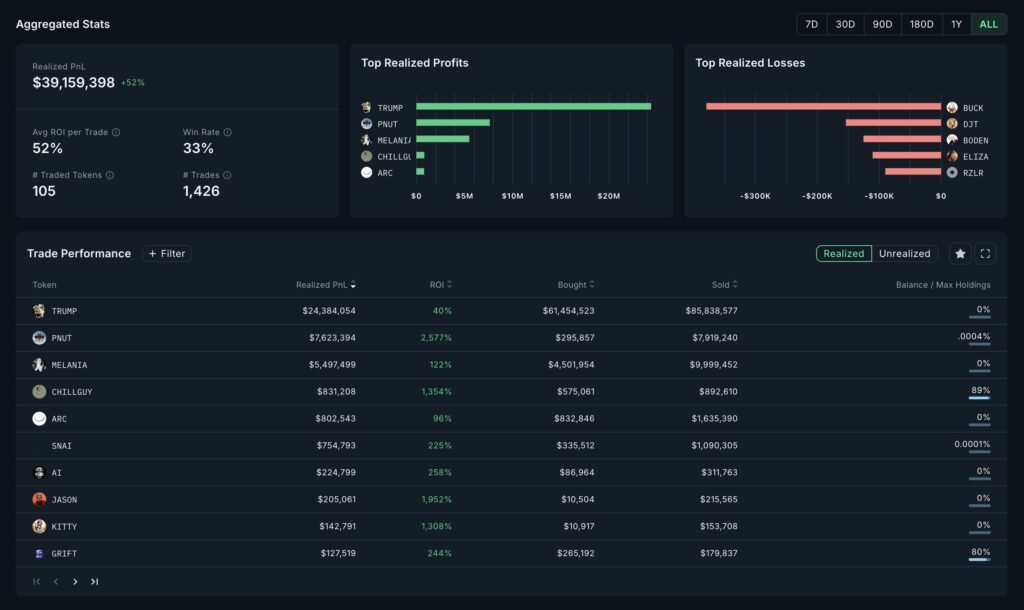

A renowned crypto whale with the address 3AWDT…gBCu once celebrated for amassing a staggering $39.15 million profit in meme coin trading, has recently suffered a $3.46 million loss after selling 600,000 $TRUMP and 740,000 $MELANIA tokens.

The transactions, which occurred just hours ago, resulted in a $2.91 million loss from $TRUMP tokens and an additional $550,000 from $MELANIA.

The significant setback marks a rare misstep in the whale’s otherwise highly profitable career in meme coin trading. Despite this loss, the trader’s earlier successes continue to position them as a dominant figure in the volatile meme coin space.

Meme Coin Trading: Profits and Risks in Perspective

Although the recent losses are substantial, they are minor compared to the trader’s prior achievements.

The whale’s earlier ventures into $TRUMP tokens yielded an impressive $24.38 million in profit.

Additionally, they secured $7.62 million from $PNUT, $5.5 million from $MELANIA, $830,000 from $CHILLGUY, and $800,000 from $ARC, showcasing the lucrative opportunities within the highly volatile meme coin market.

These numbers underscore the high-risk, high-reward nature of meme coin trading, where fortunes can fluctuate drastically based on market sentiment and timing.

Despite the latest $3.46 million loss, the trader remains significantly ahead, with an overall profit that far outweighs the setback.

Volatility in $TRUMP and $MELANIA Tokens

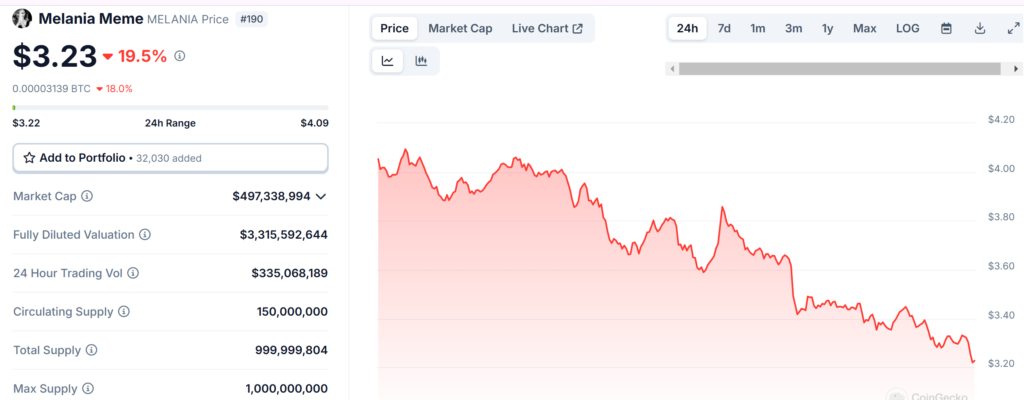

The recent losses shed light on the unpredictable nature of meme coin markets. Tokens like $TRUMP and $MELANIA, tied to cultural and political themes, often experience sharp price swings influenced by social trends and market speculation.

Over the last 24 hours, $TRUMP’s price fell by 12.89%, currently trading at $37.48 with a market cap of $7.5 billion.

Similarly, $MELANIA dropped 19.58% in value, trading at $3.23 with a market cap of $497 million.

These declines highlight the challenges of navigating meme coin markets, where rapid shifts in sentiment can lead to significant losses or gains. The whale’s decision to sell at a loss has sparked speculation that confidence in these tokens may be waning.

Community Reactions and Implications for Meme Coin Markets

The whale’s recent trades have reignited discussions within the crypto community regarding the sustainability of meme coin markets.

Analysts are divided on the reasons behind the selloff. Some suggest the whale might be rebalancing their portfolio to hedge against further losses, while others interpret the move as a loss of confidence in $TRUMP and $MELANIA specifically.

Meanwhile, other whale investors are also grappling with losses. One high-profile $TRUMP holder faced a $2.47 million loss on a $9.5 million purchase, while $MELANIA tokens have seen a steep 65% drop in value.

These developments underscore the risks and volatility associated with politically-themed cryptocurrencies.

While meme coins offer lucrative opportunities for well-timed trades, the current turbulence serves as a stark reminder of the speculative nature of this market.