A prominent PEPE whale has captured attention in the crypto market after securing a floating profit of $406,000 through a significant investment in Aave (AAVE).

On-chain data from OnChain Lens revealed that approximately 14 hours ago, the whale spent 1,928.86 WETH, equivalent to $3.95 million, to purchase 20,511 AAVE tokens at an average price of $193 per token.

The strategic move has proven to be highly lucrative, as AAVE’s price has since climbed, reflecting the investor’s deep understanding of market movements.

The whale, known for their early investment in PEPE, continues to hold a diversified portfolio across various crypto assets, reinforcing their reputation as a seasoned market participant.

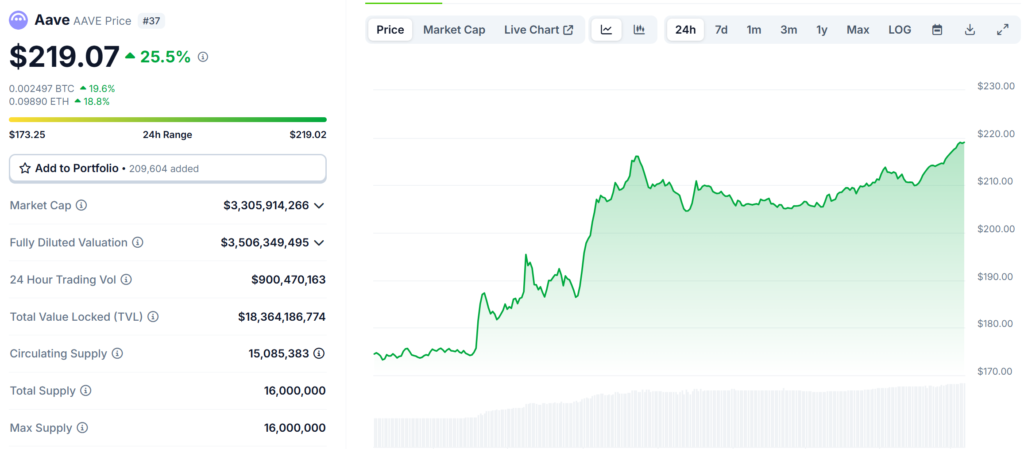

AAVE Price Rally Fuels Investor Gains

The whale’s profits have been driven by AAVE’s impressive price surge, which has seen the token rise to $219.16, marking a 25.60% increase in the past 24 hours and a 6.82% gain over the past week.

As a result, AAVE’s market capitalization now stands at approximately $3.3 billion, with a 24-hour trading volume exceeding $900 million.

With an entry price of $193 per token, the whale has already secured a profit of over $400,000 in a short period.

Given AAVE’s continued bullish momentum, the investor’s gains could further increase if the asset maintains its upward trend.

Market analysts speculate that the whale’s strategic timing could indicate confidence in AAVE’s long-term potential, possibly signaling further accumulation.

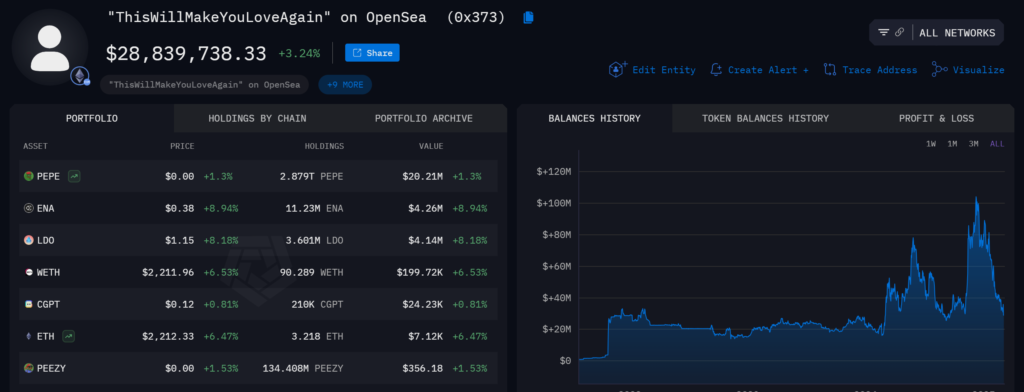

Whale’s Extensive Crypto Portfolio Showcases Diversification

Beyond AAVE, the whale maintains a well-diversified portfolio, with a dominant holding of 2.88 trillion PEPE tokens valued at around $19.97 million.

The investor also possesses significant stakes in other cryptocurrencies, including 11.23 million ENA ($4.26 million), 3.60 million LDO ($4.14 million), and 90.29 WETH ($199,720).

Additionally, the whale has smaller holdings in assets like CGPT, ARCX, and PIKA, showcasing a balanced investment approach across both established and emerging tokens.

The diversification strategy helps mitigate risk while allowing the investor to capitalize on profitable opportunities across multiple sectors of the crypto market.

Market Reactions and Broader On-Chain Activity

The whale’s sizable investment in AAVE has sparked discussions within the crypto community, with speculation about potential future moves.

Given the investor’s history of strategic accumulation, any significant buy or sell action from them could impact market trends.

Meanwhile, broader on-chain activity has seen other major investors locking in significant profits.

A dormant whale recently offloaded $83.51 million in $OM tokens after securing $107.25 million in profits, while a top TRUMP trader liquidated $7.53 million after earning $6.03 million in gains.

Additionally, a Solana investor realized a $4.5 million profit by offloading 96,155 SOL on Binance. These large transactions highlight the growing influence of whales in shaping market movements and driving volatility within the crypto space.