Cardone Capital, a prominent real estate investment company managing $4.9 billion in assets, has announced a groundbreaking investment vehicle earlier today: the 10X Space Coast Bitcoin Fund, valued at $87.5 million.

The innovative fund represents a first-of-its-kind approach to combining traditional real estate investment with cryptocurrency exposure.

Grant Cardone, the company’s founder and CEO, emphasizes that this strategy emerged from over 11 years of studying Bitcoin, aiming to merge the stability of real estate cash flow with Bitcoin’s growth potential.

The fund targets an internal rate of return of 12%-15% on the real estate component, with potential for additional returns through its hybrid approach.

The strategy aligns with major institutional movements, noting that governments including the United States, China, and the United Kingdom collectively hold over $46 billion in Bitcoin.

Also Read: Grant Cardone Foundation Takes Michael Saylor Advice, Unveils $1B Real Estate and Crypto Fund

Investment Structure and Asset Strategy

The fund’s structure includes two primary components: a 300-unit Class A multifamily property in Melbourne, Florida, purchased without initial debt, and a significant eight-figure Bitcoin investment.

What makes this strategy particularly innovative is its approach to cash flow utilization – the real estate asset will generate immediate positive cash flow, which will then fund ongoing, strategic Bitcoin purchases.

In the first few years of the hold period, the fund’s sophisticated financial strategy involves putting long term debt on the properties. In comparison with strategic partial sales of Bitcoin holdings.

The aim is to potentially get a x2 return of capital invested into the investors initial capital, non taxable event, with continued ownership of both real estate asset and remaining Bitcoin holdings.

Also Read: Bitcoin Defies Expectations, Slips Only 2% in December As Bullish Run Still Intact

Market Response and Company Track Record

The market’s response to this innovative investment vehicle has been exceptionally strong, with Cardone Capital securing $100 million in commitments within just 72 hours of the initial offering.

The company’s impressive track record shows that since 2016, they have raised in excess of $1 billion and has paid out well over $300 million to nearly 18,000 different users.

The remarkable interest is backed by the company’s impressive track record – since 2016, Cardone Capital has raised over $1.5 billion and distributed more than $370 million to nearly 18,000 unique investors.

The fund launch comes during a period of significant growth for Cardone Capital, which has completed over $500 million in all-cash multifamily acquisitions in 2024 alone and expanded its portfolio to include more than 14,000 units.

Ryan Tseko, Executive Vice President of Cardone Capital, emphasizes that this tax-free refinancing strategy mirrors wealth-building techniques traditionally used by ultra-wealthy investors and institutions.

Market Context and Current Conditions

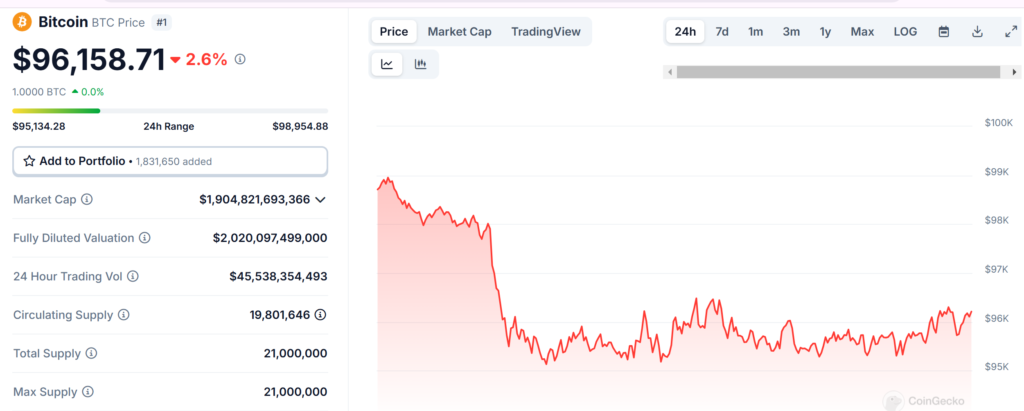

This innovative fund launch comes amid dynamic market conditions, with Bitcoin currently trading at $96,158.71, showing a 24-hour trading volume of $45,538,354,493.

Despite recent short-term fluctuations, including a -2.64% price decline in the last 24 hours and a -1.35% decrease over the past week, Bitcoin maintains a substantial market capitalization of $1,904,821,693,366 with a circulating supply of 20 Million BTC.

These market metrics provide important context for the fund’s timing and strategy, as it seeks to leverage both the established stability of real estate and the growth potential of cryptocurrency markets.

Also Read: Bank of Italy Labels Bitcoin P2P Services as “Crime-As-A-Service” Amid Money Laundering Issues