Michael Saylor, the co-founder and executive chairman of MicroStrategy, has once again made headlines in the crypto world with his strong endorsement of Bitcoin, even as its price experiences a significant downturn.

In a bold statement on X (formerly Twitter), Saylor urged investors to maintain their Bitcoin holdings no matter the circumstances, quipping, “Sell a kidney if you must, but keep the Bitcoin.”

While his remark is likely hyperbolic, it reflects his unwavering confidence in Bitcoin’s long-term value.

As one of the most influential voices in the cryptocurrency space, Saylor’s stance carries weight, particularly given MicroStrategy’s massive Bitcoin holdings, valued at billions of dollars.

His statement comes at a time of heightened concern among investors as Bitcoin faces a sharp decline, fueling debates about whether this is a temporary pullback or the start of a deeper correction.

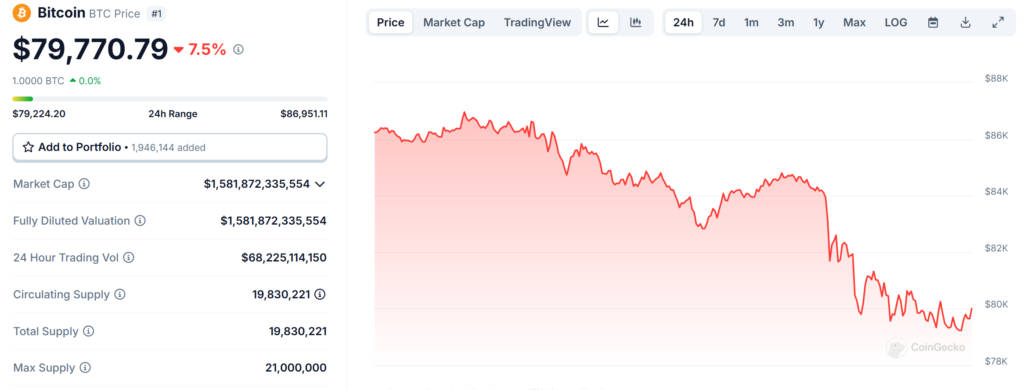

Bitcoin Drops Below $80,000 as Market Volatility Intensifies

Bitcoin (BTC) has fallen below the critical $80,000 mark for the first time in recent weeks, currently trading at $79,072.24. This marks an 8.62% decline in just 24 hours and a staggering 19.69% drop over the past week.

The cryptocurrency’s total market capitalization has now fallen to approximately $1.57 trillion, with a 24-hour trading volume reaching nearly $74 billion.

Analysts attribute this downturn to a mix of macroeconomic pressures and institutional repositioning.

Notably, crypto research firm Presto Research highlighted the unwinding of basis trade positions by major institutions as a significant factor behind Bitcoin’s ongoing decline.

Additionally, U.S. Bitcoin ETFs have seen record outflows, further contributing to market instability. Ethereum (ETH), the second-largest cryptocurrency, has also been affected, hovering around $2,100 after dropping 10% during the same period.

Institutional and Global Market Forces Impacting Bitcoin

Bitcoin’s recent price drop is not occurring in isolation; broader financial market concerns have also played a crucial role in its decline.

Augustine Fan, Head of Insights at SignalPlus, pointed out that a strong earnings report from Nvidia was not enough to lift market sentiment, as global equities took a hit due to renewed tariff concerns and fears of a slowing economy.

The announcement by former U.S. President Donald Trump that new tariffs on imports from Canada, Mexico, and China would take effect as scheduled has added to economic uncertainty, impacting risk assets, including Bitcoin.

Furthermore, Bitcoin’s high correlation with the S&P 500 means that broader TradFi (traditional finance) market sentiment has spilled over into the crypto space.

Another contributing factor is liquidity depletion caused by multiple memecoin surges, which have diverted funds away from major cryptocurrencies, further pressuring Bitcoin’s price.

Long-Term Bitcoin Believers Remain Unshaken

Despite the ongoing market turbulence, Saylor’s statement reflects the conviction held by long-term Bitcoin advocates who view price corrections as natural occurrences in a broader uptrend.

Over the years, Saylor has consistently championed Bitcoin as “digital gold” and the ultimate hedge against inflation.

MicroStrategy’s aggressive accumulation strategy has solidified its position as one of the largest corporate holders of Bitcoin, reinforcing its commitment to the asset regardless of short-term fluctuations.

While many investors panic during sharp declines, historical data suggests that major Bitcoin corrections often lead to long-term buying opportunities.

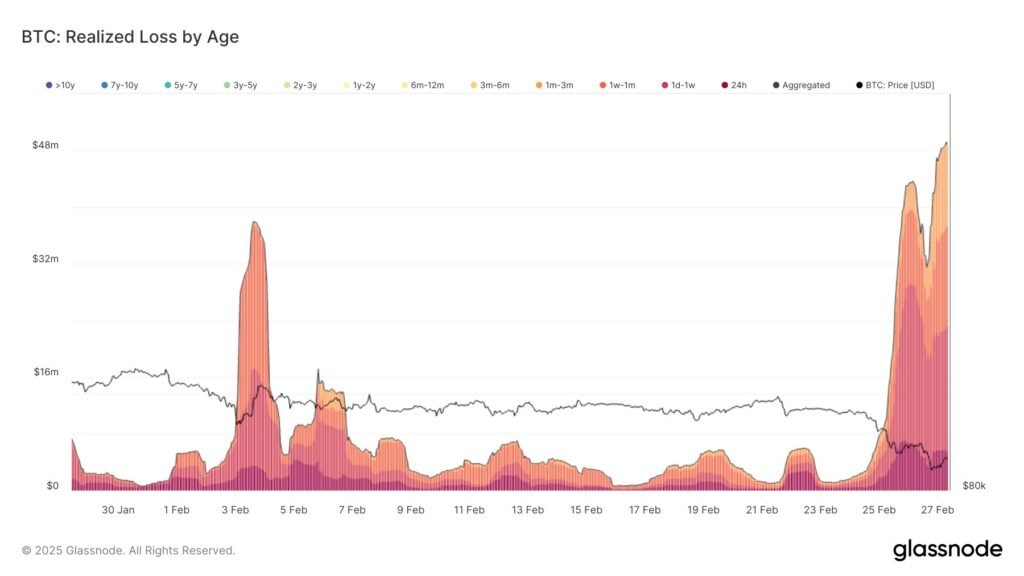

According to Glassnode, between February 25-27, investors realized over $2.16 billion in losses, primarily from newer market participants who capitulated during the crash.

However, seasoned holders—often referred to as “diamond hands”—continue to maintain confidence in Bitcoin’s long-term trajectory, aligning with Saylor’s steadfast belief that patience will ultimately reward those who stay the course.

Also Read: Michael Saylor Expresses Optimism Over Metaplanet, Urges People to Follow the Firm