Earlier today, on August 26th, Peter Schiff, the American investor and stockbroker, posted on X, that Bitcoin had fallen below $109,000 and urged holders to sell now and buy back at lower prices.

He said the move came after a roughly 13% drop from a recent peak reached less than two weeks earlier. Schiff blamed heavy hype and corporate buying for the weakness and suggested a further slide toward about $75,000 is possible.

He made the comments on X(Twitter) and told followers his play would protect investors from bigger losses.

Schiff’s warning

Schiff told his followers that the current pullback should alarm investors. He argued the rally was driven more by publicity and large-scale corporate purchases than by solid fundamentals.

He wrote that selling shares or coins now and re-entering at cheaper levels would be a safer bet. The post echoed his long-standing view that Bitcoin is overhyped and fragile in down markets.

Bitcoin’s Price Actions

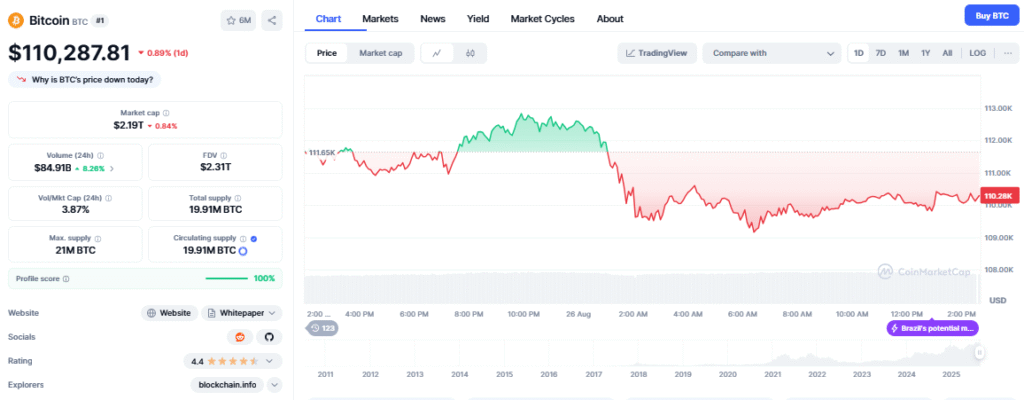

At the time Schiff posted, Bitcoin was trading at $110,309.28, and the token was down about 1.07% in the prior 24 hours.

The global crypto market cap stood near $2.19 trillion. Trading activity rose, with 24-hour volume up by 9.97%. Those figures show traders are active even as prices slip.

Policy and retirement comments

Earlier this month, UnoCrypto reported Schiff criticised a plan to allow private equity, real estate, crypto, and other nontraditional assets into 401(k) accounts.

He warned the change could worsen retirement shortfalls for many Americans. He said adding complex assets to retirement plans can expose savers to risk without clear benefits.

Stablecoin stance

Schiff also targeted USD-pegged stablecoins, and he called them flawed tokens and questioned the logic of relying on currency-linked digital assets.

He said backing holdings with dollar-linked coins makes little sense if the dollar itself is losing value. His point is that a token tied to a weakening currency may not protect wealth.

What this means?

Schiff’s comments add to a loud debate over Bitcoin’s role in portfolios. Some investors see dips as buying chances. Others worry that speculative flows and corporate buys can create volatile swings.

A call to sell now and buy back lower assumes traders can time the market. That is hard to do in practice. If many follow a sell-first approach, prices could fall faster. If buyers step in, the decline may be shallow.

For retirement policy, Schiff’s stance highlights a wider fear. Critics worry that letting retail investors hold complex or volatile assets inside retirement accounts might harm people who lack the time or knowledge to manage them.

Supporters argue it offers more choice, and the debate is likely to continue as regulators and plan managers weigh options.

Schiff’s posts emphasise the contradiction between the bullish narrative and the sceptical narrative in crypto. It will be up to the prices to tell which narrative will gain more dominance.

For the moment, the markets are still active and split. Whether traders and savers choose to trust the run or adopt a more conservative approach remains to be seen.

Also Read: Big-Time Gold Advocate Peter Schiff Seeks Public Donations To Grow His BTC Reserve