On 7th August 2025, the U.S. Securities and Exchange Commission (US SEC) and Ripple Labs have officially resolved their extended court case over the offering of XRP tokens, a milestone for the crypto community.

In a simultaneously filed memorandum with the U.S. Court of Appeals for the Second Circuit, both parties agreed to settle their cross-appeals at no expense to either.

Ripple’s Chief Legal Officer, Stuart Alderoty, confirmed the news on X, indicating the closure of the case and a return to normal business.

The dismissal follows a June resolution where Ripple agreed to pay a $125 million civil penalty, far below the SEC’s original request for $2 billion. It earns a partial legal victory for the blockchain company.

Judge Torres’ 2023 Ruling Now Final Last Precedent

With the appeals process now halted, U.S. District Judge Analisa Torres’ July 2023 ruling is now the final say in the case.

Torres ruled that XRP bought by retail investors from public exchanges was not a security, giving the cryptocurrency industry an important precedent.

The dichotomy left Ripple responsible for institutional sales, for which it was ordered to pay $125 million in fines. A permanent injunction on Ripple’s institutional sales of XRP remains in effect.

The ruling must have far-reaching implications for future judicial understandings of cryptocurrency classifications, specifically in cases where regulators pursue claims for unregistered securities offerings.

Also Read: Utah Federal Judge Denies Appeal In SEC Lawsuit Against Alleged $18 Million Crypto Mining Fraud

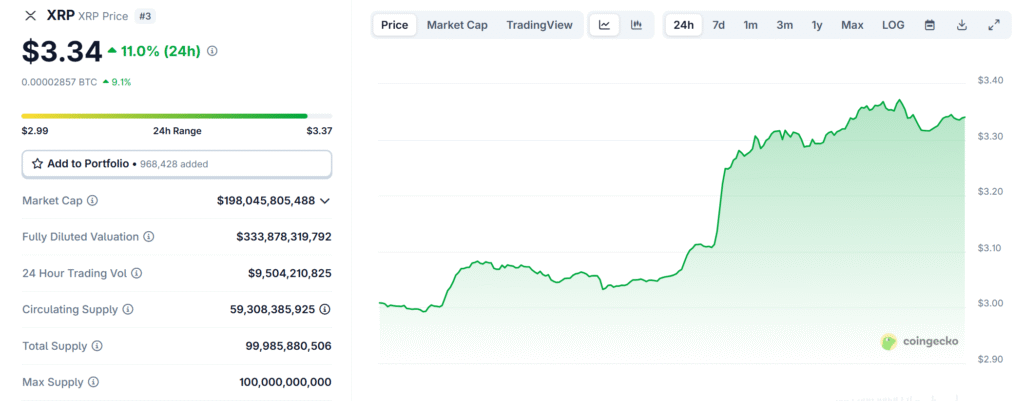

XRP Price Hurtles Towards All-Time High, Market Cap Surpasses Uber

News of the settlement has helped propel XRP’s bullish movement to $3.34, an 11.14% increase over the past 24 hours and a 13.14% increase over the past week.

With a circulating supply of 59 billion tokens, the market capitalization of XRP has almost touched $198 billion, more than ride-hailing giant Uber, which stands at $193.7 billion.

From $3.84, the highest price ever reached in January 2018, the XRP token slipped down 13%. With new fundamentals, however, the $200 billion market capitalization is about to be crossed.

Volumes remain robust at over $9.5 billion during the past 24 hours, demonstrating the huge investor interest that emerged after the much-awaited legal clarification.

Also Read: SEC Commissioner Hester Peirce Urges Protection Of Private Crypto Transactions

Broader Implications for Crypto Regulation and Market Sentiment

The resolution in the SEC vs. Ripple case comes amid a broader readjustment of the U.S. regulatory approach towards digital assets.

The SEC has recently dropped a number of lawsuits against crypto companies.

Notably, on February 26th, the CEO OF Robinhood praised the Trump Administration’s crypto policies after the SEC dropped the investigation against them.

A few days after, on February 28th, the SEC yet again dismissed the Lawsuit against Coinbase crypto exchange.

Most popularly, in May, it was reported that the SEC dropped their lawsuit against Binance.

The ruling not only clears the uncertainty cloud over Ripple’s business but also strengthens the foundation of crypto projects that are challenging the SEC’s classification of digital assets as securities.

For the sector, Judge Torres’s ruling, now legislated, becomes a benchmark in the differentiation between public market token sales and institutional offerings.

With XRP approaching all-time highs for price and market capitalization records, the settlement is being welcomed as a milestone for crypto’s co-existence with regulators in the U.S., quite possibly shaping the law of the land for years to come.