Ripple’s USD stablecoin (RLUSD) has demonstrated notably underwhelming performance since its launch in mid-December 2023, struggling to establish a significant presence in the stablecoin market.

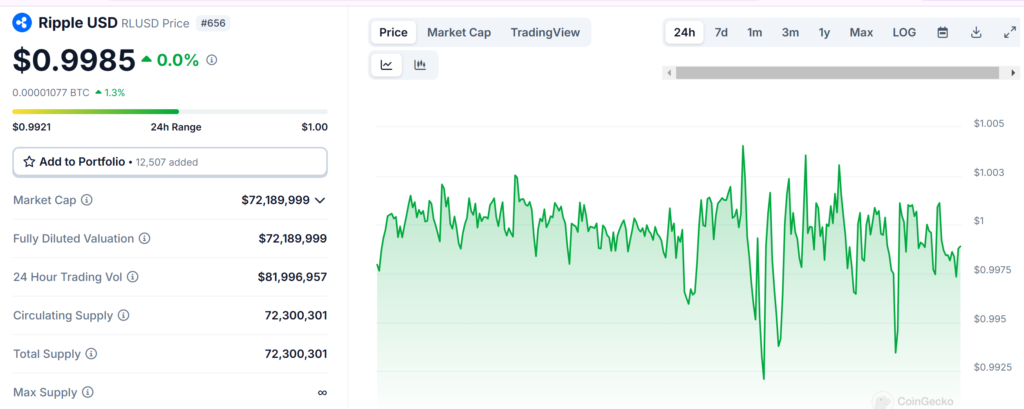

According to CoinGecko data, RLUSD’s market capitalization remains confined below $75 million, specifically at $72,146,715, representing a mere 0.04% of the total stablecoin market value.

The performance stands in stark contrast to market leader USDT (Tether), which commands a substantial market value exceeding $137 billion.

The stablecoin’s price stability has also been a concern, with fluctuations ranging from $0.97 to $1.07 since CoinGecko began tracking its price history on December 17, indicating potential liquidity challenges.

Limited Exchange Presence and Liquidity Challenges

A significant factor contributing to RLUSD’s modest performance is its limited availability across major cryptocurrency exchanges.

Currently, the stablecoin’s trading activity is primarily concentrated on exchanges with historical Ripple investment ties, such as Bitstamp and Bitso.

Bullish has emerged as the primary liquidity provider for RLUSD trading pairs. This restricted exchange presence has created a challenging environment for building user interest and maintaining stable trading volumes.

The limited accessibility has potentially hindered the stablecoin’s ability to attract a broader user base and establish itself as a significant player in the stablecoin market.

Also Read: Ripple and MoonPay Donate $50K in RLUSD to Support California Wildfire First Responders

Future Growth Initiatives and Exchange Expansion Plans

Ripple’s leadership is actively working to address these challenges, with Jack McDonald, senior vice president of Ripple’s stablecoin division, revealing plans for broader exchange listings, including potential integration with Coinbase.

McDonald acknowledges the technical complexities involved in exchange listings, particularly regarding multi-blockchain support and asset integration.

He also highlights the existing economic partnerships between exchanges and specific stablecoins, such as Coinbase’s relationship with USDC and Binance’s with FDUSD.

While expressing optimism about Coinbase’s potential expansion of supported stablecoins, noting their current support for various stablecoins including USDC, PAX, GUSD, PYUSD, and USDT.

USDT Stablecoin Market Growth

The challenges facing RLUSD are set against the backdrop of a thriving global stablecoin market, which has recently achieved a historic milestone of $200 billion in total supply.

Within this expanding market, Tether (USDT) maintains a dominant position with a 71% market share, representing approximately $142 billion in value.

The market’s growth is further characterized by significant developments, including Tether’s strategic investment in StablR and Circle’s USDC partnership with Binance, demonstrating the ongoing evolution and maturation of the stablecoin sector.

These developments highlight the intense competition and established relationships that new entrants like RLUSD must navigate to gain market share.