A U.S. Senate committee is investigating whether Dan Morehead, founder of Pantera Capital, exploited Puerto Rico’s tax incentives to avoid paying hundreds of millions in federal taxes.

Senator Ron Wyden, a Democrat from Oregon, sent a letter on January 9 to Morehead, requesting details about his tax filings and investment profits after relocating to the island, the New York Times reported.

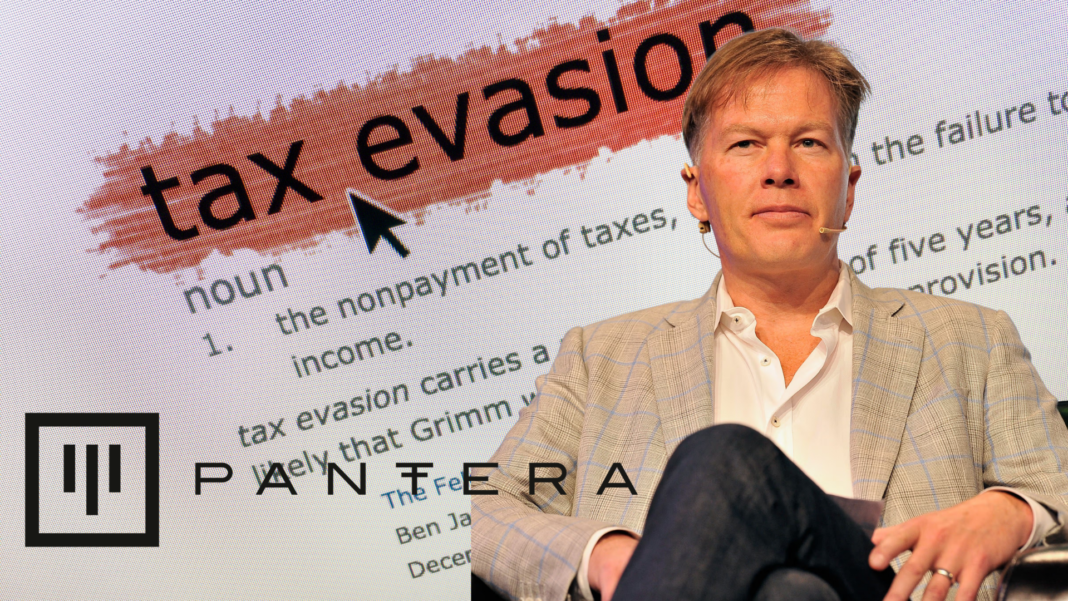

Pantera Capital Founder’s $1 Billion Capital Gains & Alleged Tax Evasion

The Senate Finance Committee is specifically examining how wealthy individuals, including cryptocurrency investors, have used Puerto Rico’s tax exemption program to minimize their tax burdens.

The investigation focuses on whether some of these individuals have improperly applied the tax break to income earned outside Puerto Rico, potentially violating U.S. tax laws.

Puerto Rico’s Tax Haven Status Draws Attention

Puerto Rico has long been a popular destination for high-net-worth individuals looking to benefit from favourable tax laws. Act 60, originally introduced in 2012 under a different name, allows residents to avoid federal income tax on capital gains generated within the U.S. territory.

This incentive has drawn wealthy investors, particularly from the cryptocurrency and tech sectors, who see an opportunity to significantly reduce their tax liabilities.

The Internal Revenue Service (IRS) and other government agencies have increased scrutiny of the program in recent years. According to the IRS, its criminal division has identified approximately 100 individuals who may have committed tax evasion by misusing these benefits.

The Justice Department and lawmakers have also taken an interest in curbing potential abuses of the system.

Morehead’s Role and Pantera’s Massive Gains

Dan Morehead, a former Goldman Sachs trader, founded Pantera Capital in the early 2000s, turning it into one of the most influential investment firms in the cryptocurrency space. Over the past decade, Pantera has invested in more than 100 crypto companies, including major players like Circle, Ripple, and Coinbase, the largest cryptocurrency exchange in the U.S.

Morehead moved to Puerto Rico in either 2020 or 2021—his statement conflicts with Wyden’s claim—and shortly after, Pantera sold a significant portion of its assets, generating over $1 billion in capital gains.

According to Wyden’s letter, Morehead’s share of these profits exceeded $850 million. The committee is now seeking information on whether he declared these gains appropriately and if he attempted to classify them as tax-exempt under Puerto Rican law.

Political Divide on Crypto and Tax Enforcement

The investigation comes amid shifting political views on cryptocurrency regulation and taxation. Under the Biden administration, federal regulators and Democratic lawmakers have increased scrutiny on crypto-related financial activities, cracking down on tax evasion and fraud within the industry.

Meanwhile, President Donald Trump and many Republicans in Congress have taken a more pro-crypto stance, advocating for relaxed regulations and less aggressive enforcement measures.

Senator Wyden, who previously chaired the Finance Committee before Republicans gained Senate control, has a history of investigating tax loopholes used by the wealthy. His letter to Morehead is part of a broader effort to hold high-earning Americans accountable for tax compliance.

Uncertain Outcome of the Investigation

While the investigation into Morehead is ongoing, it is unclear what legal consequences, if any, he may face. A spokesperson for Wyden declined to provide further details, and Senator Michael Crapo, the new chair of the Finance Committee, has not commented on the matter.

Morehead has defended his tax practices, stating, “I believe I acted appropriately with respect to my taxes.”

Growing Concerns Over Tax Avoidance in Crypto

This case highlights a growing concern over tax avoidance within the cryptocurrency industry. The use of offshore tax havens, particularly in Puerto Rico, has drawn increased attention from regulators seeking to prevent large-scale tax evasion.

As scrutiny intensifies, more investors and companies operating in the crypto space may find themselves under investigation. The outcome of the Morehead inquiry could set a precedent for how the U.S. government approaches tax enforcement on crypto wealth in the future.

Also Read: Pantera Capital Invests $20M In Toncoin Amid Renewed Optimism In TON Blockchain, Price Climbs 3%