Binance, a leading global cryptocurrency exchange, has announced a significant market action with the planned delisting of the REEFUSDT USDⓈ-M perpetual futures contract, scheduled for January 22 at 17:00 (ET).

The decisive move has triggered an immediate negative response in the market, with the REEF token experiencing a sharp 9% price decline.

The announcement earlier today the 15th of January includes specific provisions for the forced liquidation and settlement of existing contracts upon delisting, marking a critical shift in the trading landscape for REEF investors.

The exchange has also indicated that adjustments to leverage and margin levels will be implemented leading up to the delisting date, requiring traders to make immediate position adjustments.

Current Market Status and Price Analysis

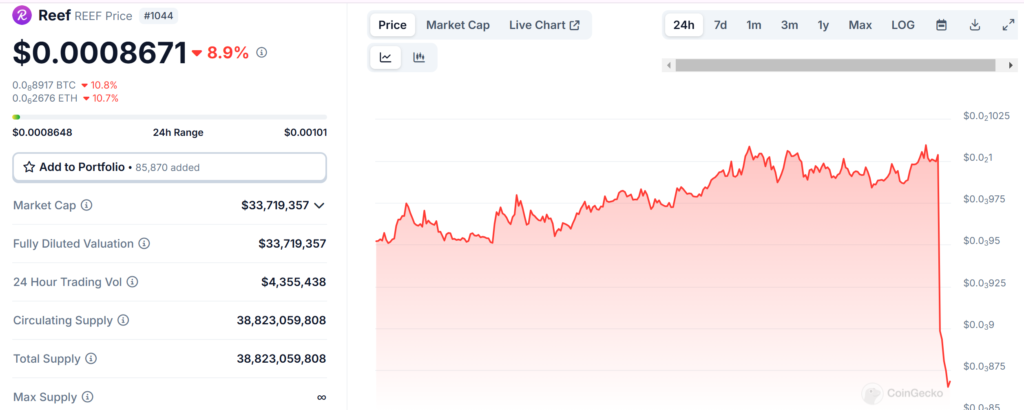

The impact of Binance’s announcement has been substantial and immediately visible in REEF’s market performance.

The token’s price has dropped to $0.0008672, representing an 8.92% decline over 24 hours, with trading volume reaching $4.36 million during this period.

The broader trend shows even more concerning metrics, with a 14.40% decline over the past week, indicating sustained selling pressure.

The token’s market capitalization currently stands at $33.7 million, with 39 billion REEF tokens in circulation, highlighting the significant scale of this market event and its potential implications for investors.

The price movement suggests a strong correlation between exchange listing status and market valuation, demonstrating the crucial role major exchanges play in cryptocurrency market dynamics.

Forced Liquidation Process and Investor Implications

The announcement’s forced liquidation provision has emerged as a particular concern for market participants.

The mandatory settlement requirement poses significant risks for traders holding open positions in the REEFUSDT perpetual contract.

The forced closure of positions, regardless of market conditions at the time of delisting, could potentially lead to unexpected losses and increased market volatility.

Traders are now faced with the urgent task of managing their positions ahead of the delisting date, considering both the impending leverage and margin adjustments and the potential impact of forced liquidations on their trading strategies.

The situation has created a challenging environment for investors who must navigate these changes while minimizing potential losses.

Context of Recent Binance Delistings and Market Trends

This REEF delisting announcement follows a pattern of similar actions by Binance affecting various cryptocurrencies.

Notable recent examples include the planned delisting of Fantom (FTM) trading pairs scheduled for January 13, 2025, to be replaced by Sonic (S) trading pairs on January 16, 2025.

Additionally, Binance’s decision to delist and cease trading for Kaon (AKRO), Bluzelle (BLZ), and WazirX (WRX) resulted in significant price impacts, with these tokens experiencing dramatic declines of 34%, 22%, and 40% respectively.

These actions reflect a broader trend of exchange-driven market movements and highlight the substantial influence that major exchanges like Binance have on cryptocurrency valuations.

The pattern of delistings and their consistent negative impact on token prices suggests a need for investors to closely monitor exchange policies and listing status as critical factors in their investment decisions.