SharpLink Gaming, a leading player in the iGaming technology space, has made headlines with a bold move to expand its digital asset holdings.

On May 30, 2025, the company submitted a Form S-3ASR shelf registration with the U.S. Securities and Exchange Commission (SEC).

The aim is to allow them to raise up to $1 billion through the future issuance of securities, including common and preferred stock.

A large portion of the proceeds will be allocated toward purchasing Ethereum (ETH), marking a significant shift in the company’s treasury strategy.

The initiative positions Ethereum at the core of SharpLink’s reserve assets, replacing traditional cash holdings, and reflects growing corporate interest in integrating blockchain into mainstream business operations.

Strategic Shift Highlights Confidence in Ethereum Over Traditional Assets

SharpLink’s new filing indicates it can issue up to 72 million shares under this registration, depending on market conditions.

The company has already secured “at-the-market” agreements with Alliance Global Partners (AGP), enabling it to sell stock in tranches when needed.

While part of the raised funds will be used for standard purposes like working capital and operational costs, the dominant focus is acquiring ETH.

The recent development follows an earlier purchase of $425 million worth of Ethereum just days prior, signaling a deliberate and aggressive pivot toward blockchain integration.

The move sets SharpLink apart from peers like Meta, whose shareholders recently rejected a similar Bitcoin treasury proposal, demonstrating a more cautious approach compared to SharpLink’s bold Ethereum strategy.

Investment in CryptoCasino and Broader Blockchain Ambitions

Beyond treasury management, SharpLink is also embedding blockchain deeper into its product offerings.

Earlier this year, the company invested in CryptoCasino.com, a blockchain-based gaming portal developed by Armchair Enterprises.

The platform accepts Bitcoin and Ethereum and integrates seamlessly with MetaMask wallets, reflecting the broader crypto gaming trend that prioritizes speed, privacy, and security.

The strategic investment supports SharpLink’s larger vision of leading innovation in the crypto gaming ecosystem.

With the gaming industry increasingly adopting decentralized technologies, SharpLink’s Ethereum-centric strategy could influence other companies to reassess their approach to blockchain and digital assets.

Market Headwinds for Ethereum Amid SharpLink’s Bullish Bet

Despite SharpLink’s bullish stance on Ethereum, the crypto market is facing downward pressure.

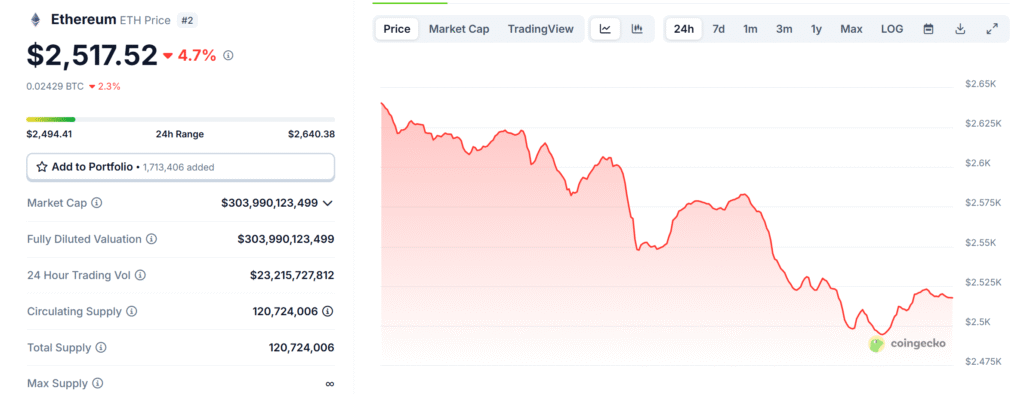

Ethereum’s price has dropped 4.7% over the last 24 hours, settling at $2,529.82 after briefly reaching a high of $2,649.90.

The decline comes amid a broader crypto market slump, with Bitcoin and other major coins also in the red.

Traders are eyeing the $2,500 level as a critical support zone; a breakdown below could signal further downside, while a recovery above $2,600 would suggest a potential rebound.

Despite current volatility, Ethereum continues to maintain a strong community reputation, evidenced by its perfect 100% 3-month profile score.

SharpLink’s confidence in ETH amid market dips underscores a long-term vision rather than short-term price action.

Also Read: NASDAQ Listed BTCS’s Crypto Holdings Surge 88% Following $8.42M Ethereum Purchase; Shares Up 13%