Plasma (XPL) launched its long-awaited mainnet on September 25, 2025, and immediately created excitement throughout the crypto market.

It is a Layer 1 blockchain with a single purpose: to enable stablecoin transfers at scale. Plasma entered the market with $2 billion in starting liquidity and a whopping 14.6x price increase from their ICO to the open market.

The project is supported by firms such as Tether and Founders Fund, as it hopes to build a solution focused on stablecoin payments as opposed to a general-purpose blockchain.

Plasma has already gained attention with zero-fee USDT transfers and very fast block finality using their proprietary PlasmaBFT consensus.

Mainnet Details and Performance Metrics

The Plasma mainnet beta launched at 8:00 AM ET, starting with deep liquidity across more than 100 DeFi protocols, including Aave, Euler, and Ethena.

At the center of the network is PlasmaBFT, a modified version of HotStuff consensus that provides deterministic finality with block finality in under one second. Notably, it has a throughput of over 1,000 TPS.

Also noteworthy is the custom fee model, which allows users to pay gas fees in stablecoins directly, rather than governance tokens, thereby eliminating friction for typical users who may prefer to transact in USDT rather than governance tokens.

There’s already some early evidence of utility, with users able to send zero-fee USDT transfers via the native Plasma dashboard.

Also Read: Ethereum Core Devs Target Dec. 3 For Fusaka Mainnet Launch After October Testnet Rollout

Explosive Trading Debut and Exchange Rollouts

After the successful launch of the mainnet, Plasma’s native token, XPL, entered the markets and immediately gained traction.

XPL is noted to have started trading between $0.55 and $0.83.

Binance Futures quickly gained market leadership with more than 55% of trading volume, while OKX and Hyperliquid engaged in a nearly $127 million daily volume each.

Furthermore, with XPL featured in its 44th HODLer Airdrops campaign, Binance helped promote further adoption by activating 75 million tokens for BNB stakers.

Exchanges carefully staggered their releases to mitigate demand pressure, with KuCoin running a call auction, Upbit offering fiat access in the Korean won, while Gate.io listed launchpad tokens at a discounted price of $0.35.

XPL recorded $632 million in futures volume within the first 24 hours and achieved a fully diluted valuation close to $7.8 billion. Preliminary figures were comparable to early Solana numbers.

Also Read: Nemo Protocol Says $2.6M Lost After Two Code Flaws Were Pushed To Mainnet

Tokenomics, Supply Schedule, and Community Incentives

Plasma established a maximum of 10 billion XPL tokens as its genesis supply, along with a controlled inflation model commencing at a 5% inflation rate annually and settling at a 3% rate over time.

There is a considerable focus on growth in the token allocations, which distribute 40% for ecosystem incentives, 25% to the team, 25% to investors, and 10% sold to the public.

The token sale in July of 2025 raised $373 million, far exceeding its intended goal of $50 million, and was sold at $0.05 per token.

At launch, 1.8 billion tokens entered circulation (18% of total supply) with multiple unlocks scheduled to happen over the next three years.

In an effort to engage retail users, Plasma distributed 25 million tokens to small depositors who verified their accounts and issued an additional 2.5 million tokens to Stablecoin Collective members, indicating the utilization of community-led adoption in tandem with institutional investments.

Also Read: Pectra Goes Live In Ethereum’s Largest-Ever Mainnet Update, $ETH Climbs 3%

Positioning in the Stablecoin Ecosystem

Plasma is seeking to disrupt the stablecoin market, which is currently valued at $225 billion, with a primary focus on Ethereum and Tron chains, both of which are known for experiencing hurdles with fees and scalability.

To get things started, Plasma initially seeded $2 billion of liquidity across the two largest DeFi protocols, ensuring users could access lending, yield farming, and stablecoin markets without needing to bridge assets across chains.

This, in turn, provided liquidity and highlights how Plasma separates itself from competitors such as STBL, which are exploring different governance and yield approaches.

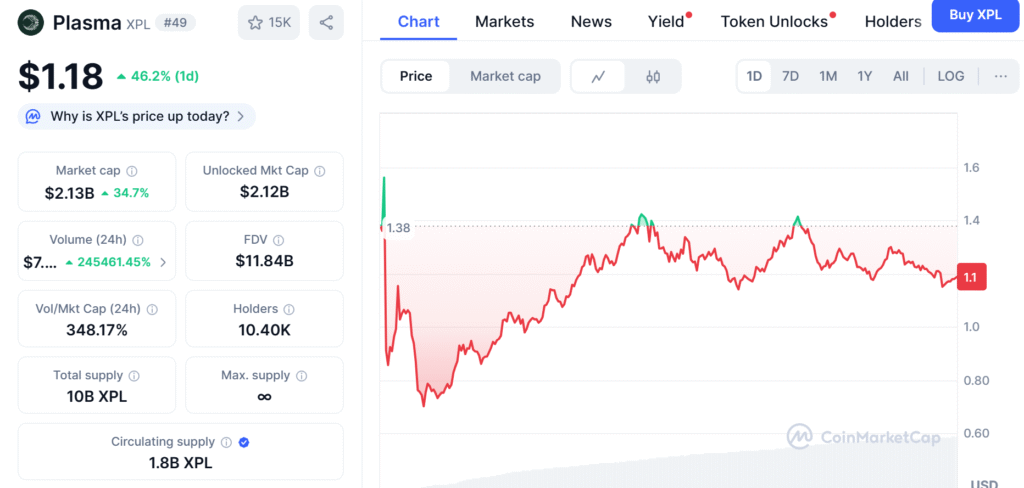

Currently, with a live market price of $1.18, a market cap of over $2.1 billion, and trading over $7.3 billion and counting within 24 hours, Plasma has quickly established itself as one of the most noteworthy Layer 1 launches of 2025.

The next step is to maintain that momentum and demonstrate that the payment-based model can continue to scale well after the opening-week hype has subsided.

Also Read: Vana Deploys Mainnet, Activates Staking and Airdrops for DataDAO Pre-Miners and Discord Community