BNB Network Company, the treasury branch of CEA Industries Inc., said it bought 200,000 BNB tokens, making it the largest corporate holder of BNB in the world. The move follows a $500 million private placement led by 10X Capital with backing from YZi Labs.

The cash raise will fund a treasury plan that places BNB at the centre of the company’s reserves. New leadership is in place to steer the strategy, and the firm says it plans more purchases as it deploys the raised capital.

A clear shift in focus

Under its new ticker, BNC (formerly VAPE), the company has shifted its treasury strategy to concentrate almost entirely on BNB. Executives say the coin is now the company’s primary reserve asset.

The change is sharp and deliberate. It marks a pivot from a varied asset mix to one centred on a single token tied to a major blockchain ecosystem.

New team to run the play

The company reshuffled its leadership to match the new direction. David Namdar, a Galaxy Digital co-founder, is now the CEO. He is joined by Russell Read, who previously worked as CIO at CalPERS, and Saad Naja, a former director at Kraken.

10X Capital’s Hans Thomas and Alexander Monje have also been named to the board. The hires add industry experience across markets, institutions, and crypto operations.

The size and logic of the bet

BNC’s initial buy equates to about $160 million and confirms the firm as a leading institutional BNB treasury. The company says it will continue acquiring more BNB until its initial capital is fully used.

It can also tap up to $750 million more through its warrant structure. If those warrants are exercised, total proceeds could reach roughly $1.25 billion for additional BNB purchases.

Why BNB?

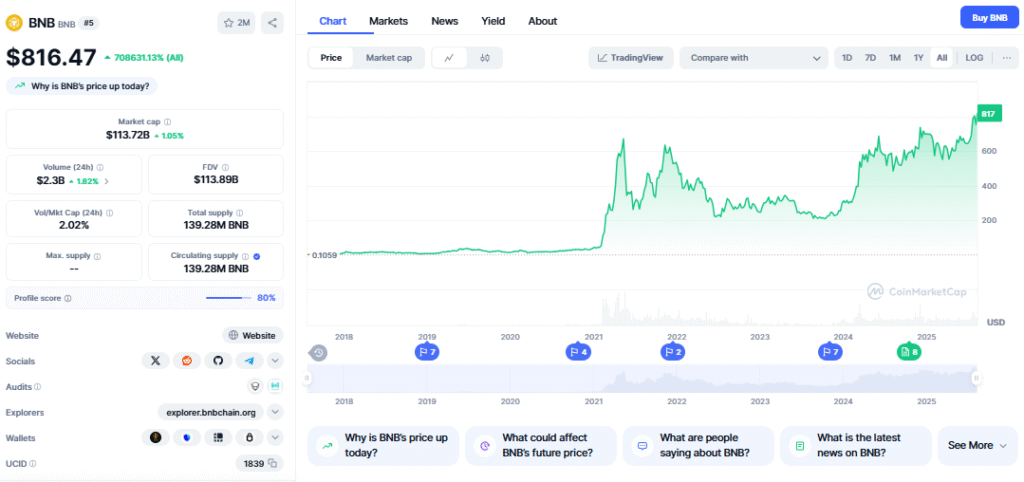

BNB is the native token of BNB Chain, a network with a large developer and user base. The chain holds about $12.3 billion in total value locked, putting it among the top chains by TVL.

Supporters point to token burns that reduce supply, growing on-chain activity, and market events such as a possible BNB spot ETF as reasons the token could rise in value. For BNC, these factors make BNB an attractive candidate for a concentrated treasury.

Also Read: Nasdaq-Listed Windtree Therapeutics Plans $520 Million Fundraising To Expand Its BNB Treasury

Market context and reach

The share price of the company is up by 1.95% in the last 24 hours. The company says BNB has a global user base of about 250 million and an average daily trading volume of $9.3 billion as of July 2025.

Despite that scale, BNB is still under-represented among U.S. institutional portfolios, BNC’s team argues. The firm hopes its public treasury will create a bridge for U.S. and global investors who want exposure to BNB without holding the token themselves.

Related deals and backing

Earlier moves tied to this plan include a strategic equity investment by Nano Labs Ltd in CEA Industries. The company and its partners, including 10X Capital and YZi Labs, also completed an oversubscribed PIPE financing that helped fund the plan to build a large, publicly traded BNB treasury.

A heavy BNB weighting brings both opportunity and risk. Concentrating reserves in a single crypto makes price fluctuations of greater concern to the company’s balance sheet.

Custodial controls, regulatory oversight, accounting, and risk management will all be more complex as the treasury increases in size.

How the company manages those specifics will determine the level of investor trust as well as regulatory oversight.