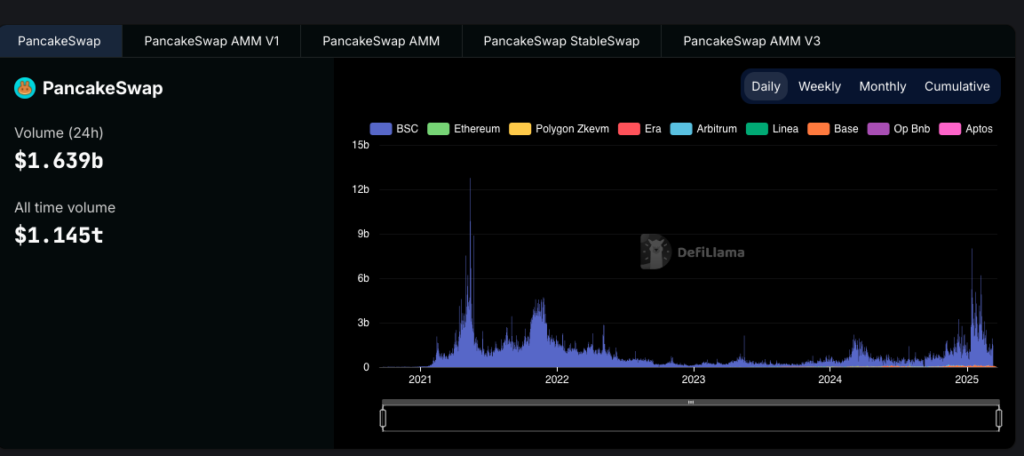

PancakeSwap has officially claimed the top spot among decentralized exchanges (DEXs), surpassing competitors with a staggering 24-hour trading volume of $1.639 billion.

The achievement represents an 11.04% increase in trading volume, securing PancakeSwap’s dominance with a 30.36% market share.

According to DeFiLlama, PancakeSwap now leads the DEX market, leaving behind major competitors such as Uniswap and Raydium.

The platform’s overall trading volume has reached an impressive $54.535 billion, reinforcing its position as the go-to DEX for traders seeking efficiency and liquidity.

Competitors Struggle as PancakeSwap Gains Momentum

While PancakeSwap surged ahead, rival exchanges have faced significant setbacks. Uniswap, the second-largest DEX, suffered a 17.06% drop in trading volume, bringing its daily activity down to $1.021 billion.

Despite this decline, Uniswap maintains an overall transaction volume of $15.261 billion. Meanwhile, Solana-based Raydium recorded a steep 27.32% decrease, with its trading volume falling to $334.98 million.

Other Solana DEXs, such as Orca and Meteora, also saw sharp declines of 18.94% and 34.55%, respectively, highlighting a shifting market dynamic favoring PancakeSwap.

In a surprising turn, Canto Dex experienced a 6,970% surge in trading volume, reaching $154.05 million.

The explosive growth is attributed to heightened interest in its liquidity pools and recent protocol upgrades, demonstrating that niche DEXs can still carve out space in the competitive market.

The milestone has also led to a 40% surge in the price of PancakeSwap’s native token, $CAKE, reflecting growing investor confidence.

CAKE saw a 42.85% price increase in the last 24 hours and a 65.13% price increase in the past 7 days. The token has a circulating supply of 300 Million CAKE as of time of report and a market cap of $792.3 Million.

Also Read: Solana Network Sees Massive 7.11% Surge in Stablecoin Supply, Hits 2-Year High at $5.89B

Binance Investment and Layer-2 Expansion Fuel PancakeSwap’s Rise

PancakeSwap’s growth has been further boosted by Binance’s recent $2 billion investment in Abu Dhabi’s MGX, reinforcing investor confidence in Binance-backed projects.

As the largest DEX on Binance’s BNB Chain, PancakeSwap has directly benefited from this strategic partnership.

Additionally, the platform has aggressively expanded its Layer-2 integrations, driving massive increases in trading volume.

In 2024, PancakeSwap saw a 3,656% year-over-year (YoY) surge in trading volume on Arbitrum, reaching $13.2 billion. Similarly, its trading activity on Base jumped by 3,539% YoY, hitting $11.6 billion.

Even on Ethereum, PancakeSwap experienced a 251% increase, while BNB Chain activity grew by 155% to $268 billion. This multi-chain expansion has made the platform more attractive to traders across various ecosystems, further cementing its dominance.

Innovative Features and DeFi Growth Accelerate Adoption

To enhance user experience and maintain its competitive edge, PancakeSwap has introduced several new features, including PancakeSwapX, a redesigned swap interface and Telegram Swap bots, which allow seamless transactions directly within messaging platforms.

Additionally, the launch of SpringBoard, a no-code token creation tool, has drawn in developers looking to create new tokens without requiring advanced technical knowledge.

These innovations align with PancakeSwap’s mission to make decentralized finance (DeFi) more accessible.

Moreover, the overall DeFi market has experienced a 124% surge in 2024, with Total Value Locked (TVL) rising from $54 billion in January to $121 billion by December.

As more users transition from centralized exchanges to decentralized alternatives, PancakeSwap remains at the forefront, capitalizing on the booming DeFi ecosystem.

Also Read: Binance Records $5.323 Billion in February Net Inflows Amid Bybit Hacking Incident