Ripple has secured an in-principal approval from Dubai’s Financial Services Authority to enable cross-border payments, the digital asset infrastructure provider announced on Tuesday, October 1st.

With the in-principal license, Ripple will now be able to roll out end-to-end payment services in the UAE, boosting the Middle East’s exposure to crypto usage. The approval will also help Ripple’s global presence as a regulated business and the United Arab Emirates can now use cross-border payment services, such as Ripple Payments Direct (RPD).

Ripple’s decision to usher out into the digital space comes at a time when the Middle East is becoming a growing hub for crypto payments. Additionally, DFSA’s approval for Ripple also comes as the first for a blockchain-enabled payment services provider.

Having received DFSA Authorization, Ripple plans to expand its customer base in the UAE by offering its enterprise-grade digital asset infrastructure.

Ripple’s Middle East Conquest Takes Full Swing

After establishing its regional headquarters in Dubai in 2020, Ripple had already set out its plans to increase its footprint in the Middle East, and the DFSA’s in-principle license approval seems in tandem with the firm’s earlier expressed road map.

Interestingly, over 20% of Ripple’s global customer base is located in the UAE, according to Reece Merrick, Ripple Managing Director, Middle East and Africa. “We look forward to supporting the UAE’s vision to become a leading global crypto and fintech hub by driving the institutional adoption of blockchain technology” he adds.

By combining strict regulatory compliance with continuous investments in vital infrastructure elements like liquidity, best-in-class custody, and on/off-ramps between fiat and digital assets, Ripple will also offer cross-border payment solutions that are quicker, cheaper, and more effective to businesses in the UAE.

Ripple’s Expansion In Line With UAE’s Trajectory Of Becoming Crypto-Giant

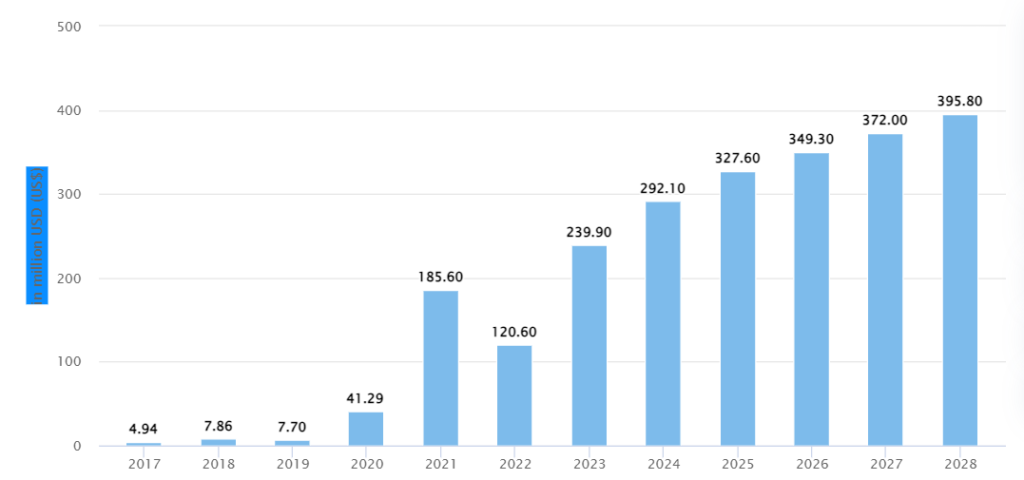

UAE’s crypto market is anticipated to increase at a 7.89% annual rate (cagr 2024–2028). Its total projected value stands at US$395.80 million by 2028, per data from Statista. Additionally, in the Middle East, the United Arab Emirates is quickly becoming a major center for blockchain innovation and cryptocurrency adoption.

According to Chainalysis data, the UAE received nearly $30 billion in cryptocurrency between July 2023 and June 2024, placing it in the top 40 worldwide and making it the third-largest crypto economy in the Middle East and North Africa.

It is projected that the percentage of UAE residents who utilize cryptocurrency would rise to 29.85% by 2028 from an estimated 26.96% in 2024.

Recently, UnoCrypto reported that Dubai’s Virtual Assets Regulatory Authority (VARA) had unveiled updated marketing regulations aimed at strengthening the regulatory framework for VASPs in Dubai. The purpose of these new regulations, which take effect on October 1st, 2024, is to improve the integrity and transparency of marketing initiatives in the virtual asset industry.

At present, the Middle East is still behind many countries in the virtual asset space but still holds immense potential. Although decentralized platforms and DeFi applications are gradually gaining pace in the region, centralized exchanges (CEXs) continue to be the main source of cryptocurrency inflows in the Middle East and North Africa (MENA), suggesting that the majority of consumers and institutions still favor traditional crypto platforms.