Earlier today, On December 7th, the market cap of XRP, the cryptocurrency associated with Ripple, saw a remarkable surge.

To put this in perspective, XRP’s market cap has now surpassed that of the financial giant Citigroup, which stands at $136.45 billion.

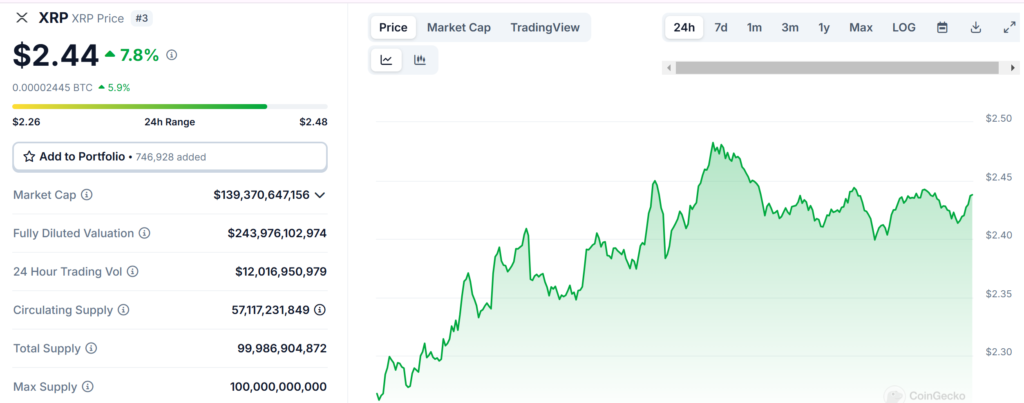

The current XRP price stands at $2.44, representing a 7.87% increase in the last 24 hours and a staggering 30.55% price rise over the past 7 days.

With a circulating supply of 57 billion XRP tokens, this latest price movement has propelled XRP’s total market capitalization to an impressive $139.37 billion.

Also read: Tron (TRX) Surges Over 80% As Justin Sun Calls It The “Next XRP,” Market Cap Surpasses $30 Billion

XRP’s Recent Price Surge

XRP’s current price surge marks a remarkable comeback for the cryptocurrency, which had previously faced challenges related to the ongoing lawsuit between Ripple and the U.S. Securities and Exchange Commission (SEC).

After enduring a three-day price decline, XRP has now skyrocketed, jumping from a low of $0.50 to a peak of $2.82 in the last 30 days.

This phenomenal price increase of over 400% has allowed XRP to outperform both Ethereum and Bitcoin during this period.

Also read: WisdomTree, Managing $100B In Assets, Files For Spot XRP ETF, XRP Surges 24%

Significant XRP Token Transfer

Adding to the excitement around XRP’s performance, on-chain data has revealed a massive 20 million XRP transaction that took place within the last 24 hours.

This transfer, worth approximately $47.2 million, moved funds from an unknown wallet to the Bitstamp cryptocurrency exchange.

Such large token movements often capture the attention of the crypto community, as they can signal increased trading activity or potential market developments.

Potential Factors Driving XRP’s Rally

Analysts believe that the key driver behind XRP’s recent rally is the growing optimism surrounding Ripple’s potential victory in the ongoing SEC lawsuit.

Investors are speculating that a favorable outcome for Ripple could kickstart another major bull run for XRP, as the cryptocurrency would be further legitimized and potentially adopted more widely.

Additionally, the large trading volume and significant token transfers suggest heightened market interest and activity, which could be fueling XRP’s price surge.

Also Read: Tron (TRX) Surges Over 80% As Justin Sun Calls It The “Next XRP,” Market Cap Surpasses $30 Billion

Citigroup’s Price & Valuation Metrics

As of December 6th, Citigroup’s stock price closed at $72.15, down 0.11% or $0.08 for the day. However, in after-hours trading, the stock price rose slightly to $72.25, up 0.14% or $0.10.

Throughout the trading day, Citigroup’s stock price fluctuated between a low of $71.71 and a high of $72.60, demonstrating the volatility typical of the stock market. The company’s stock opened the day at $71.98.

Citigroup’s current market cap of $136.45 billion is based on its outstanding shares of 1.89 billion and a stock price of $72.15 per share. The company’s price-to-earnings (P/E) ratio, which compares the stock price to the company’s earnings per share, stands at 20.89.

Additionally, Citigroup’s dividend yield, which represents the annual dividend payments per share as a percentage of the stock price, is 3.10%. This dividend yield can be attractive to investors seeking regular income from their stock holdings.

Outlook and Potential Future Developments

As XRP continues to reach new milestones, surpassing the market capitalization of established financial institutions, the cryptocurrency’s future prospects are being closely watched.

If Ripple is successful in the SEC lawsuit, it could pave the way for increased mainstream adoption and further price appreciation for XRP.

However, the cryptocurrency market remains highly volatile, and investors are advised to exercise caution and conduct thorough research before making any investment decisions.

Nonetheless, XRP’s current performance is a testament to the growing influence and recognition of the broader cryptocurrency ecosystem.