Robert Kiyosaki, the acclaimed author of “Rich Dad Poor Dad,” has reinforced his investment strategy focusing on what he terms “real” assets, particularly Bitcoin, gold, and silver.

In his recent social media communications, Kiyosaki has taken a clear stance against speculative investments, explicitly stating, “I don’t invest in any ETFs or speculative tokens.”

His skepticism extends to the trending $TRUMP memecoin, as he distances himself from what he characterizes as the “crypto farce” in the industry.

Kiyosaki’s recent market commentary has been particularly notable, advising investors to “Buy Low….& HODL” during Bitcoin’s recent 6% dip to $95,000, demonstrating his commitment to a long-term accumulation strategy.

His ambitious goal of acquiring 100 Bitcoin this year underscores his conviction in the cryptocurrency’s future potential.

Bitcoin’s Historic Market Performance and Institutional Impact

The cryptocurrency market has witnessed unprecedented momentum with Bitcoin reaching a new all-time high of $108,744.

The remarkable achievement represents a weekly gain of 15.34%, supported by extraordinary trading volumes exceeding $114 billion.

With a circulating supply of 20 million BTC, the cryptocurrency’s market capitalization has reached an impressive $2.13 trillion.

The surge is attributed to multiple factors, including increased institutional investor participation, favorable macroeconomic conditions, and growing recognition of Bitcoin as a legitimate store of value.

The achievement is particularly significant as it occurs against the backdrop of various market dynamics, including the emergence of speculative tokens and broader market volatility.

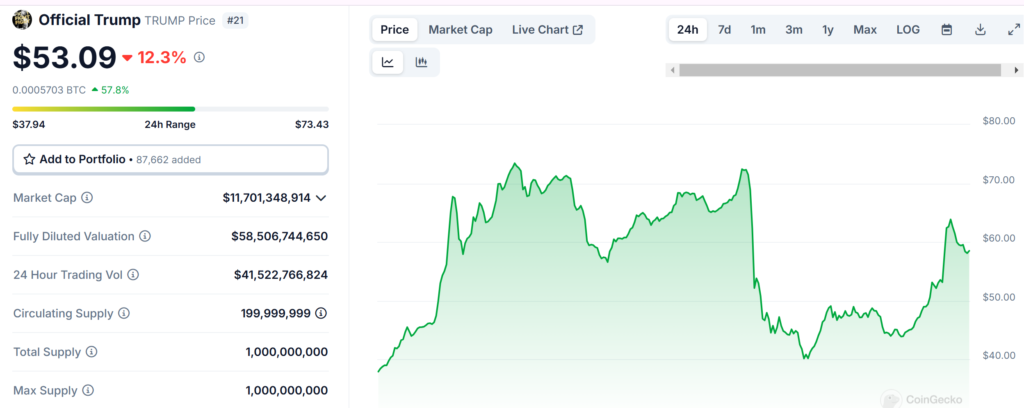

$TRUMP Token Market Analysis and Performance

Despite skepticism from influential figures like Kiyosaki, the Official Trump ($TRUMP) token has demonstrated notable market presence.

Currently trading at $53.25, the token has generated substantial trading activity with a 24-hour volume of $41.5 billion.

With 200 million tokens in circulation, its market capitalization stands at $11.7 billion. While experiencing an 11.46% decline in recent daily trading, the token has shown resilience over longer periods.

The performance exemplifies the growing interest in politically or culturally aligned cryptocurrencies, even as traditional investors and market analysts caution against their speculative nature.

Kiyosaki’s Market Predictions and Investment Recommendations

Robert Kiyosaki has recently expanded his market commentary to include broader economic predictions, warning of a potential market crash while maintaining his bullish stance on specific assets.

His investment advice remains consistent: “Save gold, silver, and Bitcoin,” arguing these assets provide protection against currency devaluation.

Kiyosaki’s perspective on Bitcoin has become increasingly enthusiastic, describing it as a vehicle that “makes getting rich easy” through a simple strategy of buying and holding through market fluctuations.

His advocacy for Bitcoin aligns with his broader economic outlook and represents a significant endorsement from a well-respected voice in personal finance.

The position gains additional weight given his track record and influence in the investment community, particularly as he continues to emphasize the importance of tangible assets in an increasingly volatile economic landscape.

Also Read: Rich Dad Poor Dad Author Robert Kiyosaki Suggests “Buy One Satoshi, Get Rich” Plan for Followers