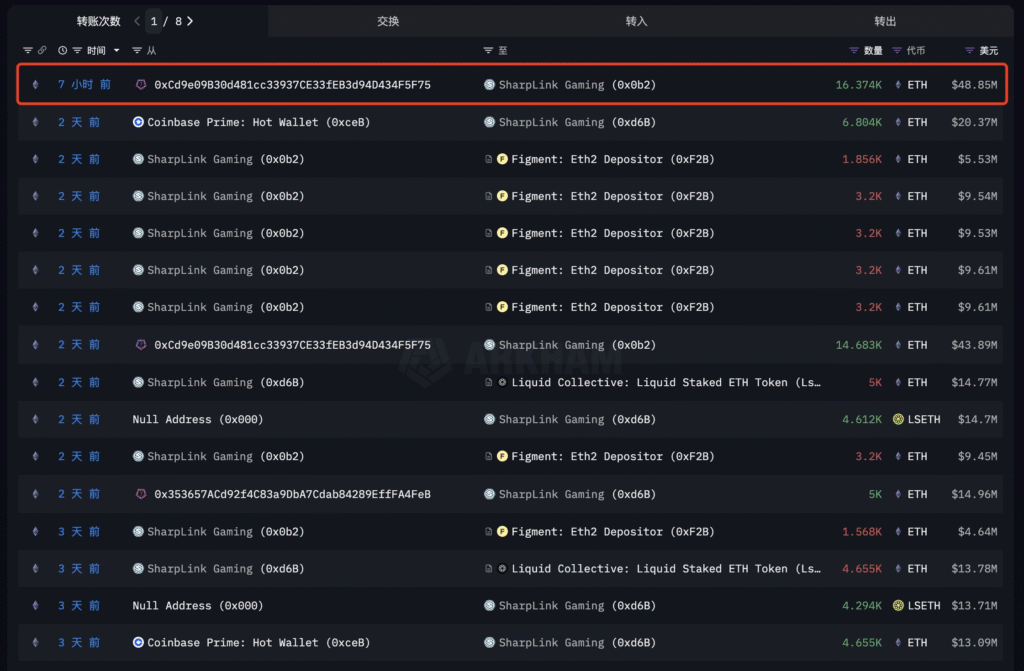

Within the past 24 hours alone, the company added another 16,374 ETH to its balance sheet, investing $50 million more and ultimately bringing its total holdings to 270,000 coins.

Blockchain analytics firm EmberCN confirmed the average acquisition price to be around $2,667 per ETH, giving SharpLink a strong profit margin amid rising prices.

Notably, these acquisitions were primarily conducted via over-the-counter (OTC) deals, a strategic approach designed to avoid triggering large price swings in public markets.

Also Read: SharpLink Gaming Increases Ethereum Holdings with Additional $2 Million Stake, Share Price Up 28%

Strategic Moves Include Direct Deal with Ethereum Foundation

In a noteworthy twist, SharpLink also entered into a direct agreement with the Ethereum Foundation last week to acquire over 10,000 ETH.

The transaction further contributed to the firm surpassing the Foundation’s holdings.

By choosing OTC methods for these transfers, SharpLink minimized market disruption while rapidly strengthening its crypto treasury.

The method mirrors strategies used by other large institutional players who aim to quietly accumulate significant assets without contributing to short-term volatility.

The decision to focus on ETH specifically signals growing corporate conviction in Ethereum’s long-term value and role in the evolving decentralized economy.

SharpLink Stock Price Soars as Institutions Race for ETH

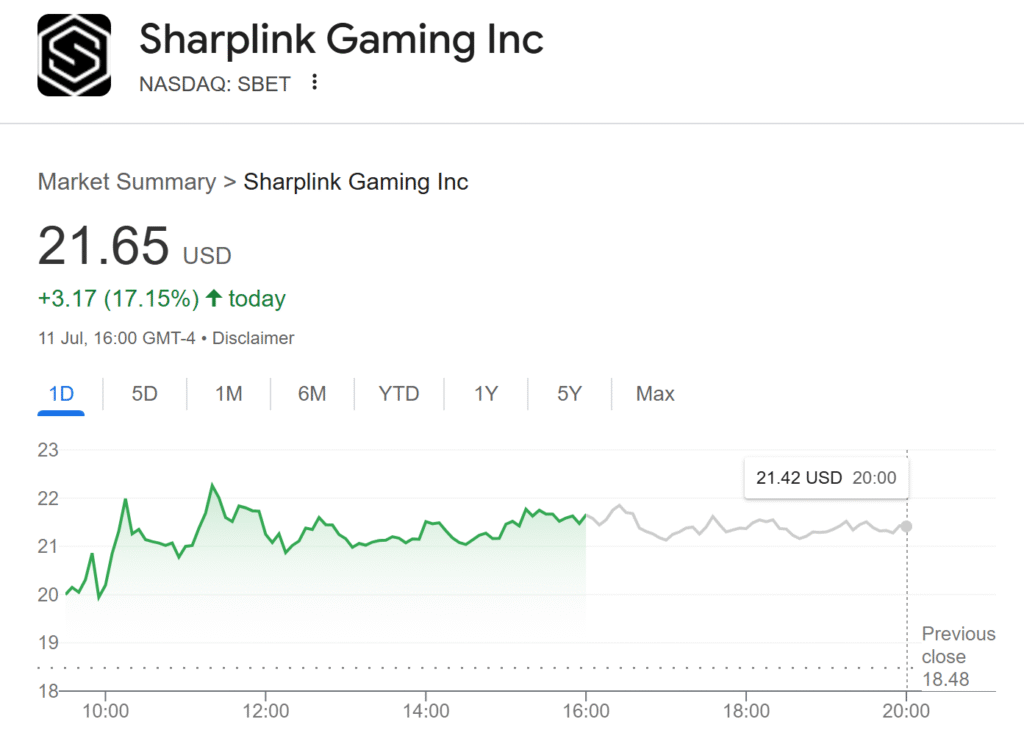

The bullish sentiment surrounding SharpLink’s Ethereum purchases is also reflected in its stock price.

The company’s shares (SBET) jumped by 17.15% today alone, closing at $21.65, and are up more than 275% since the beginning of 2025.

Over the past month, the stock has climbed more than 60%, largely driven by investor enthusiasm over its crypto treasury strategy.

Inspired by SharpLink’s success, other firms like GameSquare have announced their own Ethereum treasury-building efforts.

Institutional enthusiasm for ETH appears to be rising across the board, with Ethereum-based ETFs seeing a $900 million inflow last week, their best performance since launch.

Ethereum’s Fundamentals Strengthen Amid Corporate and ETF Interest

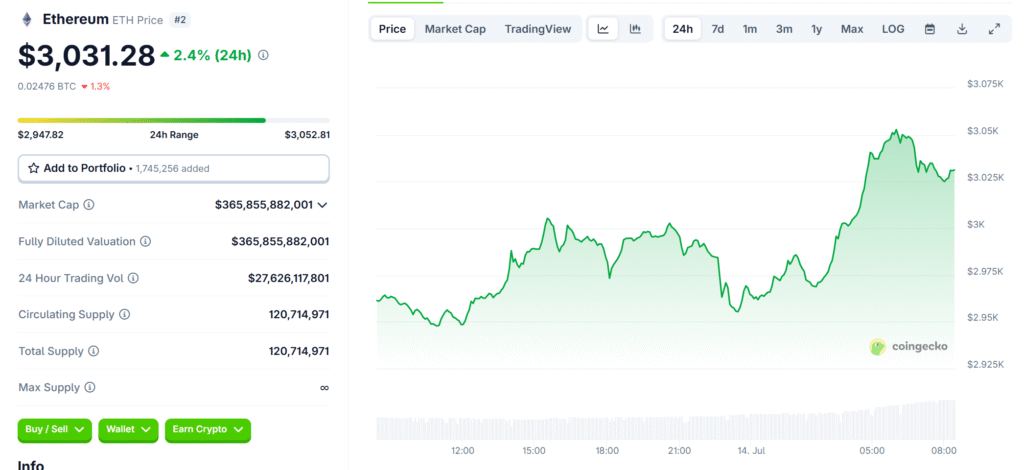

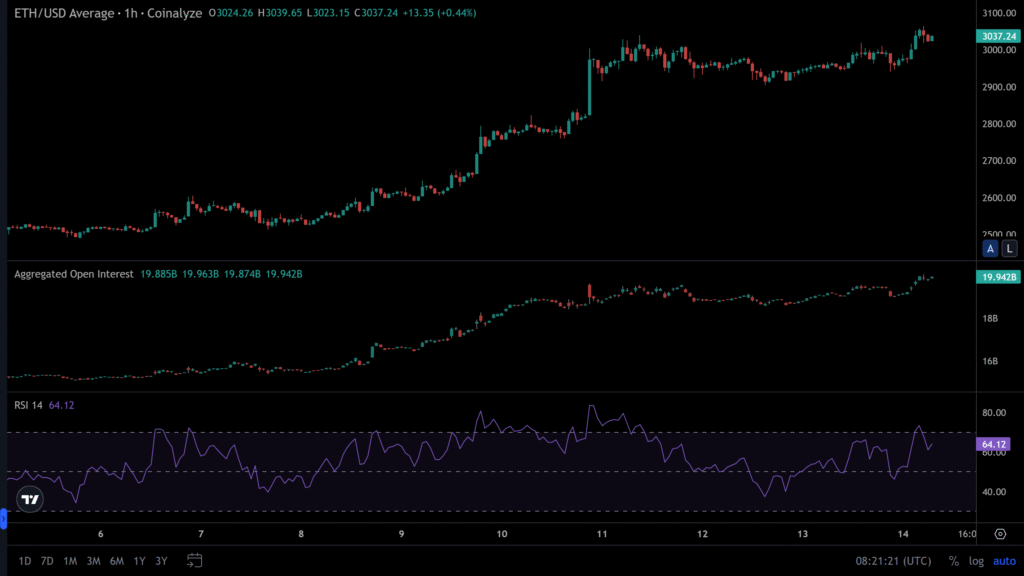

The broader Ethereum ecosystem is also experiencing bullish momentum. ETH is trading at $3,031.23, marking a 2.36% gain in the past 24 hours and an 18.15% gain over the past week.

With a circulating supply of 120 million ETH and a total market capitalization exceeding $366 billion, Ethereum continues to assert its dominance in the blockchain space.

Furthermore, ETH open interest has surged by 4.06% to $19.9 billion, while its relative strength index (RSI) remains in a bullish “60” zone.

Analysts like Eric Jackson from EMJ Capital anticipate staking integration with Ether ETFs before October 2025, which could further bolster ETH demand among institutions and retail investors alike.