The White House hosted its first-ever digital asset summit on Friday, bringing together top executives from the crypto industry to discuss policy changes under the Trump administration.

The summit marks a significant shift in the government’s stance on cryptocurrency, moving away from the stringent regulatory measures implemented under the Biden administration.

During the event, President Donald J. Trump reaffirmed his commitment to making the United States the global leader in digital assets.

He also emphasized the importance of fostering innovation and financial sovereignty, signaling a more supportive approach toward the burgeoning industry.

Establishing a Strategic Bitcoin Reserve

One of the major announcements from the summit was the signing of an Executive Order to establish a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile.

The Strategic Bitcoin Reserve will function as a treasury-backed store of digital value, capitalized with bitcoin seized through criminal or civil asset forfeiture proceedings.

The government has committed to maintaining this reserve without selling off Bitcoin holdings, thereby strengthening the nation’s financial position in the global crypto economy.

Additionally, the U.S. Digital Asset Stockpile will house other cryptocurrencies confiscated through legal proceedings, with the Treasury Secretary authorized to determine the best strategies for managing these assets.

Addressing a Crypto Management Gap

The Executive Order aims to resolve long-standing inefficiencies in the federal government’s management of confiscated digital assets.

Historically, seized cryptocurrency has been handled in a fragmented manner across multiple agencies, often leading to premature sell-offs that have cost U.S. taxpayers billions.

The new policy centralizes control and ensures proper oversight, allowing the government to maximize the value of its digital holdings.

Bitcoin, often referred to as “digital gold” due to its fixed supply and decentralized nature, presents a strategic advantage for the U.S. government in maintaining financial stability and securing national assets in an increasingly digital world.

Trump’s Vision for America as a Crypto Leader

President Trump has consistently advocated for a pro-crypto stance, promising to transform the United States into the “crypto capital of the world.”

His administration has already taken steps toward this goal by appointing a “crypto czar” and hosting the first-ever digital asset summit at the White House.

The Executive Order aligns with his broader vision of fostering financial innovation while ensuring that digital assets are leveraged to strengthen the U.S. economy.

Trump’s open support for the industry starkly contrasts with previous administrations, which largely approached cryptocurrency with caution and regulatory scrutiny.

Market Reactions and Industry Response

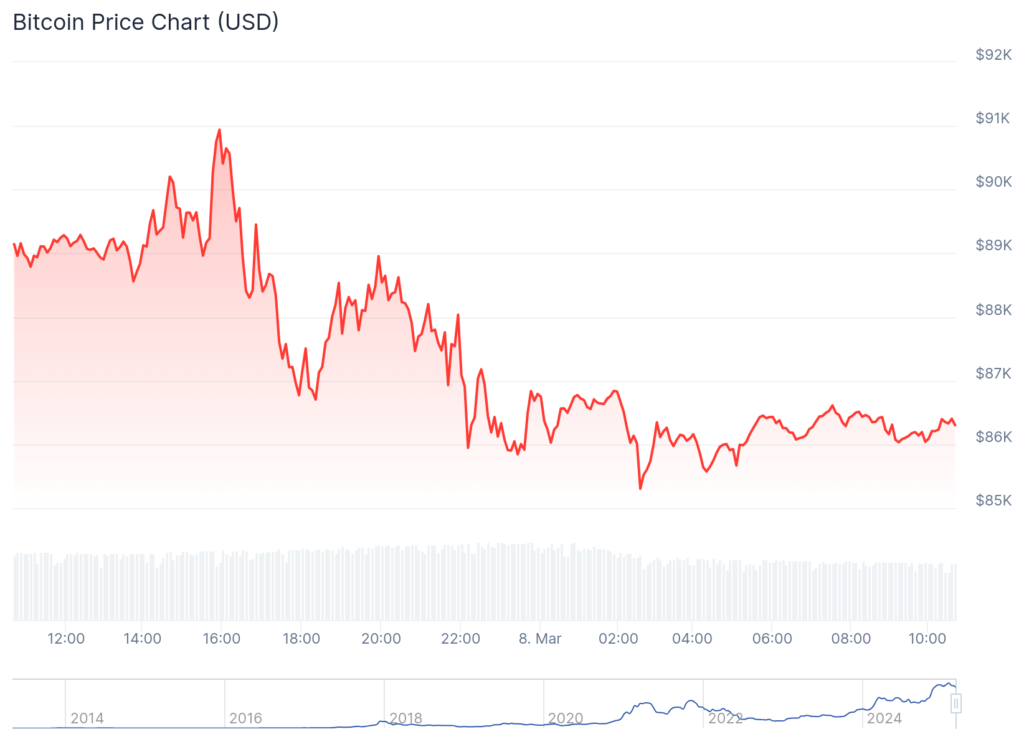

Despite the promising announcements, the immediate market response was mixed. Bitcoin’s price dropped by approximately 3% following the summit, finishing the week down around 7% at $87,000.

As of today, Bitcoin (BTC) is trading at $86,362.89, reflecting a 2.49% decline in the last 24 hours, although it remains up 1.13% over the past week.

While some industry players welcomed the administration’s new approach, others expressed concerns over the lack of clear regulatory frameworks beyond asset forfeiture.

Nevertheless, the summit has sparked discussions on long-term strategies for integrating digital assets into the U.S. financial system, setting the stage for continued policy developments in the crypto space.