MicroStrategy, a company widely recognized for its aggressive Bitcoin accumulation strategy, has rebranded itself as Strategy, reinforcing its commitment to both corporate transparency and digital asset adoption.

MicroStrategy’s Rebrand To Strategy

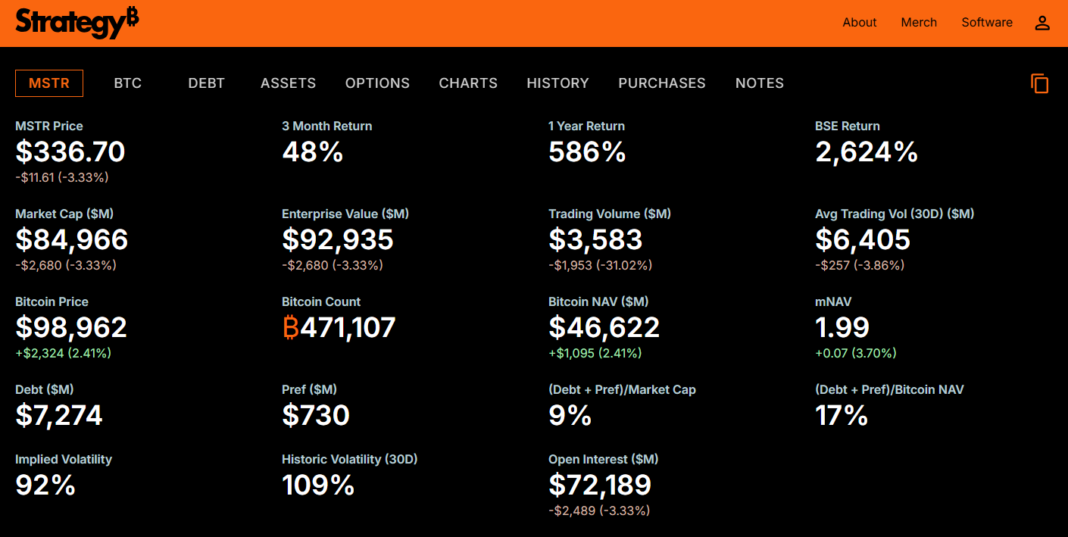

The company’s new homepage reflects this shift, setting a new standard for financial disclosure and corporate governance in the cryptocurrency sector.

By openly sharing key financial data, Bitcoin holdings, and strategic plans, Strategy is redefining transparency for publicly traded firms. The updated homepage provides real-time insights into the company’s financial health, emphasizing accountability to shareholders.

This move comes as institutional interest in Bitcoin surges, further positioning Strategy as a leader in the corporate adoption of digital assets.

Also Read: MicroStrategy Redeems $1.05 Billion Convertible Notes Amid Potential Tax Concerns On Bitcoin Gains

A Bitcoin-Focused Evolution

Under the leadership of Chairman and co-founder Michael Saylor, Strategy has transformed from a software company into a leveraged Bitcoin proxy. The company has consistently tapped into capital markets to finance its Bitcoin acquisitions, amassing a staggering 471,107 BTC—worth over $45 billion.

This makes Strategy the largest corporate Bitcoin holder in the world, a position that continues to attract both institutional and retail investors.

CEO Phong Le emphasized the company’s progress, stating that it is already ahead of its original roadmap and well-positioned to create further value for shareholders. With institutional support growing and Bitcoin’s mainstream adoption accelerating, Strategy’s approach appears to be paying off.

Institutional Endorsement: Norway’s Central Bank Invests

A major endorsement of Strategy’s vision came with a recent $500 million investment from Norway’s Central Bank, which acquired a 0.72% ownership stake in the company.

This investment signals a strong institutional belief in Bitcoin as a long-term asset class and highlights Strategy’s role as a gateway for traditional finance to gain exposure to digital assets.

Norway’s move reflects a broader trend of financial institutions integrating Bitcoin into their portfolios. With regulatory clarity improving and Bitcoin gaining legitimacy as an alternative store of value, Strategy’s business model is increasingly viewed as a pioneering approach to corporate treasury management.

Setting a New Standard for Financial Transparency

Strategy’s new corporate identity and enhanced transparency set a precedent for companies integrating Bitcoin into their financial strategies. By making key information readily available, the company is fostering trust among investors and regulators alike.

As Bitcoin adoption continues to expand, Strategy’s proactive approach could serve as a blueprint for other corporations looking to follow a similar path. With institutional backing and a clear strategic direction, the company is poised for continued success in the evolving digital asset landscape.

Also Read: MicroStrategy Spends $1.1B To Buy 10,107 Bitcoins; Total Holdings Jump to 471,107 $BTC