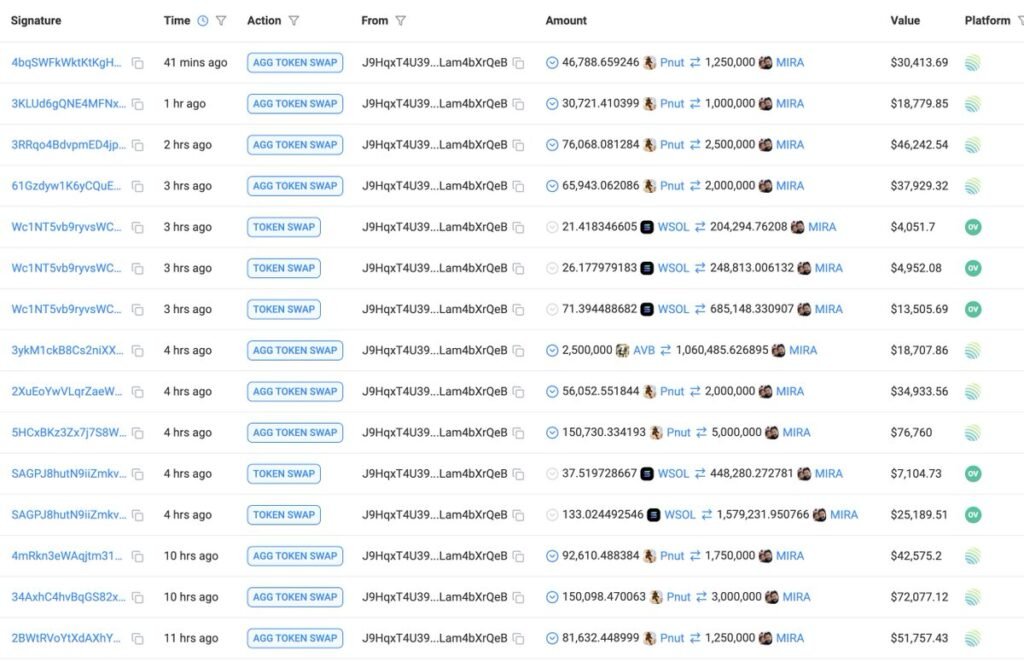

A significant cryptocurrency investor has experienced substantial losses following a major investment in MIRA tokens, as reported by blockchain analytics platform Lookonchain.

The investor’s initial position consisted of 50 million MIRA tokens, purchased for $1.56 million at an average price of $0.0312 per token.

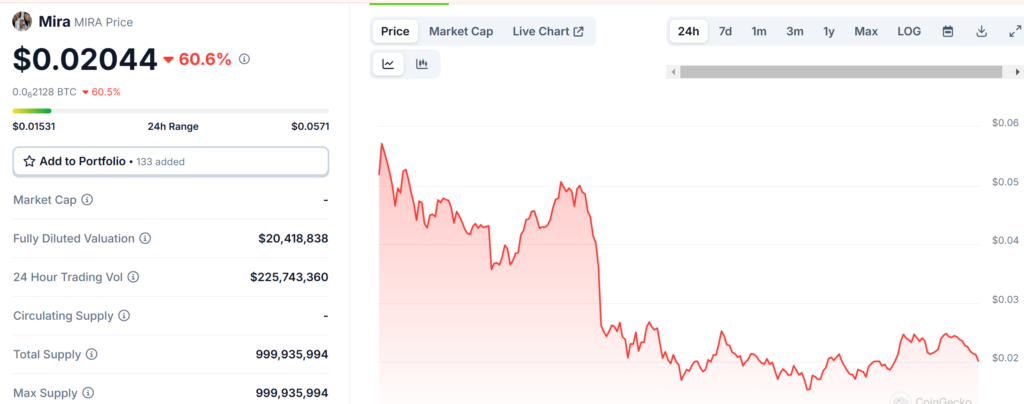

With MIRA’s current trading price falling to $0.02044, the investment’s value has dramatically decreased to approximately $1,022,000.

The recent transaction reflected a devastating loss of $538,000, marking a 34.5% decline from the entry price.

The situation has continued to deteriorate, with losses expanding beyond the initially reported $500,000 mark, accumulating an additional $38,000 in losses as the token’s price continued its downward trajectory.

Current Market Status and Trading Metrics

MIRA’s market performance has been particularly concerning, with the token experiencing a dramatic 60.59% price decline within a 24-hour period.

Despite maintaining a significant trading volume of $225,743,360, the token’s severe price deterioration has raised concerns among market participants.

The current trading price of $0.02044 represents a substantial decrease from previous levels, though interestingly, the token has shown some positive movement over a seven-day period.

It’s worth noting that the Solana-based memecoin $MIRA reached a staggering market capitalization of $80 million within just five hours of its launch.

The token, created to support brain tumor research funding, gained traction due to its unique mission and community-driven ethos.

Investors rallied around the project, propelled by social media buzz and the potential for both philanthropic impact and financial gain.

Broader Market Context and Related Losses

The MIRA token situation is not isolated, as other significant losses have been reported across the cryptocurrency market.

A notable Solana whale investor has incurred losses of $1.44 million across three memecoin investments – $PNUT, $FRED, and $OPK. This particular case involved an initial investment of 13,642 SOL (valued at $2.22 million), with losses on individual tokens reaching as high as 85%.

Additionally, another significant incident involved a crypto trader losing $102,000 in a failed swap from $ARC to $ELIZA/$eliza, attributed to incorrect data released by Binance Alpha.

These cases collectively highlight the volatile and risky nature of cryptocurrency investments, particularly in newer or less established tokens.

Market Implications and Risk Assessment

The substantial losses experienced by major investors have created ripple effects throughout the cryptocurrency market.

Market analysts are particularly concerned about the potential for forced selling by large holders, which could create additional downward pressure on token prices.

The situation has become a prominent discussion point within the cryptocurrency community, serving as a stark reminder of the risks associated with concentrated positions in volatile digital assets.

The concurrent regulatory developments, including allegations by Australian authorities regarding Binance Australia Derivatives’ improper client classification, add another layer of complexity to the market landscape.

These events collectively emphasize the critical importance of proper risk management and due diligence in cryptocurrency investments, particularly when dealing with substantial position sizes or newer tokens.