Robert Kiyosaki, the author of Rich Dad Poor Dad, recently sparked controversy with a post on X (Twitter). In his post, he raised a hypothetical question: What if the gold in Fort Knox is missing?

Kiyosaki speculated that if the U.S. gold reserves were gone, the consequences would be devastating. He warned that the U.S. economy would collapse, the dollar would lose its value, and inflation would destroy millions of lives.

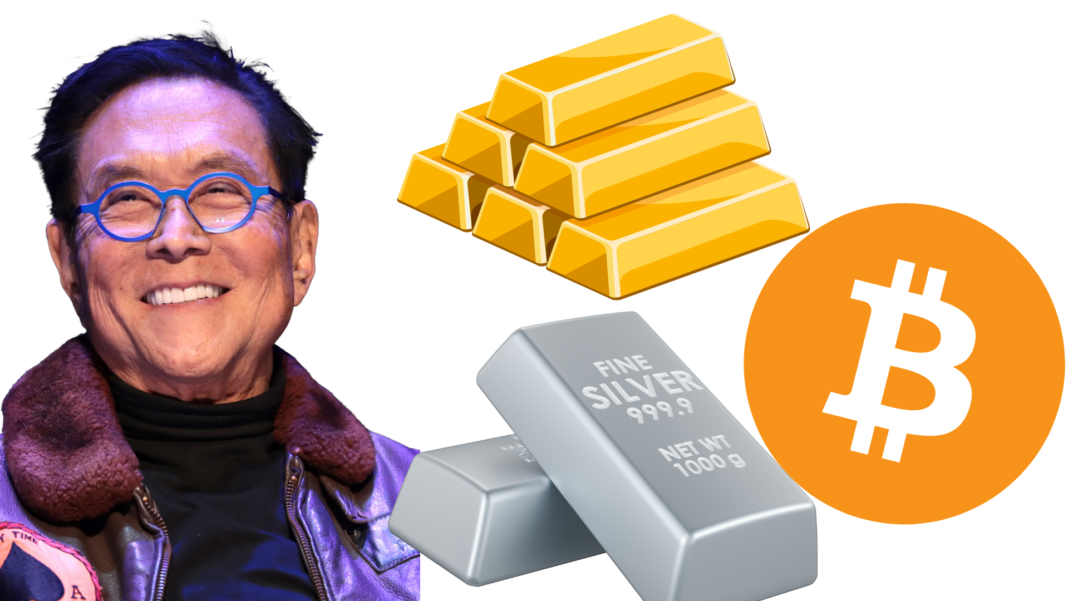

He further suggested that, in such a scenario, assets like gold, silver, and Bitcoin would be the best hedge against financial ruin.

Kiyosaki’s Strong Support for Bitcoin

Kiyosaki has been a vocal advocate for Bitcoin and has repeatedly encouraged people to invest in it. He believes Bitcoin is a safer and smarter alternative to saving in U.S. dollars. According to him, excessive money printing and poor government policies are eroding the dollar’s purchasing power.

In a recent post on X, he urged investors to secure their financial future by investing in Bitcoin, gold, and silver. He sees these assets as a shield against economic uncertainty and inflation.

Over the years, Kiyosaki has positioned himself as a strong hodler—a term used in the crypto community to describe those who hold Bitcoin for the long term, regardless of market fluctuations.

A Grim Prediction for 2025

Kiyosaki has made several such predictions. Referring to his 2013 book Rich Dad’s Prophecy, he recently predicted that the “biggest stock market crash in history” will take place in February 2025.

He believes economic instability, rising debt, and reckless government policies are pushing the world toward a major financial crisis.

While some experts dismiss such predictions as fear-mongering, others acknowledge that the global economy is facing uncertainty. Inflation, rising interest rates, and geopolitical tensions continue to affect financial markets.

Also Read: Robert Kiyosaki Responds To Buffett & Munger’s Criticism Of Bitcoin, Says “Bitcoin Made Me Rich”

Bitcoin’s Price Actions

Meanwhile, Bitcoin continues to show strong momentum. At the time of writing, Bitcoin is trading at $95,696.67. Its 24-hour trading volume has surged by more than 33%, reflecting growing investor interest.

Many analysts believe Bitcoin’s rising adoption as a store of value could further strengthen its position as an alternative to traditional currencies.

Robert Kiyosaki’s warnings have sparked debates about the stability of the global financial system. His concerns about inflation, government policies, and excessive money printing resonate with many investors.

Whether his predictions come true remains to be seen. However, his message is clear, people should be prepared for economic uncertainty by diversifying their investments into assets like Bitcoin, gold, and silver.

Also Read: Robert Kiyosaki Asks Investors To “Buy Low….& HODL” As Bitcoin Comes Down By 6% To $95K